- China

- /

- Life Sciences

- /

- SHSE:688238

Subdued Growth No Barrier To Obio Technology (Shanghai) Corp., Ltd. (SHSE:688238) With Shares Advancing 30%

Obio Technology (Shanghai) Corp., Ltd. (SHSE:688238) shareholders are no doubt pleased to see that the share price has bounced 30% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 57% share price drop in the last twelve months.

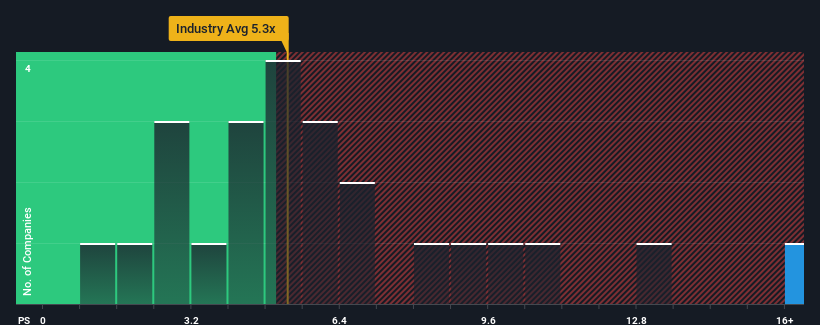

Following the firm bounce in price, you could be forgiven for thinking Obio Technology (Shanghai) is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 20.4x, considering almost half the companies in China's Life Sciences industry have P/S ratios below 5.3x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Obio Technology (Shanghai)

What Does Obio Technology (Shanghai)'s Recent Performance Look Like?

Obio Technology (Shanghai) hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Obio Technology (Shanghai) will help you uncover what's on the horizon.How Is Obio Technology (Shanghai)'s Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Obio Technology (Shanghai)'s is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 27% decrease to the company's top line. Even so, admirably revenue has lifted 49% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 13% per year over the next three years. That's shaping up to be materially lower than the 18% per year growth forecast for the broader industry.

In light of this, it's alarming that Obio Technology (Shanghai)'s P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Obio Technology (Shanghai)'s P/S?

Shares in Obio Technology (Shanghai) have seen a strong upwards swing lately, which has really helped boost its P/S figure. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've concluded that Obio Technology (Shanghai) currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Obio Technology (Shanghai) with six simple checks on some of these key factors.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688238

Obio Technology (Shanghai)

A biotechnology company, focuses on the development of gene therapy vectors in China.

Excellent balance sheet very low.

Market Insights

Community Narratives