High Growth Tech Stocks Including Suzhou Zelgen BiopharmaceuticalsLtd and Two Others

Reviewed by Simply Wall St

As global markets experience fluctuations with key indices like the Nasdaq Composite showing mixed performance amid economic indicators such as declining consumer confidence and manufacturing orders, investors are keenly observing the tech sector for potential high-growth opportunities. In this environment, identifying stocks that demonstrate robust innovation and adaptability to market changes can be crucial, as seen in companies like Suzhou Zelgen Biopharmaceuticals Ltd and others within the tech industry.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.24% | 56.34% | ★★★★★★ |

| TG Therapeutics | 30.06% | 45.28% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1262 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266)

Simply Wall St Growth Rating: ★★★★★☆

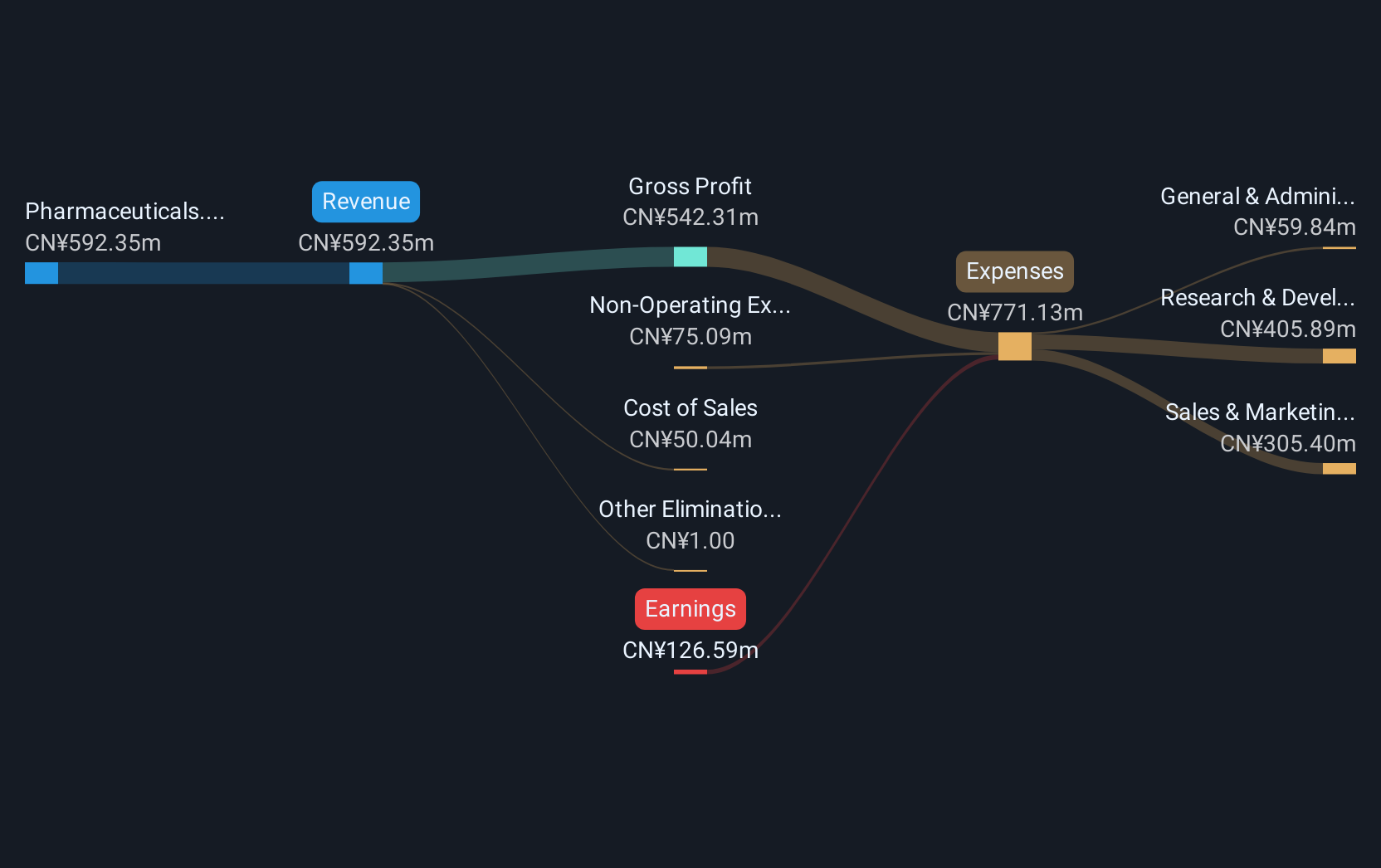

Overview: Suzhou Zelgen Biopharmaceuticals Co., Ltd. focuses on the research, development, and commercialization of innovative pharmaceutical products and has a market cap of approximately CN¥16.49 billion.

Operations: The company generates revenue primarily from its pharmaceuticals segment, with reported sales of CN¥488.45 million.

Suzhou Zelgen Biopharmaceuticals has demonstrated a robust trajectory with its revenue surging by 59.6% annually, outpacing the Chinese market's average of 13.6%. Despite current unprofitability, the firm is on a path to profitability within three years, supported by an expected annual profit growth of 127.3%. This growth is underpinned by significant R&D investments, crucial for sustaining innovation and competitiveness in the biotech sector. The company's recent earnings report shows a reduction in net loss from CNY 202.09 million to CNY 97.9 million year-over-year, indicating effective cost management and potential for future financial stability.

Anhui Ronds Science & Technology (SHSE:688768)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Anhui Ronds Science & Technology Incorporated Company offers machinery condition monitoring solutions for predictive maintenance in China, with a market cap of CN¥2.97 billion.

Operations: Ronds specializes in machinery condition monitoring solutions, focusing on predictive maintenance within China. The company generates revenue primarily through the sale of its monitoring systems and related services.

Anhui Ronds Science & Technology has pivoted impressively from a net loss to generating a net income of CNY 2.72 million, reflecting a strategic overhaul that's beginning to bear fruit. With revenue climbing to CNY 342.74 million, up from CNY 299.94 million the previous year, the firm is capitalizing on robust market demand. This financial revitalization is backed by significant R&D investments, aligning with an industry trend where continuous innovation fuels growth; indeed, their recent private placement and earnings momentum underscore a proactive approach in scaling operations and technology advancements.

Long Young Electronic (Kunshan) (SZSE:301389)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Long Young Electronic (Kunshan) Co., Ltd. operates in the packaging and containers industry with a market capitalization of CN¥4.72 billion.

Operations: The company generates revenue primarily from its packaging and containers segment, amounting to CN¥275.97 million.

Amid a challenging year, Long Young Electronic (Kunshan) has demonstrated resilience with its revenue reaching CNY 208.66 million, marking a 5.35% increase from the previous year. Despite a downturn in net income to CNY 52.66 million from CNY 79.81 million, reflecting a decrease of about 34%, the company's commitment to innovation remains robust, evident in its strategic share repurchases totaling CNY 17.43 million under the recent buyback scheme. This move underscores confidence in their operational strategy and future growth potential, particularly as they navigate through market fluctuations and maintain competitive momentum within the tech sector.

Turning Ideas Into Actions

- Get an in-depth perspective on all 1262 High Growth Tech and AI Stocks by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688266

Suzhou Zelgen BiopharmaceuticalsLtd

Suzhou Zelgen Biopharmaceuticals Co.,Ltd.

Exceptional growth potential with excellent balance sheet.