- China

- /

- Life Sciences

- /

- SHSE:688238

Why Investors Shouldn't Be Surprised By Obio Technology (Shanghai) Corp., Ltd.'s (SHSE:688238) 27% Share Price Surge

Obio Technology (Shanghai) Corp., Ltd. (SHSE:688238) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 13% over that time.

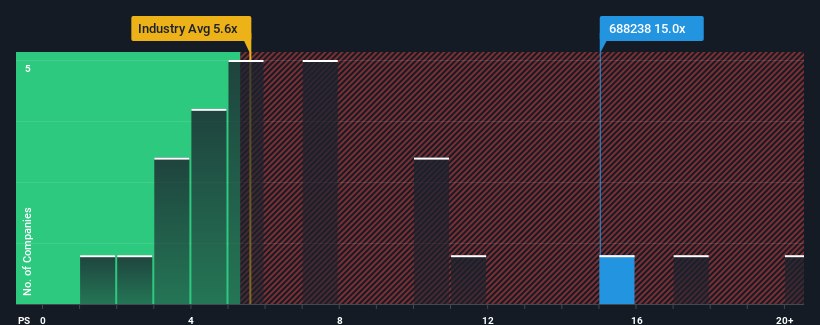

After such a large jump in price, when almost half of the companies in China's Life Sciences industry have price-to-sales ratios (or "P/S") below 5.6x, you may consider Obio Technology (Shanghai) as a stock not worth researching with its 15x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Obio Technology (Shanghai)

How Has Obio Technology (Shanghai) Performed Recently?

Obio Technology (Shanghai) certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. It seems that many are expecting the company to continue defying the broader industry adversity, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Obio Technology (Shanghai)'s future stacks up against the industry? In that case, our free report is a great place to start.How Is Obio Technology (Shanghai)'s Revenue Growth Trending?

Obio Technology (Shanghai)'s P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 18%. The latest three year period has also seen a 8.8% overall rise in revenue, aided extensively by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 28% per annum during the coming three years according to the two analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 13% per year, which is noticeably less attractive.

With this information, we can see why Obio Technology (Shanghai) is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Obio Technology (Shanghai)'s P/S Mean For Investors?

The strong share price surge has lead to Obio Technology (Shanghai)'s P/S soaring as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Obio Technology (Shanghai)'s analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You should always think about risks. Case in point, we've spotted 1 warning sign for Obio Technology (Shanghai) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688238

Obio Technology (Shanghai)

A biotechnology company, focuses on the development of gene therapy vectors in China.

Excellent balance sheet very low.

Market Insights

Community Narratives