Sands China And 2 Other Stocks That Investors Might Be Undervaluing

Reviewed by Simply Wall St

As global markets continue to navigate the evolving landscape shaped by political developments and economic indicators, major indices like the S&P 500 have reached new heights, buoyed by optimism around potential trade deals and AI investments. Amidst this backdrop of growth stock outperformance and large-cap dominance, investors are increasingly on the lookout for undervalued stocks that may offer hidden potential in a market driven by sentiment and strategic policy shifts. Identifying such opportunities often involves assessing stocks with strong fundamentals that may not yet be fully appreciated by the market, making them prime candidates for consideration in today's environment.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alltop Technology (TPEX:3526) | NT$264.50 | NT$526.73 | 49.8% |

| Guangdong Mingyang ElectricLtd (SZSE:301291) | CN¥50.90 | CN¥101.57 | 49.9% |

| World Fitness Services (TWSE:2762) | NT$92.70 | NT$184.31 | 49.7% |

| 74Software (ENXTPA:74SW) | €26.50 | €52.89 | 49.9% |

| Solum (KOSE:A248070) | ₩18950.00 | ₩37756.10 | 49.8% |

| Dynavox Group (OM:DYVOX) | SEK68.20 | SEK136.07 | 49.9% |

| GemPharmatech (SHSE:688046) | CN¥13.06 | CN¥26.02 | 49.8% |

| Shandong Weigao Orthopaedic Device (SHSE:688161) | CN¥25.57 | CN¥51.06 | 49.9% |

| St. James's Place (LSE:STJ) | £9.31 | £18.53 | 49.8% |

| Netum Group Oyj (HLSE:NETUM) | €2.82 | €5.63 | 49.9% |

Here we highlight a subset of our preferred stocks from the screener.

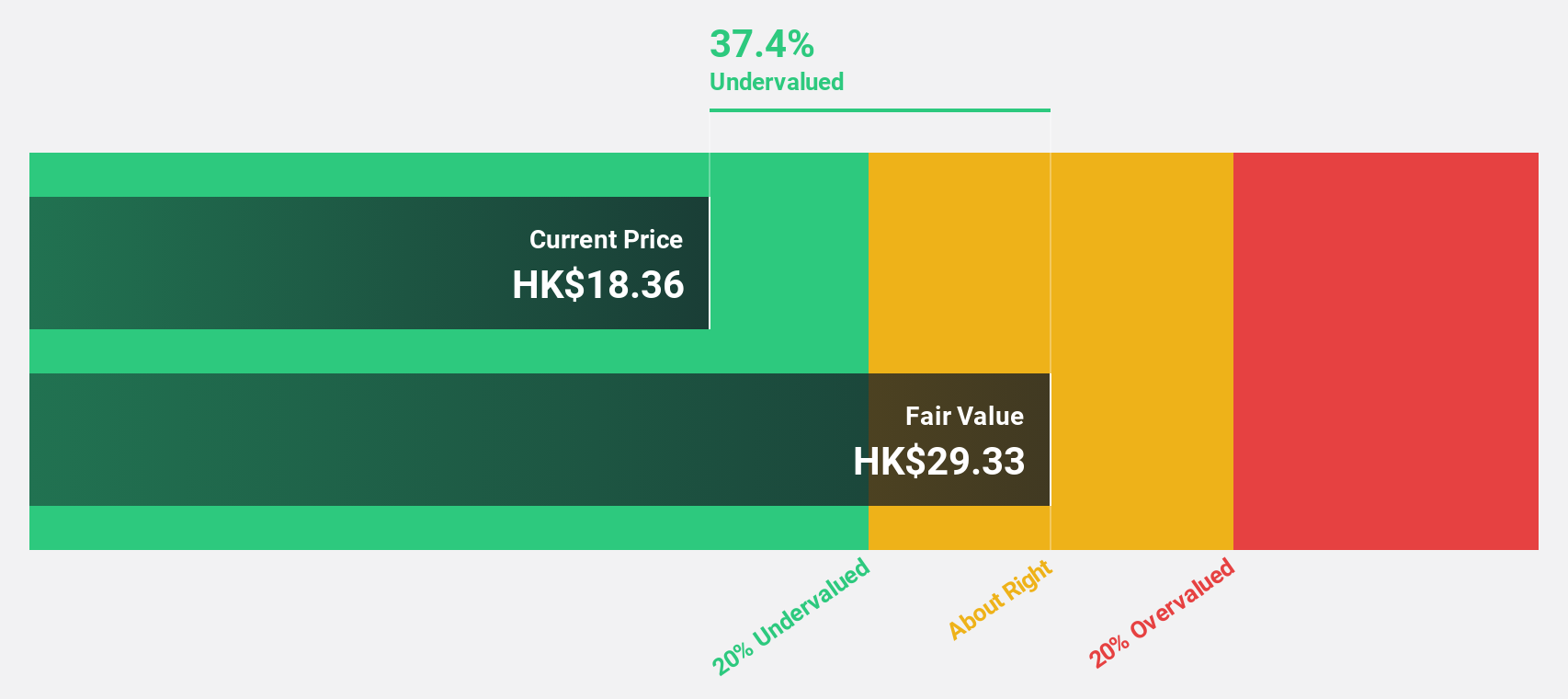

Sands China (SEHK:1928)

Overview: Sands China Ltd. develops, owns, and operates integrated resorts and casinos in Macao with a market cap of HK$150.54 billion.

Operations: The company's revenue segments include The Venetian Macao generating $2.93 billion, The Londoner Macao with $2.11 billion, The Parisian Macao contributing $961 million, The Plaza Macao at $776 million, Sands Macao with $319 million, and Ferry and Other Operations bringing in $109 million.

Estimated Discount To Fair Value: 38.4%

Sands China is trading at HK$18.6, significantly below its estimated fair value of HK$30.18, indicating potential undervaluation based on discounted cash flow analysis. Despite high debt levels, the company's earnings and revenue are forecast to grow faster than the Hong Kong market. Recent collaborations with Alipay enhance digital payment capabilities at Sands Resorts Macao, potentially boosting operational efficiency and supporting growth in Macau's tourism sector through innovative technology integration.

- Our earnings growth report unveils the potential for significant increases in Sands China's future results.

- Dive into the specifics of Sands China here with our thorough financial health report.

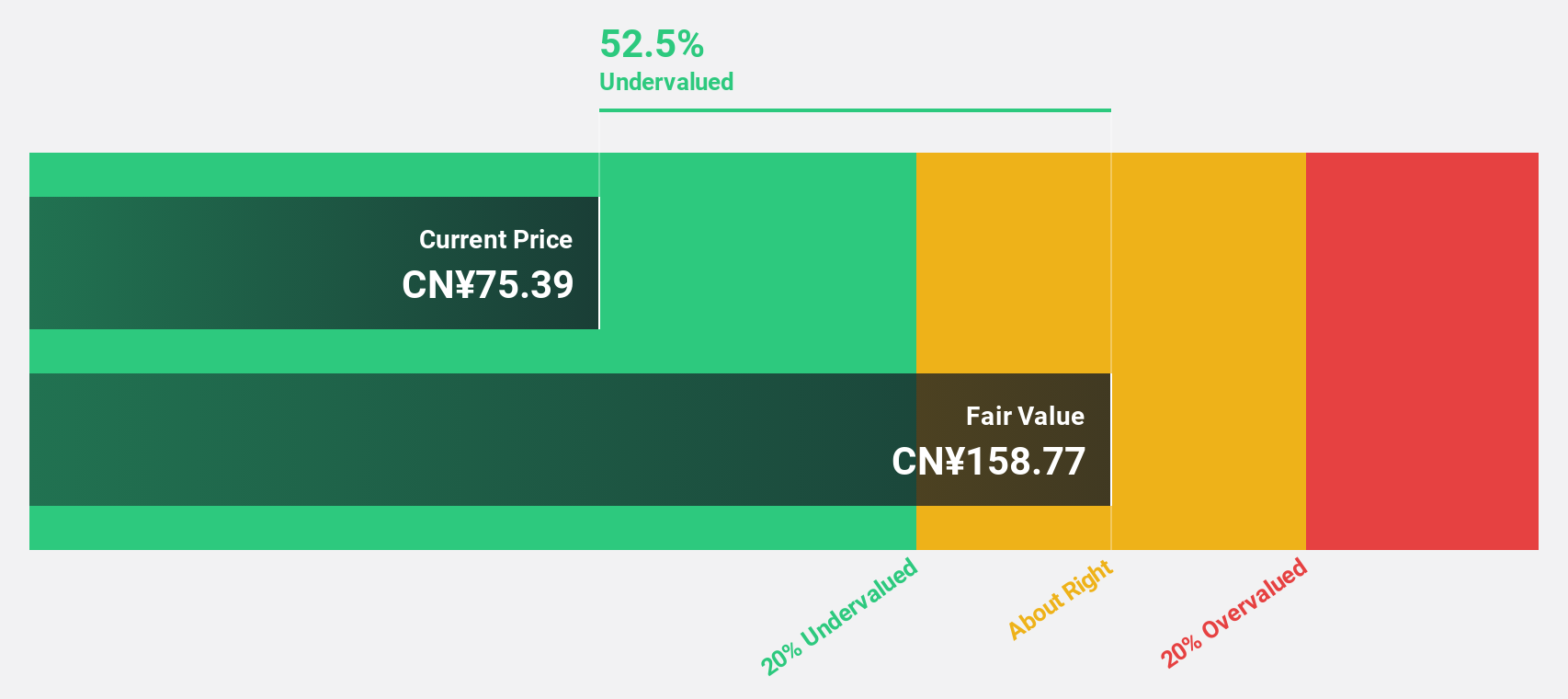

Xiamen Amoytop Biotech (SHSE:688278)

Overview: Xiamen Amoytop Biotech Co., Ltd. focuses on the research, development, production, and sale of recombinant protein drugs in China with a market cap of CN¥32.90 billion.

Operations: The company's revenue is primarily derived from its biologics segment, amounting to CN¥2.60 billion.

Estimated Discount To Fair Value: 14.2%

Xiamen Amoytop Biotech, priced at CN¥80.88, trades below its estimated fair value of CN¥94.31, reflecting a potential undervaluation based on cash flows. The company is poised for robust growth with earnings expected to rise 31.7% annually over the next three years and revenue projected to grow 28.5% per year, outpacing the Chinese market average. However, investors should consider its high level of non-cash earnings when evaluating quality and sustainability.

- The analysis detailed in our Xiamen Amoytop Biotech growth report hints at robust future financial performance.

- Navigate through the intricacies of Xiamen Amoytop Biotech with our comprehensive financial health report here.

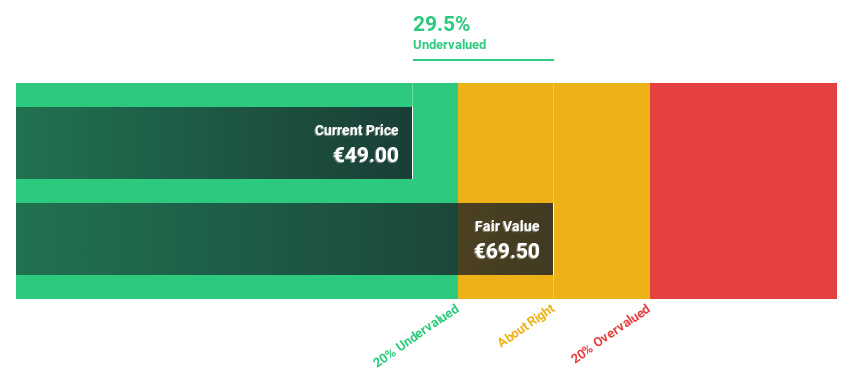

JOST Werke (XTRA:JST)

Overview: JOST Werke SE manufactures and supplies safety-critical systems for the commercial vehicle industry across Germany, Europe, North America, Asia, Pacific, and Africa with a market cap of €674.97 million.

Operations: The company's revenue segment includes Auto Parts & Accessories, generating €1.13 billion.

Estimated Discount To Fair Value: 38.1%

JOST Werke, trading at €45, is significantly undervalued with a fair value estimate of €72.68. Despite a decline in recent earnings and revenue, the company anticipates robust annual profit growth of 27.3%, surpassing the German market's average. However, challenges include reduced profit margins and high debt levels. Revenue growth is expected at 13.3% annually, faster than the market average but below optimal targets for high-growth companies.

- Our comprehensive growth report raises the possibility that JOST Werke is poised for substantial financial growth.

- Take a closer look at JOST Werke's balance sheet health here in our report.

Key Takeaways

- Get an in-depth perspective on all 888 Undervalued Stocks Based On Cash Flows by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:JST

JOST Werke

Manufactures and supplies safety-critical systems for the commercial vehicle industry in Germany, Europe, North America, Asia, Pacific, and Africa.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives