Bio-Thera Solutions, Ltd. (SHSE:688177) Shares May Have Slumped 30% But Getting In Cheap Is Still Unlikely

Bio-Thera Solutions, Ltd. (SHSE:688177) shareholders that were waiting for something to happen have been dealt a blow with a 30% share price drop in the last month. The recent drop has obliterated the annual return, with the share price now down 5.9% over that longer period.

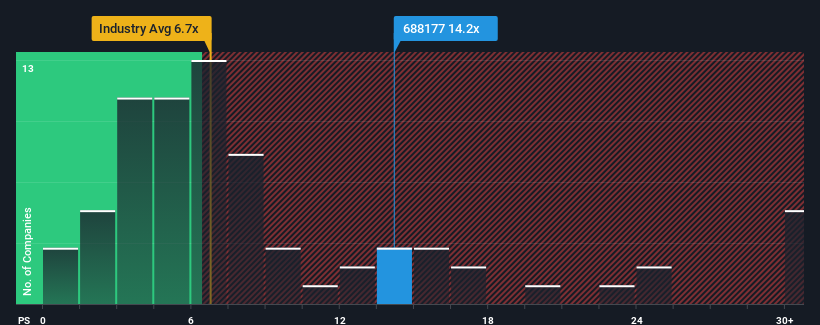

In spite of the heavy fall in price, when almost half of the companies in China's Biotechs industry have price-to-sales ratios (or "P/S") below 6.7x, you may still consider Bio-Thera Solutions as a stock not worth researching with its 14.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Bio-Thera Solutions

How Bio-Thera Solutions Has Been Performing

Bio-Thera Solutions certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Bio-Thera Solutions.Is There Enough Revenue Growth Forecasted For Bio-Thera Solutions?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Bio-Thera Solutions' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 33% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 218% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 67% per year as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 507% each year, which is noticeably more attractive.

In light of this, it's alarming that Bio-Thera Solutions' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

A significant share price dive has done very little to deflate Bio-Thera Solutions' very lofty P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Bio-Thera Solutions, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Bio-Thera Solutions, and understanding should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Bio-Thera Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688177

Bio-Thera Solutions

A biopharmaceutical company, researches and develops novel therapeutics for the treatment of cancer, autoimmune, cardiovascular, eye diseases, and other severe unmet medical needs in China and internationally.

Mediocre balance sheet and slightly overvalued.