- China

- /

- Life Sciences

- /

- SHSE:688238

Obio Technology (Shanghai) Corp., Ltd. (SHSE:688238) Looks Just Right With A 27% Price Jump

Obio Technology (Shanghai) Corp., Ltd. (SHSE:688238) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 43% over that time.

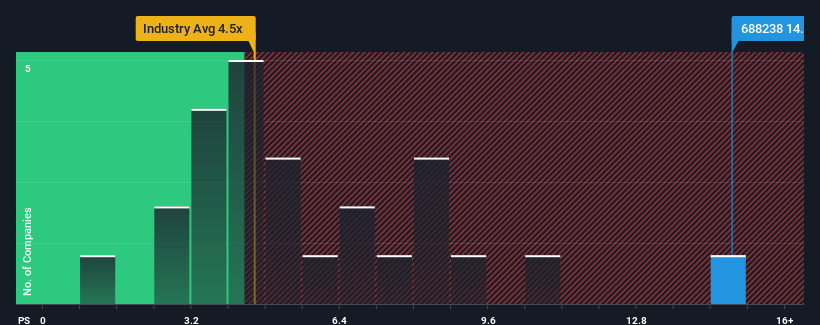

Since its price has surged higher, you could be forgiven for thinking Obio Technology (Shanghai) is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 14.9x, considering almost half the companies in China's Life Sciences industry have P/S ratios below 4.5x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Obio Technology (Shanghai)

How Has Obio Technology (Shanghai) Performed Recently?

Obio Technology (Shanghai)'s negative revenue growth of late has neither been better nor worse than most other companies. It might be that many expect the company's revenue to strengthen positively despite the tough industry conditions, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Obio Technology (Shanghai)'s future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

Obio Technology (Shanghai)'s P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 2.5%. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 28% per annum over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 21% per annum, which is noticeably less attractive.

With this information, we can see why Obio Technology (Shanghai) is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Obio Technology (Shanghai)'s P/S

Obio Technology (Shanghai)'s P/S has grown nicely over the last month thanks to a handy boost in the share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Obio Technology (Shanghai) maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Life Sciences industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Having said that, be aware Obio Technology (Shanghai) is showing 2 warning signs in our investment analysis, you should know about.

If you're unsure about the strength of Obio Technology (Shanghai)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688238

Obio Technology (Shanghai)

A biotechnology company, focuses on the development of gene therapy vectors in China.

Excellent balance sheet very low.

Market Insights

Community Narratives