Some Confidence Is Lacking In Bio-Thera Solutions, Ltd. (SHSE:688177) As Shares Slide 27%

Bio-Thera Solutions, Ltd. (SHSE:688177) shares have had a horrible month, losing 27% after a relatively good period beforehand. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

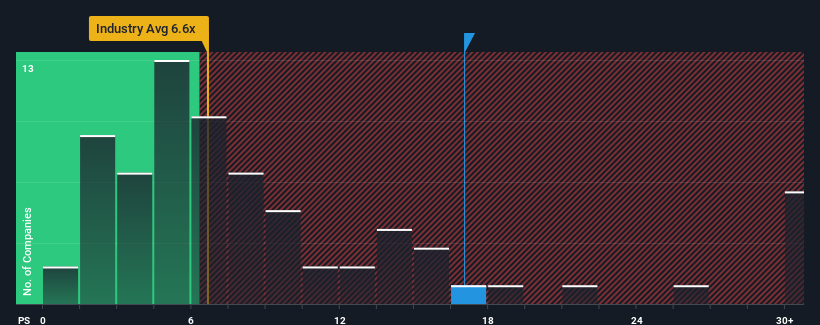

Although its price has dipped substantially, given around half the companies in China's Biotechs industry have price-to-sales ratios (or "P/S") below 6.6x, you may still consider Bio-Thera Solutions as a stock to avoid entirely with its 17x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Bio-Thera Solutions

How Bio-Thera Solutions Has Been Performing

Bio-Thera Solutions certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Bio-Thera Solutions will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Bio-Thera Solutions' is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 55% gain to the company's top line. Pleasingly, revenue has also lifted 285% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 84% per year as estimated by the two analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 209% each year, which is noticeably more attractive.

With this information, we find it concerning that Bio-Thera Solutions is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Bio-Thera Solutions' P/S

Bio-Thera Solutions' shares may have suffered, but its P/S remains high. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Bio-Thera Solutions, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Bio-Thera Solutions that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Bio-Thera Solutions, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bio-Thera Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688177

Bio-Thera Solutions

A biopharmaceutical company, researches and develops novel therapeutics for the treatment of cancer, autoimmune, cardiovascular, eye diseases, and other severe unmet medical needs in China and internationally.

Mediocre balance sheet and slightly overvalued.