- India

- /

- Tech Hardware

- /

- NSEI:NETWEB

High Growth Tech Stocks To Watch In November 2024

Reviewed by Simply Wall St

As global markets navigate the implications of the incoming Trump administration, investors are observing a mixed landscape with U.S. stocks retracting some gains and long-term interest rates on the rise, reflecting broader economic uncertainties. In this environment, high-growth tech stocks can be particularly appealing due to their potential for innovation and resilience in adapting to shifting regulatory landscapes and economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Seojin SystemLtd | 33.54% | 52.43% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 25.59% | 31.50% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1301 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Netweb Technologies India (NSEI:NETWEB)

Simply Wall St Growth Rating: ★★★★★★

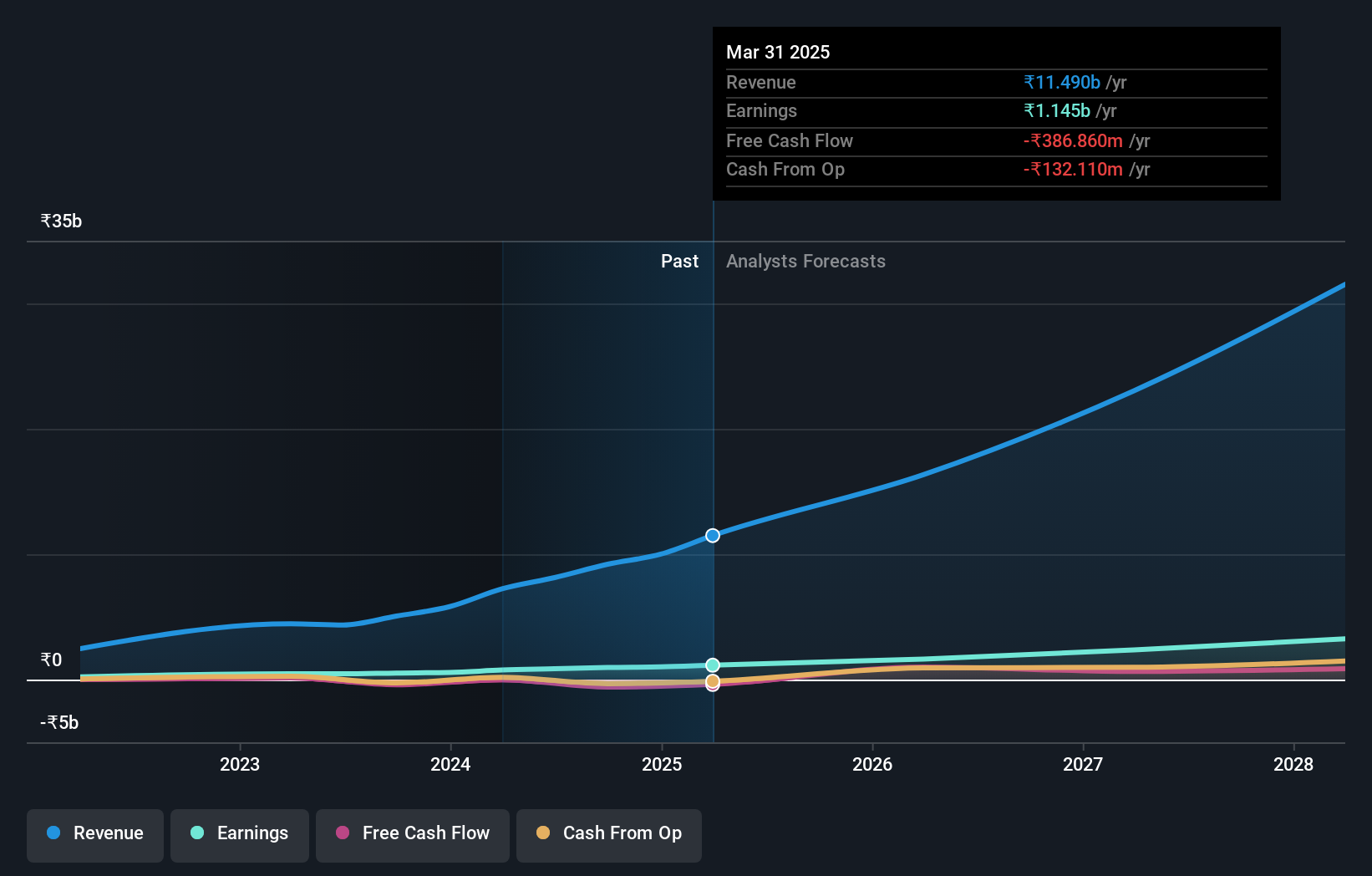

Overview: Netweb Technologies India Limited is engaged in the design, manufacturing, and sale of high-end computing solutions within India, with a market capitalization of ₹151.88 billion.

Operations: Netweb Technologies India Limited primarily generates revenue through the manufacturing and sale of computer servers, contributing ₹9.20 billion to its financials.

Netweb Technologies India is poised for robust growth with its revenue and earnings expected to outpace the Indian market's average, growing at 34.9% and 39.1% per year, respectively. This performance is underpinned by significant investment in R&D, which not only fuels innovation but also aligns with industry shifts towards more sustainable and advanced tech solutions. Recent executive changes hint at a strategic realignment that could further enhance operational efficiency and market responsiveness. The company's involvement in high-profile projects, like the reselling arrangement with Beetel Teletech Ltd., although not immediately transformative, reflects a steady commitment to expanding its market reach through existing product lines.

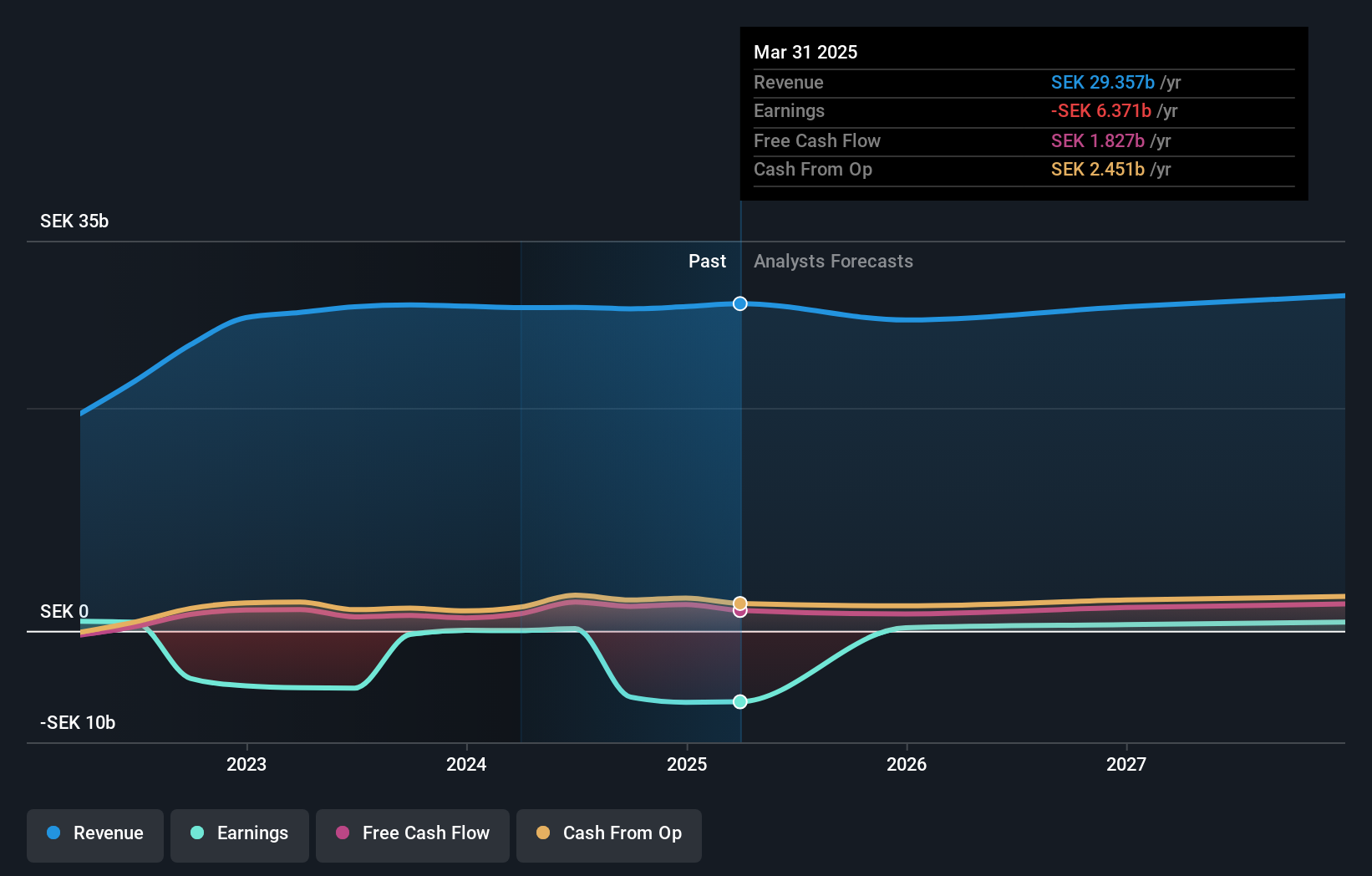

Sinch (OM:SINCH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sinch AB (publ) offers cloud communications services and solutions to enterprises and mobile operators across various countries, with a market cap of SEK17.46 billion.

Operations: Sinch generates revenue primarily through its cloud communications services, catering to enterprises and mobile operators in multiple countries, including Sweden, France, the UK, Germany, Brazil, India, Singapore, and the US. The company's business model focuses on providing scalable communication solutions that integrate with existing systems to enhance customer engagement.

Sinch's recent strategic movements, including the appointment of David Ruggiero as Senior Vice President for North America, signal a robust push towards enhancing sales strategies and customer engagement in key markets. Despite facing a net loss of SEK 6,094 million this quarter compared to last year’s profit, Sinch is actively pursuing growth through potential M&As and innovations like its Next Generation 911 technology. This tech not only broadens emergency communication capabilities but also solidifies Sinch's footprint in advanced communication solutions across the U.S., handling over 40% of NG911 traffic where available.

Xiamen Amoytop Biotech (SHSE:688278)

Simply Wall St Growth Rating: ★★★★★★

Overview: Xiamen Amoytop Biotech Co., Ltd. is involved in the manufacture, marketing, and sale of recombinant protein drugs in China with a market cap of CN¥29.97 billion.

Operations: Amoytop Biotech generates revenue primarily from its biologics segment, amounting to CN¥2.60 billion. The company focuses on recombinant protein drugs within the Chinese market.

Xiamen Amoytop Biotech is demonstrating significant growth dynamics, with a 29% annual revenue increase outpacing the broader Chinese market's 13.9% expansion. This trajectory is underpinned by robust R&D investment, crucial for sustaining innovation and competitive edge in biotechnology—a sector driven by rapid technological advances and regulatory changes. In the latest reporting period, R&D expenses surged to 32% of revenue, reflecting a strategic emphasis on developing new drug solutions and enhancing existing ones. The company's earnings also reflect this positive trend, showing a substantial year-on-year growth of 62.6%, which suggests effective cost management and successful commercialization of its research outcomes.

Where To Now?

- Unlock more gems! Our High Growth Tech and AI Stocks screener has unearthed 1298 more companies for you to explore.Click here to unveil our expertly curated list of 1301 High Growth Tech and AI Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netweb Technologies India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:NETWEB

Netweb Technologies India

Designs, manufactures, and sells high-end computing solutions (HCS) in India.

Exceptional growth potential with excellent balance sheet.