High Insider Ownership In Top Growth Companies February 2025

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of rising inflation and shifting trade policies, U.S. stock indexes are climbing toward record highs, with growth stocks notably outperforming value shares. In this environment, companies with high insider ownership can be particularly appealing as they often signal strong confidence from those closest to the business, aligning interests between management and shareholders in times of economic uncertainty.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 50.1% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 38.5% |

| On Holding (NYSE:ONON) | 19.1% | 29.9% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

Here's a peek at a few of the choices from the screener.

BrightGene Bio-Medical Technology (SHSE:688166)

Simply Wall St Growth Rating: ★★★★★☆

Overview: BrightGene Bio-Medical Technology Co., Ltd. is a pharmaceutical company focused on the research, development, manufacture, and commercialization of pharmaceutical products in China with a market cap of CN¥12.30 billion.

Operations: Unfortunately, the provided text does not include specific revenue segment details for BrightGene Bio-Medical Technology Co., Ltd.

Insider Ownership: 32.2%

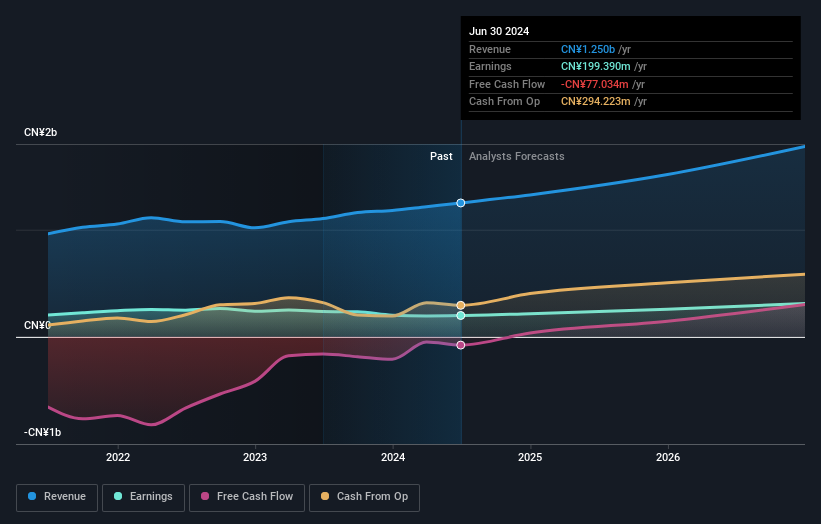

BrightGene Bio-Medical Technology is positioned for significant growth, with earnings projected to increase by 37.6% annually and revenue expected to grow at 29.8% per year, surpassing the Chinese market average. While trading at 68% below its estimated fair value, the company's debt coverage by operating cash flow remains a concern. Recent participation in BIO Partnering @JPM Week highlights its active engagement in strategic partnerships and industry visibility efforts.

- Unlock comprehensive insights into our analysis of BrightGene Bio-Medical Technology stock in this growth report.

- According our valuation report, there's an indication that BrightGene Bio-Medical Technology's share price might be on the expensive side.

SolaX Power Network Technology (Zhejiang) (SHSE:688717)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SolaX Power Network Technology (Zhejiang) Co., Ltd. operates in the renewable energy sector, focusing on the development and production of solar power products, with a market cap of CN¥7.22 billion.

Operations: The company generates revenue primarily from its Electronic Components & Parts segment, amounting to CN¥2.87 billion.

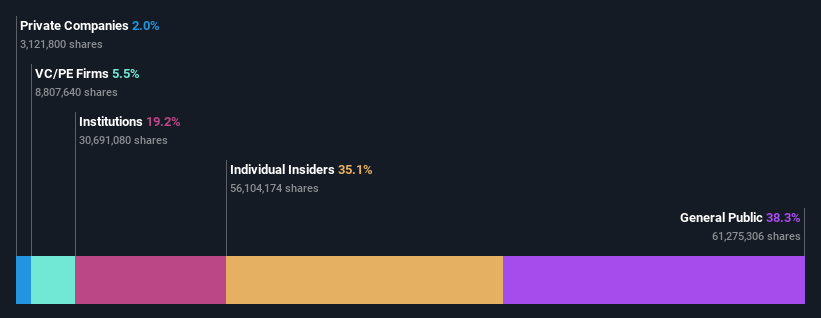

Insider Ownership: 35.1%

SolaX Power Network Technology is poised for robust growth, with earnings projected to rise by 55.03% annually and revenue expected to grow at 30% per year, both outpacing the Chinese market averages. The company trades at 17.4% below its estimated fair value, presenting a potentially attractive valuation despite a decline in profit margins from last year. Recent innovations like the TRENE Liquid-Cooling Energy Storage System underscore SolaX's commitment to scalable and sustainable energy solutions.

- Take a closer look at SolaX Power Network Technology (Zhejiang)'s potential here in our earnings growth report.

- Our expertly prepared valuation report SolaX Power Network Technology (Zhejiang) implies its share price may be lower than expected.

Hubei Feilihua Quartz Glass (SZSE:300395)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hubei Feilihua Quartz Glass Co., Ltd. is engaged in the global manufacturing and sale of quartz material and quartz fiber products, with a market capitalization of CN¥18.30 billion.

Operations: The company's revenue primarily comes from the Non-Metallic Mineral Products Industry, amounting to CN¥1.84 billion.

Insider Ownership: 18%

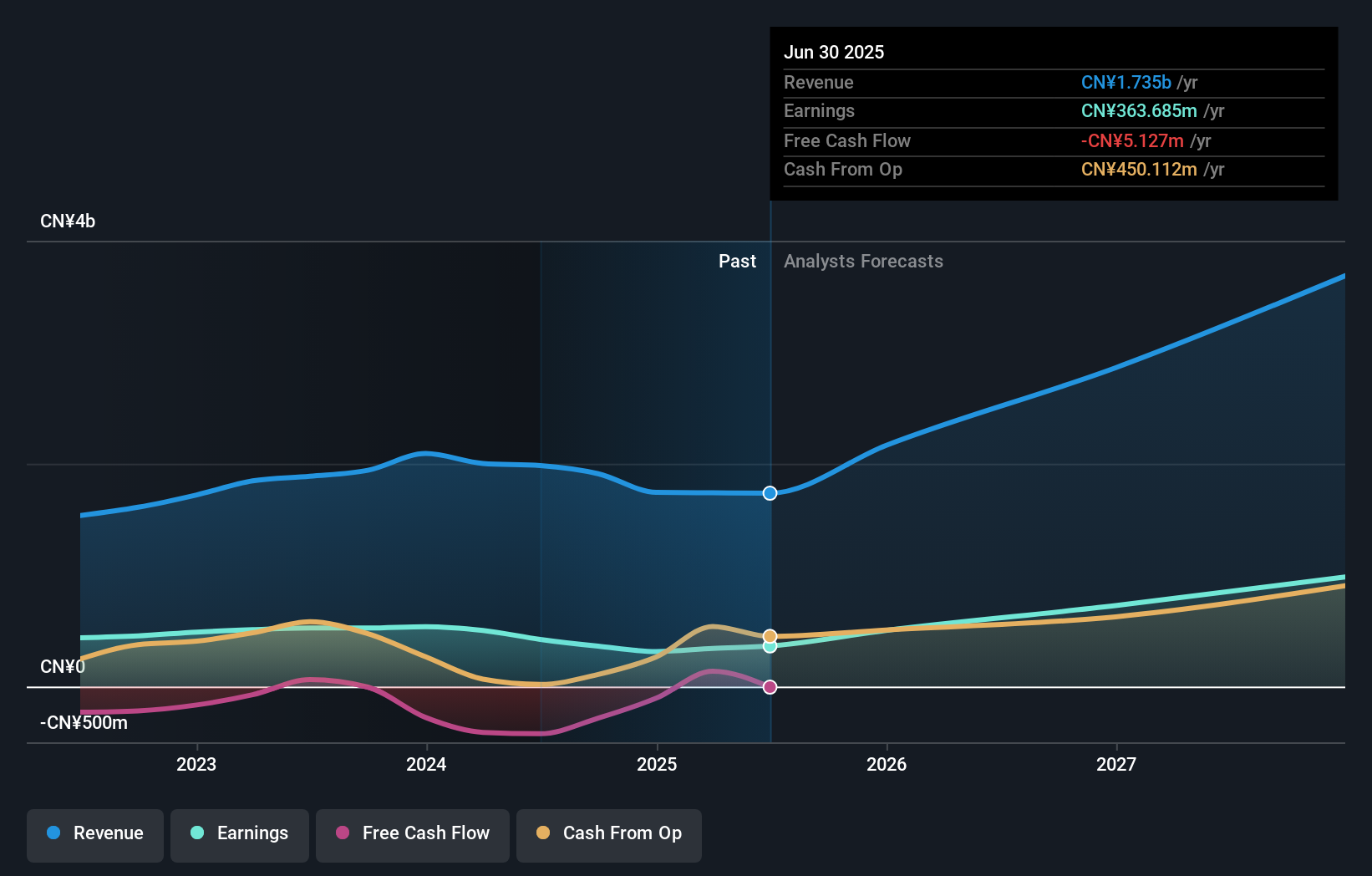

Hubei Feilihua Quartz Glass shows promising growth potential, with earnings forecasted to increase by 44.6% annually and revenue expected to rise by 28.5% per year, both surpassing the Chinese market averages. Despite a low Return on Equity forecast of 14.9%, analysts agree that the stock price could appreciate by 27.9%. However, its dividend yield of 0.55% is not well covered by free cash flows, indicating potential sustainability issues.

- Click here and access our complete growth analysis report to understand the dynamics of Hubei Feilihua Quartz Glass.

- The analysis detailed in our Hubei Feilihua Quartz Glass valuation report hints at an inflated share price compared to its estimated value.

Next Steps

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1463 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hubei Feilihua Quartz Glass might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300395

Hubei Feilihua Quartz Glass

Manufactures and sells quartz material and quartz fiber products worldwide.

High growth potential with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives