Nanjing Vazyme Biotech Co., Ltd's (SHSE:688105) 45% Price Boost Is Out Of Tune With Revenues

Nanjing Vazyme Biotech Co., Ltd (SHSE:688105) shareholders have had their patience rewarded with a 45% share price jump in the last month. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 3.4% over the last year.

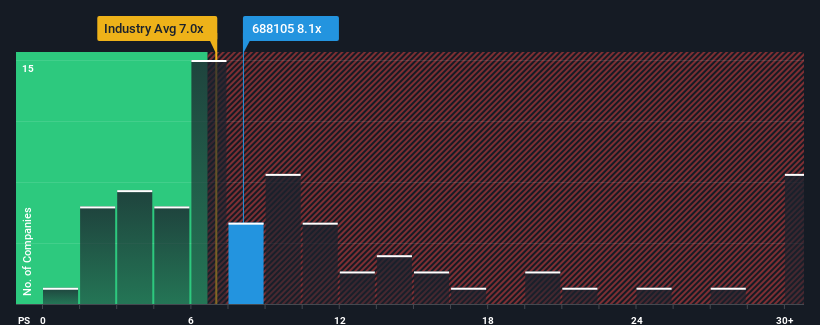

In spite of the firm bounce in price, it's still not a stretch to say that Nanjing Vazyme Biotech's price-to-sales (or "P/S") ratio of 8.1x right now seems quite "middle-of-the-road" compared to the Biotechs industry in China, where the median P/S ratio is around 7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Nanjing Vazyme Biotech

How Has Nanjing Vazyme Biotech Performed Recently?

Nanjing Vazyme Biotech hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Nanjing Vazyme Biotech's future stacks up against the industry? In that case, our free report is a great place to start.How Is Nanjing Vazyme Biotech's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Nanjing Vazyme Biotech's is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 46%. As a result, revenue from three years ago have also fallen 20% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 30% over the next year. That's shaping up to be materially lower than the 230% growth forecast for the broader industry.

In light of this, it's curious that Nanjing Vazyme Biotech's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Key Takeaway

Nanjing Vazyme Biotech's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

When you consider that Nanjing Vazyme Biotech's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Nanjing Vazyme Biotech you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Nanjing Vazyme Biotech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688105

Nanjing Vazyme Biotech

Offers technology solutions for life science, biomedicine, and in vitro diagnostics.

High growth potential with adequate balance sheet.