Global Value Stocks Priced Below Estimated Worth In March 2025

Reviewed by Simply Wall St

As global markets grapple with inflation concerns and trade policy uncertainties, major indices like the S&P 500 and Nasdaq Composite have seen consecutive weeks of losses, reflecting investor apprehension. Amid this volatility, identifying undervalued stocks becomes crucial as they may offer potential value when priced below their estimated worth.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sichuan Kexin Mechanical and Electrical EquipmentLtd (SZSE:300092) | CN¥13.07 | CN¥25.91 | 49.6% |

| Absolent Air Care Group (OM:ABSO) | SEK258.00 | SEK511.18 | 49.5% |

| Tabuk Cement (SASE:3090) | SAR13.34 | SAR26.37 | 49.4% |

| Avant Group (TSE:3836) | ¥1793.00 | ¥3535.89 | 49.3% |

| CS Wind (KOSE:A112610) | ₩38050.00 | ₩75304.03 | 49.5% |

| Cosmax (KOSE:A192820) | ₩179300.00 | ₩356622.11 | 49.7% |

| Takara Bio (TSE:4974) | ¥854.00 | ¥1697.03 | 49.7% |

| JSHLtd (TSE:150A) | ¥558.00 | ¥1107.85 | 49.6% |

| BalnibarbiLtd (TSE:3418) | ¥1123.00 | ¥2222.51 | 49.5% |

| Doosan Fuel Cell (KOSE:A336260) | ₩16010.00 | ₩31734.60 | 49.6% |

Let's explore several standout options from the results in the screener.

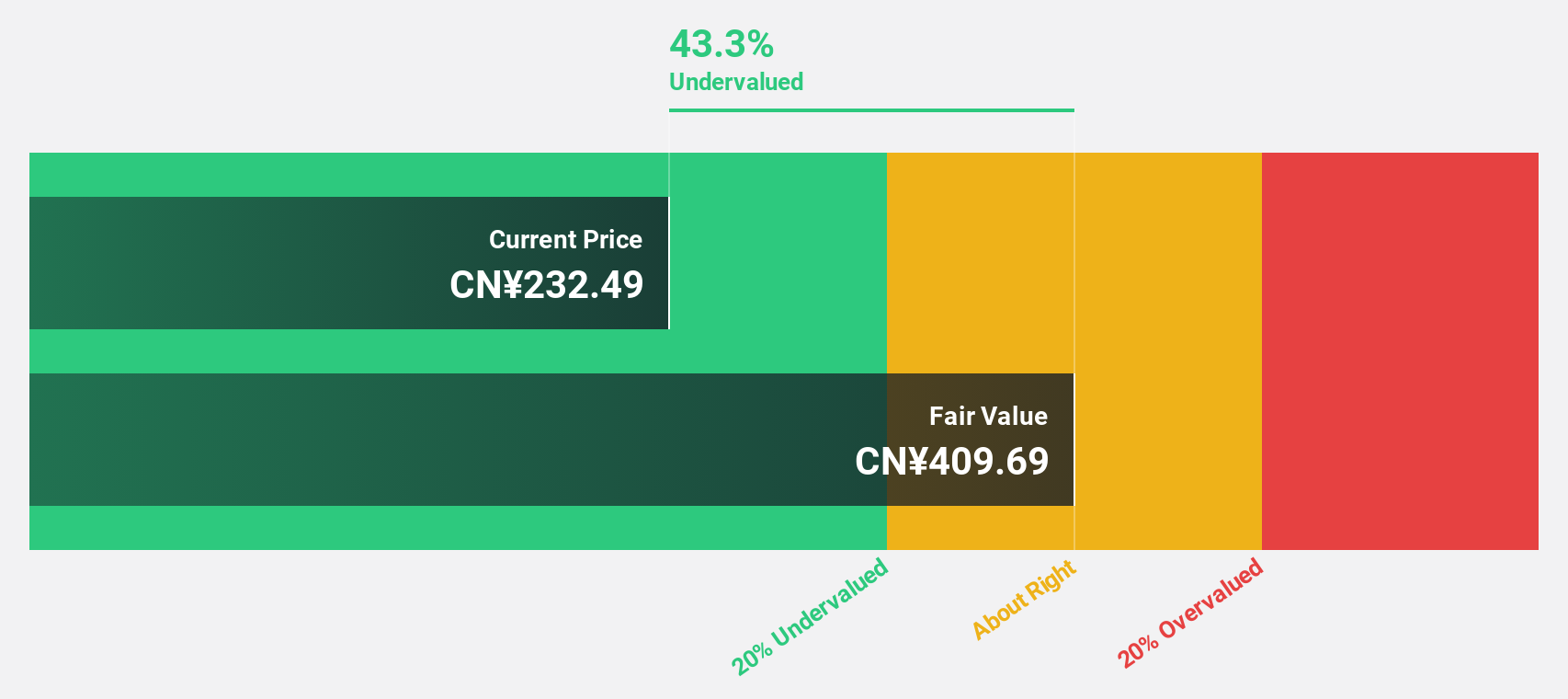

Zhejiang Cfmoto PowerLtd (SHSE:603129)

Overview: Zhejiang Cfmoto Power Co., Ltd is engaged in the development, manufacturing, and marketing of motorcycles, all-terrain vehicles, side-by-side utility vehicles, powersports engines, gears, parts, and apparel and accessories globally with a market cap of CN¥27.16 billion.

Operations: Zhejiang Cfmoto Power Co., Ltd generates revenue from the production and sale of motorcycles, all-terrain vehicles, side-by-side utility vehicles, powersports engines, gears, parts, and apparel and accessories on a global scale.

Estimated Discount To Fair Value: 47%

Zhejiang Cfmoto Power Ltd. is trading at 47% below its estimated fair value of CN¥349.9, making it highly undervalued based on discounted cash flow analysis. Its earnings grew by 38% last year and are forecast to grow significantly, although slightly slower than the broader Chinese market. The company is expected to see revenue growth of 21.3% annually, outpacing the market average, while maintaining a strong return on equity forecasted at 23.9%.

- The growth report we've compiled suggests that Zhejiang Cfmoto PowerLtd's future prospects could be on the up.

- Get an in-depth perspective on Zhejiang Cfmoto PowerLtd's balance sheet by reading our health report here.

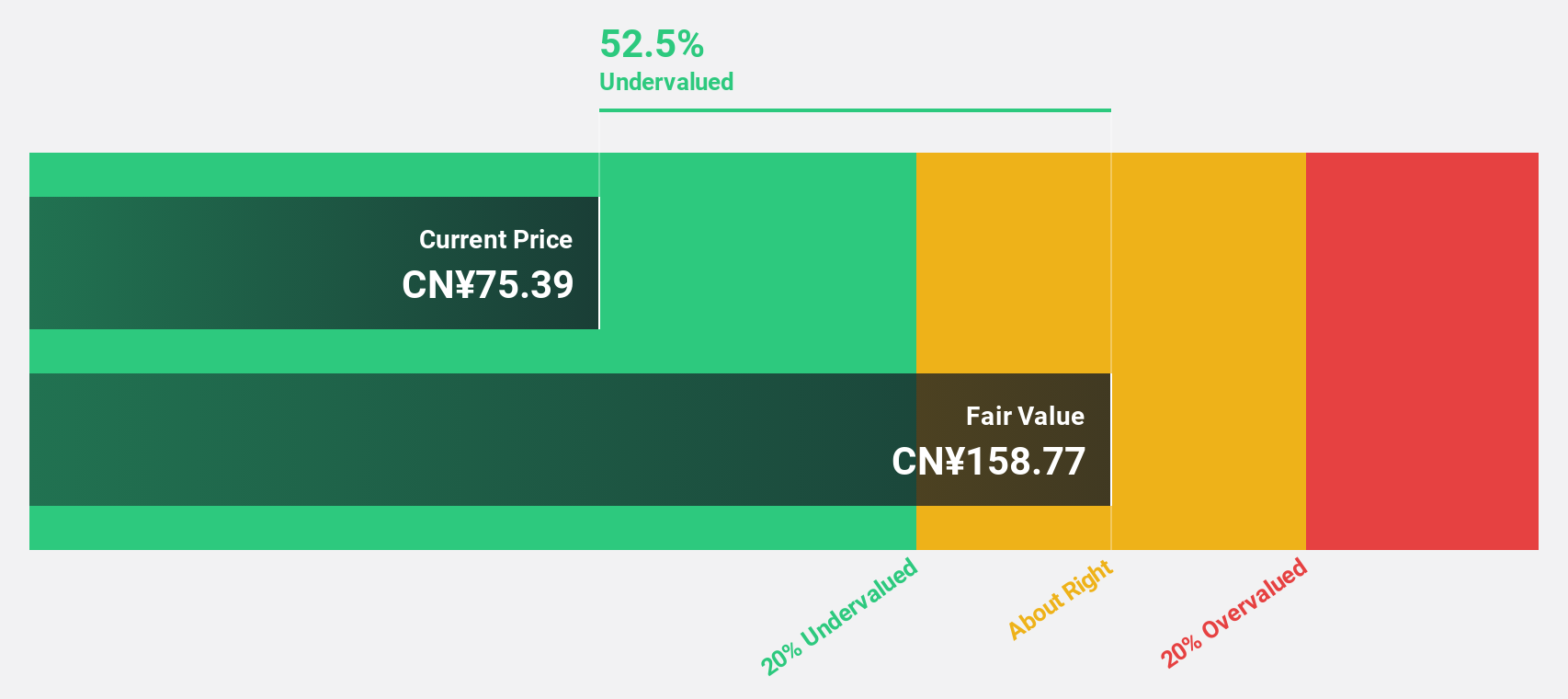

Xiamen Amoytop Biotech (SHSE:688278)

Overview: Xiamen Amoytop Biotech Co., Ltd. focuses on the research, development, production, and sale of recombinant protein drugs in China with a market cap of CN¥32.87 billion.

Operations: The company's revenue primarily comes from its Biologics segment, which generated CN¥2.82 billion.

Estimated Discount To Fair Value: 15.5%

Xiamen Amoytop Biotech is trading at CN¥82.1, 15.5% below its estimated fair value of CN¥97.11, suggesting it may be undervalued based on cash flows. The company reported sales of CN¥2.82 billion for 2024, up from CN¥2.10 billion the previous year, with net income rising to CN¥827.6 million from CN¥555.45 million. Earnings are projected to grow at 29% annually, surpassing both revenue and market growth expectations in China.

- The analysis detailed in our Xiamen Amoytop Biotech growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Xiamen Amoytop Biotech stock in this financial health report.

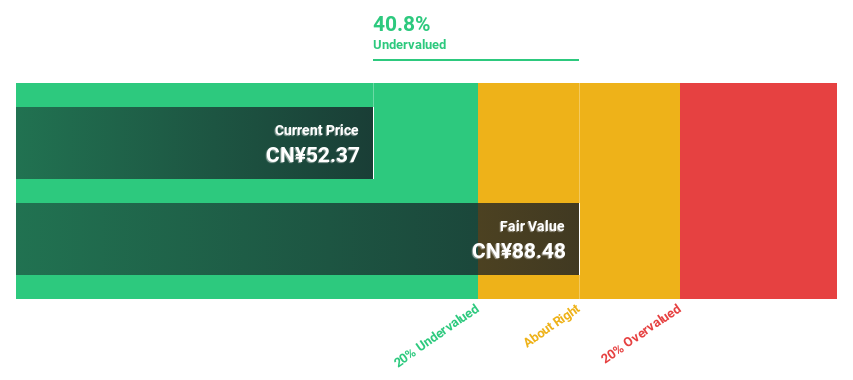

Betta Pharmaceuticals (SZSE:300558)

Overview: Betta Pharmaceuticals Co., Ltd. is a Chinese company that researches, develops, manufactures, and markets cancer treatment medicines with a market cap of CN¥21.79 billion.

Operations: The company's revenue is primarily derived from its Pharmaceutical Manufacturing segment, which generated CN¥2.76 billion.

Estimated Discount To Fair Value: 36.9%

Betta Pharmaceuticals is trading at CN¥53.11, significantly below its estimated fair value of CN¥84.15, highlighting potential undervaluation based on cash flows. The company's earnings are expected to grow substantially at 34.8% annually, outpacing the market's 25.1% growth rate in China, although revenue growth is forecasted at a slower pace of 15.9%. Despite large one-off items affecting results and a modest future return on equity of 15.2%, its valuation remains attractive.

- Our expertly prepared growth report on Betta Pharmaceuticals implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Betta Pharmaceuticals with our comprehensive financial health report here.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 498 Undervalued Global Stocks Based On Cash Flows now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Betta Pharmaceuticals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Betta Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300558

Betta Pharmaceuticals

Researches and develops, manufactures, and markets medicines for the treatment of cancer in China.

Reasonable growth potential with acceptable track record.