- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6976

Exploring Three High Growth Tech Stocks With Promising Potential

Reviewed by Simply Wall St

In the current global market landscape, volatility has been a significant theme, with U.S. stocks experiencing fluctuations due to competitive pressures in the tech sector and ongoing geopolitical concerns. Despite these challenges, some tech stocks continue to show high growth potential by leveraging innovation and strategic positioning within rapidly evolving industries.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★☆ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1226 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Nanjing Vazyme Biotech (SHSE:688105)

Simply Wall St Growth Rating: ★★★★★☆

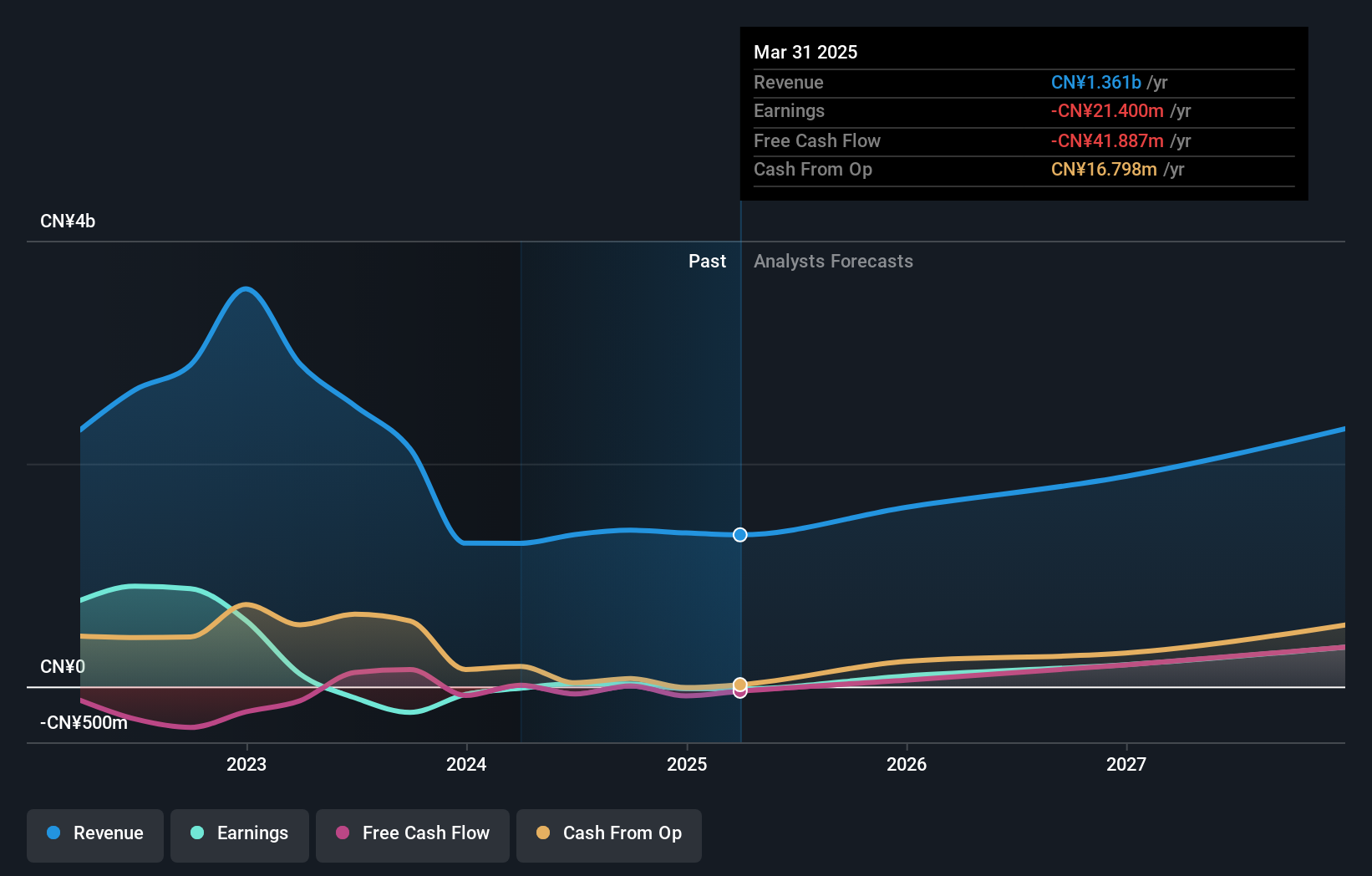

Overview: Nanjing Vazyme Biotech Co., Ltd provides technology solutions for life science, biomedicine, and in vitro diagnostics with a market capitalization of CN¥8.02 billion.

Operations: Vazyme Biotech focuses on developing technology solutions across life science, biomedicine, and in vitro diagnostics. The company generates revenue through its specialized offerings in these sectors.

Nanjing Vazyme Biotech has demonstrated robust growth, with revenue forecasted to increase by 23.7% annually, surpassing the CN market's average of 13.5%. This growth is complemented by an impressive projected annual earnings increase of 90%, significantly outpacing the broader market's expectation of 25.3%. The company's strategic focus on R&D is evident from its substantial investment, which includes a notable one-off gain of CN¥209.2 million that impacted recent financial results. Moreover, Vazyme's commitment to shareholder returns is highlighted by its recent share repurchase program, completing the buyback of over 4 million shares for CN¥104.38 million.

Wuxi Taclink Optoelectronics Technology (SHSE:688205)

Simply Wall St Growth Rating: ★★★★★☆

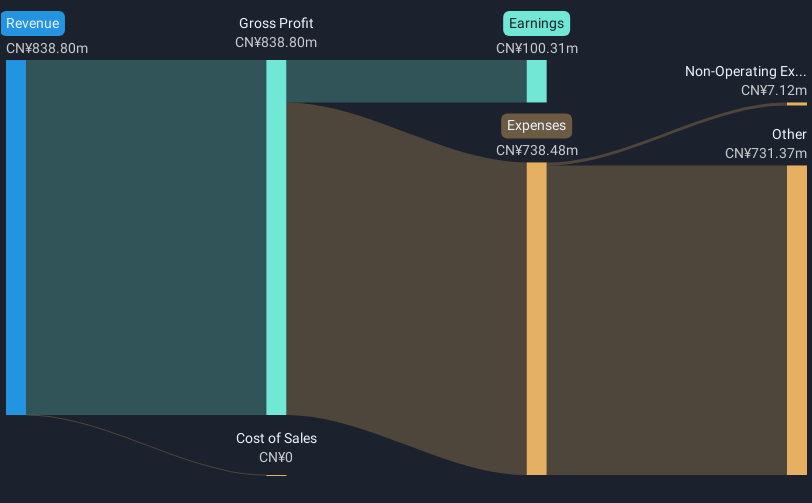

Overview: Wuxi Taclink Optoelectronics Technology Co., Ltd. specializes in the development and manufacturing of optoelectronic components and systems, with a market cap of CN¥12.20 billion.

Operations: Taclink Optoelectronics generates revenue primarily through the sale of optoelectronic components and systems. The company focuses on leveraging its expertise in this niche market to drive growth and innovation.

Wuxi Taclink Optoelectronics Technology is capturing attention with its robust performance in the tech sector, marked by a significant annual revenue growth of 27.9%, outpacing the Chinese market average of 13.5%. This growth trajectory is complemented by an impressive earnings increase projected at 33.7% annually. The company's commitment to innovation is underscored by its strategic R&D investments, which are crucial for maintaining technological leadership and competitiveness in optoelectronics. Recent developments include a notable Q3 earnings call that may influence future performance projections and investor sentiment, highlighting Wuxi Taclink's potential in both domestic and global markets.

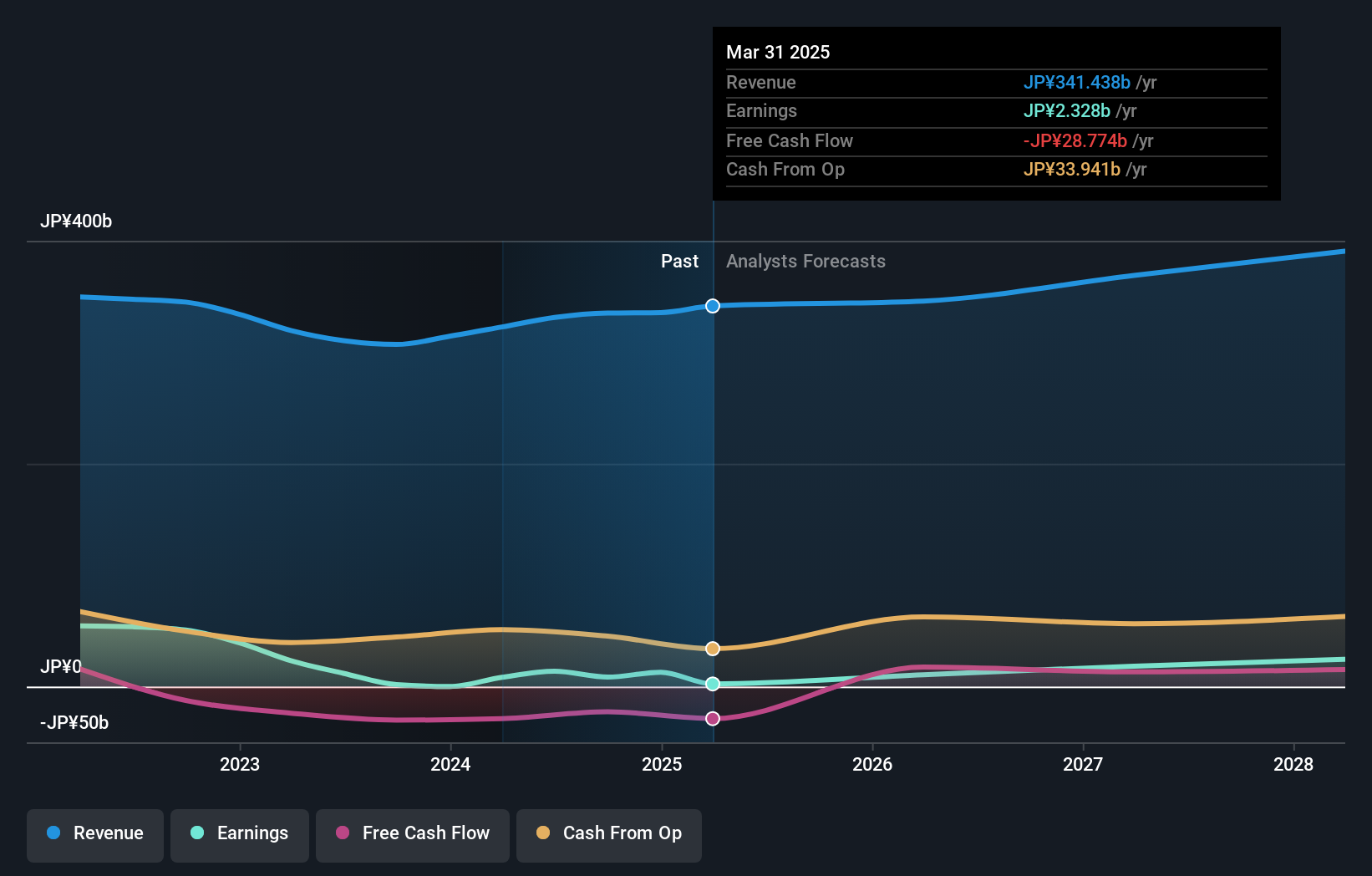

Taiyo Yuden (TSE:6976)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Taiyo Yuden Co., Ltd. is a company that develops, manufactures, and sells electronic components across Japan, China, Hong Kong, and other international markets with a market cap of ¥273.48 billion.

Operations: The company primarily generates revenue from its Electronic Components Business, which reported sales of ¥335.08 billion.

Taiyo Yuden's recent performance in the tech sector is marked by a notable 34.9% forecasted annual earnings growth, significantly outpacing the Japanese market's 7.8% average, reflecting its robust strategic positioning. Despite a recent revision in earnings guidance lowering expectations for the fiscal year ending March 2025, the company has demonstrated resilience with an impressive 388.7% earnings growth over the past year, highlighting its potential to recover and adapt in dynamic market conditions. At CES 2025, Taiyo Yuden showcased innovations that could further solidify its market presence, underscoring its commitment to leveraging R&D for long-term competitiveness.

- Delve into the full analysis health report here for a deeper understanding of Taiyo Yuden.

Evaluate Taiyo Yuden's historical performance by accessing our past performance report.

Seize The Opportunity

- Reveal the 1226 hidden gems among our High Growth Tech and AI Stocks screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Taiyo Yuden, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Taiyo Yuden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6976

Taiyo Yuden

Develops, manufactures, and sells electronic components in Japan, China, Hong Kong, and internationally.

Excellent balance sheet with reasonable growth potential.