- China

- /

- Personal Products

- /

- SZSE:003006

Discover 3 Stocks Estimated To Be Up To 46.7% Below Their Intrinsic Value

Reviewed by Simply Wall St

In a week marked by record highs in major U.S. stock indexes and mixed performances across sectors, growth stocks have notably outpaced their value counterparts. As investors navigate these diverse market conditions, identifying undervalued stocks becomes crucial for those seeking potential opportunities amidst economic uncertainties and shifting interest rate expectations.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SKS Technologies Group (ASX:SKS) | A$1.945 | A$3.85 | 49.5% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP289.00 | CLP576.34 | 49.9% |

| Befesa (XTRA:BFSA) | €22.32 | €44.53 | 49.9% |

| Visional (TSE:4194) | ¥8394.00 | ¥16975.49 | 50.6% |

| Ingenia Communities Group (ASX:INA) | A$4.56 | A$9.18 | 50.3% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$27.10 | HK$54.03 | 49.8% |

| First Advantage (NasdaqGS:FA) | US$19.81 | US$39.49 | 49.8% |

| DoubleVerify Holdings (NYSE:DV) | US$20.77 | US$41.28 | 49.7% |

| Nyab (OM:NYAB) | SEK5.20 | SEK10.29 | 49.5% |

| Carter Bankshares (NasdaqGS:CARE) | US$19.30 | US$38.28 | 49.6% |

Let's uncover some gems from our specialized screener.

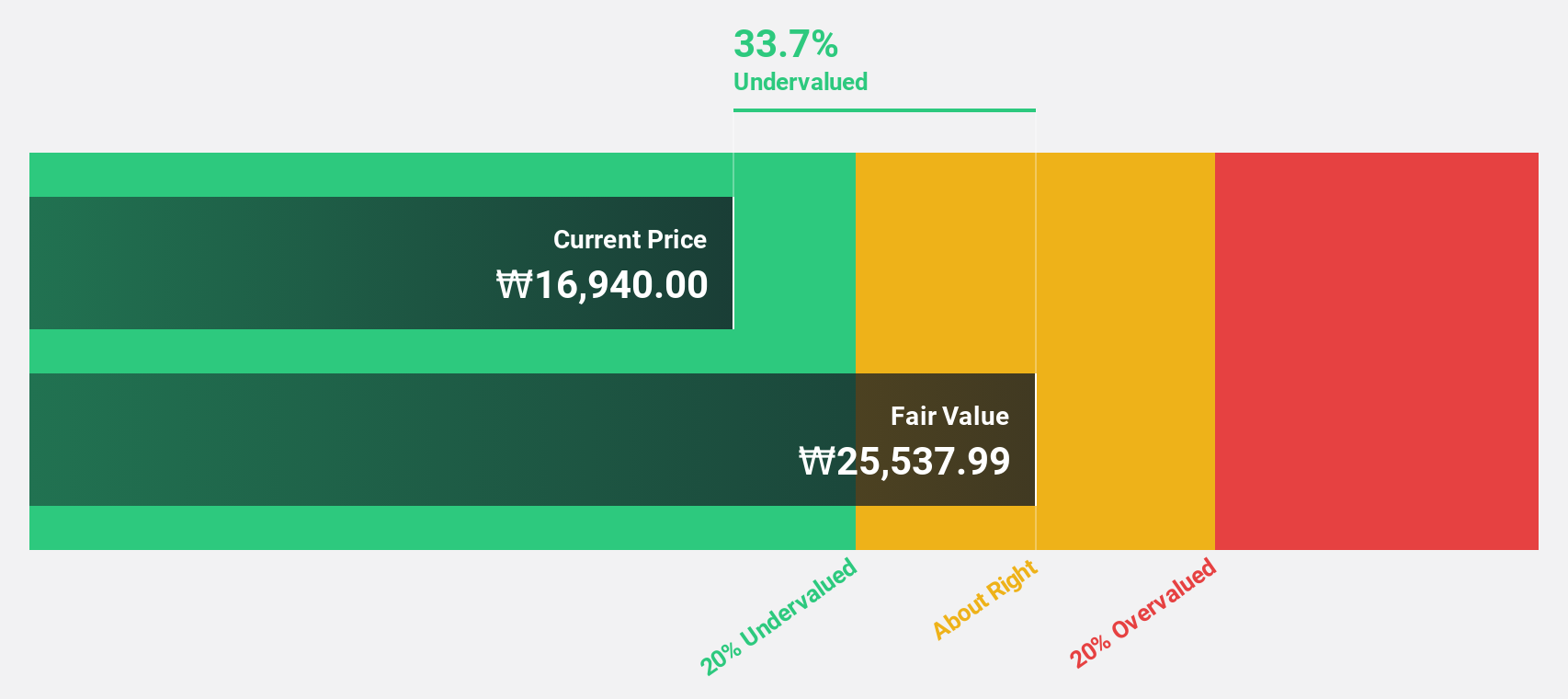

DAEDUCK ELECTRONICS (KOSE:A353200)

Overview: Daeduck Electronics Co., Ltd. manufactures and supplies a range of printed circuit boards (PCB) both domestically in South Korea and internationally, with a market cap of ₩732.09 billion.

Operations: Revenue Segments (in millions of ₩):

Estimated Discount To Fair Value: 46.7%

DAEDUCK ELECTRONICS is trading at ₩14,920, significantly below its estimated fair value of ₩28,002.61, indicating it may be undervalued based on cash flows. Despite a lower net profit margin this year compared to last and an unstable dividend track record, the company's earnings are forecast to grow significantly at 57.4% annually. Recent earnings show net income improvement with basic EPS rising from KRW 73 to KRW 100 year-over-year for Q3.

- Our earnings growth report unveils the potential for significant increases in DAEDUCK ELECTRONICS' future results.

- Delve into the full analysis health report here for a deeper understanding of DAEDUCK ELECTRONICS.

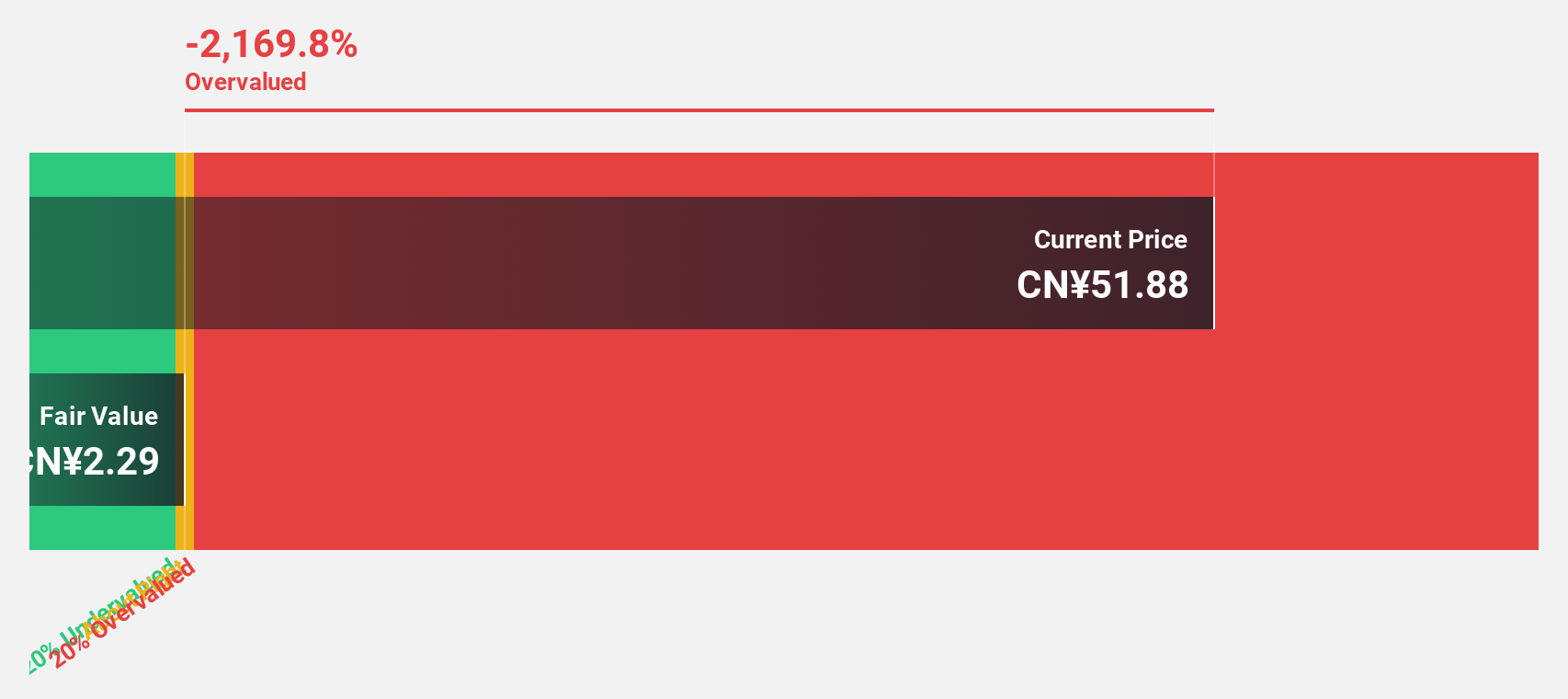

BrightGene Bio-Medical Technology (SHSE:688166)

Overview: BrightGene Bio-Medical Technology Co., Ltd. is a pharmaceutical company involved in the research, development, manufacture, and commercialization of pharmaceutical products in China, with a market cap of CN¥13.24 billion.

Operations: Unfortunately, the provided text does not include specific revenue segment data for BrightGene Bio-Medical Technology Co., Ltd.

Estimated Discount To Fair Value: 41.5%

BrightGene Bio-Medical Technology is trading at CN¥33.8, significantly below its estimated fair value of CN¥57.75, highlighting potential undervaluation based on cash flows. Despite a recent decline in net income to CNY 177.41 million for the first nine months of 2024, the company's earnings are forecast to grow substantially at 34.8% annually, outpacing the Chinese market average growth rate. However, its debt coverage by operating cash flow remains inadequate and share price volatility persists.

- Our comprehensive growth report raises the possibility that BrightGene Bio-Medical Technology is poised for substantial financial growth.

- Get an in-depth perspective on BrightGene Bio-Medical Technology's balance sheet by reading our health report here.

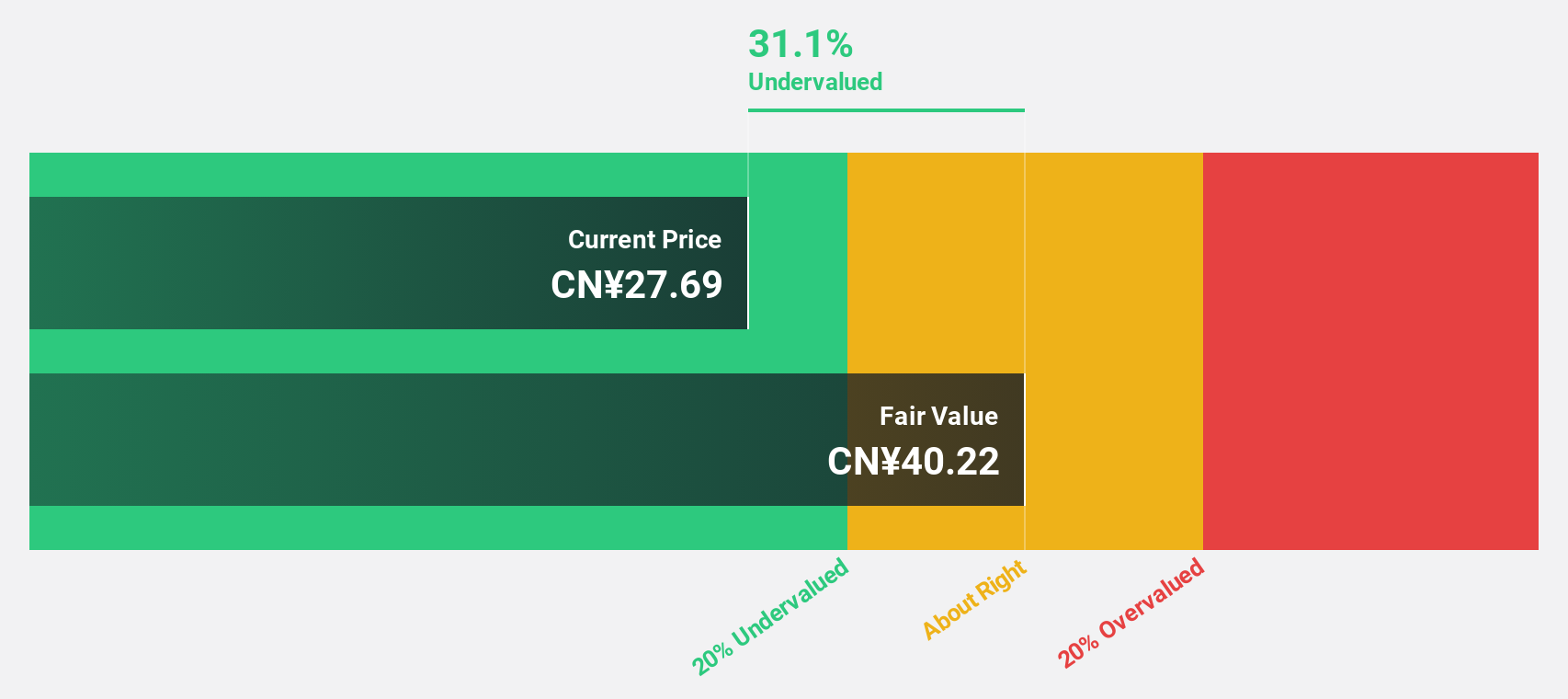

Chongqing Baiya Sanitary Products (SZSE:003006)

Overview: Chongqing Baiya Sanitary Products Co., Ltd. operates in the sanitary products industry and has a market cap of CN¥11.08 billion.

Operations: The company generates revenue primarily from its Personal Products segment, amounting to CN¥2.99 billion.

Estimated Discount To Fair Value: 15%

Chongqing Baiya Sanitary Products is trading at CN¥27.23, slightly below its estimated fair value of CN¥32.02, indicating potential undervaluation based on cash flows. The company reported a strong increase in sales to CNY 2.32 billion for the first nine months of 2024, with net income rising to CNY 238.52 million from CNY 182.4 million a year ago. Despite this growth, its dividend yield of 2.02% is not well covered by free cash flows.

- Our growth report here indicates Chongqing Baiya Sanitary Products may be poised for an improving outlook.

- Click here to discover the nuances of Chongqing Baiya Sanitary Products with our detailed financial health report.

Summing It All Up

- Investigate our full lineup of 901 Undervalued Stocks Based On Cash Flows right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:003006

Chongqing Baiya Sanitary Products

Chongqing Baiya Sanitary Products Co., Ltd.

Exceptional growth potential with flawless balance sheet.