- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A338220

3 Growth Companies With High Insider Ownership Seeing Earnings Rise Up To 110%

Reviewed by Simply Wall St

As global markets navigate the challenges posed by rising U.S. Treasury yields and tepid economic growth, investors are keenly observing how these conditions impact various sectors. Despite mixed performances across major indices, growth stocks have managed to outperform value stocks, highlighting the potential for companies with robust insider ownership to capitalize on current market dynamics. In this environment, a good stock often combines strong earnings growth with significant insider ownership, indicating confidence from those who know the company best and potentially offering resilience amid broader market fluctuations.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 21.1% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 25.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Medley (TSE:4480) | 34% | 30.4% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's dive into some prime choices out of the screener.

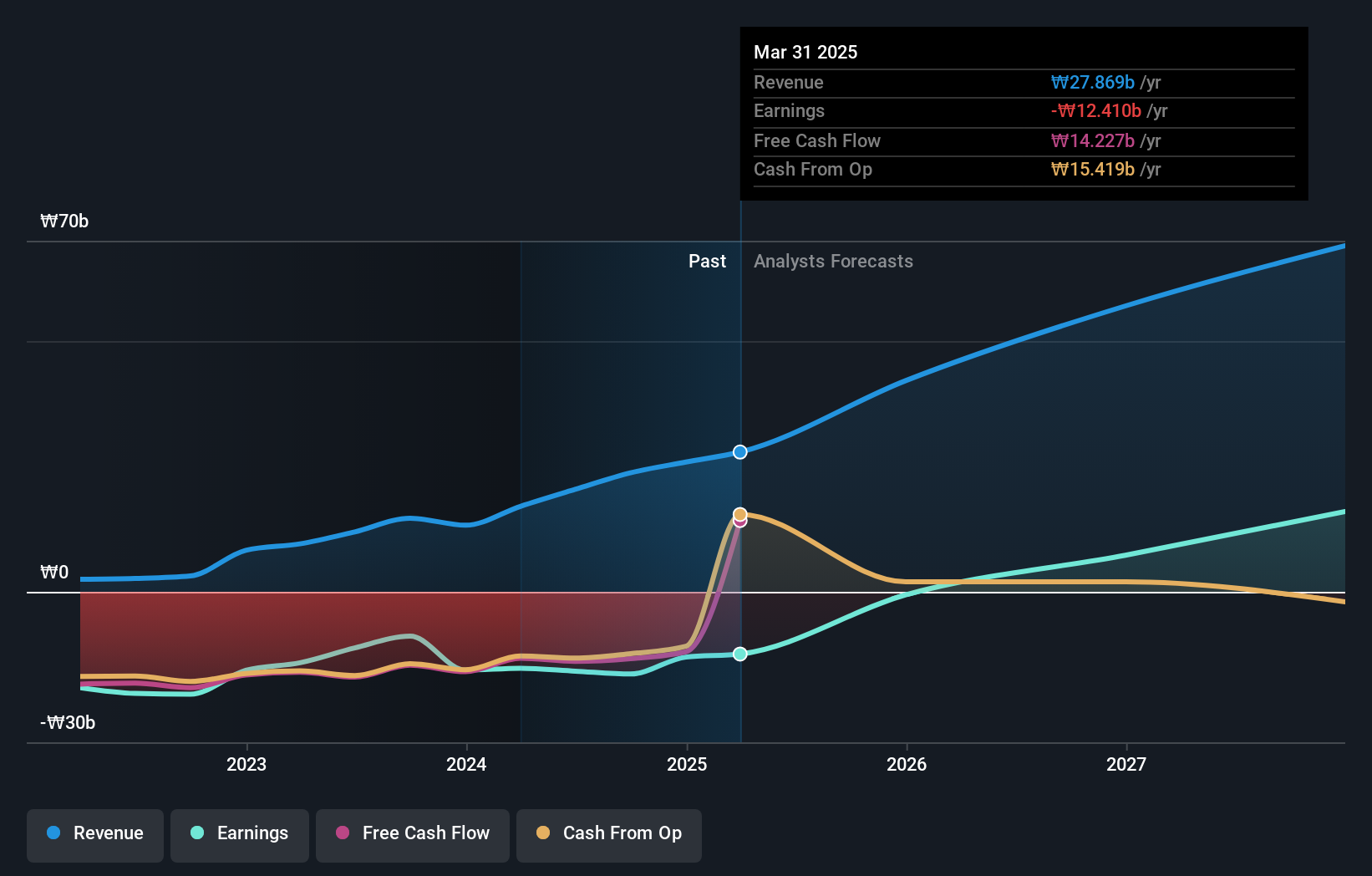

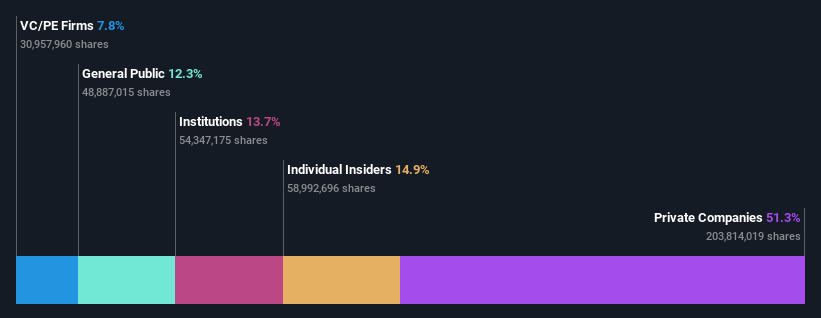

Vuno (KOSDAQ:A338220)

Simply Wall St Growth Rating: ★★★★★★

Overview: Vuno Inc. is a medical artificial intelligence solution development company with a market cap of ₩405.54 billion.

Operations: The company generates revenue from its artificial intelligence medical software production, amounting to ₩20.42 billion.

Insider Ownership: 19.4%

Earnings Growth Forecast: 110.9% p.a.

Vuno is expected to achieve profitability within three years, with revenue projected to grow at an impressive 43.7% annually, surpassing the market average of 10.2%. Despite recent shareholder dilution, its earnings are forecast to increase by a substantial 110.92% per year. The stock trades at approximately 15.6% below estimated fair value and anticipates a very high return on equity of 114.3% in three years, reflecting strong growth potential despite no significant insider trading activity recently.

- Dive into the specifics of Vuno here with our thorough growth forecast report.

- The analysis detailed in our Vuno valuation report hints at an inflated share price compared to its estimated value.

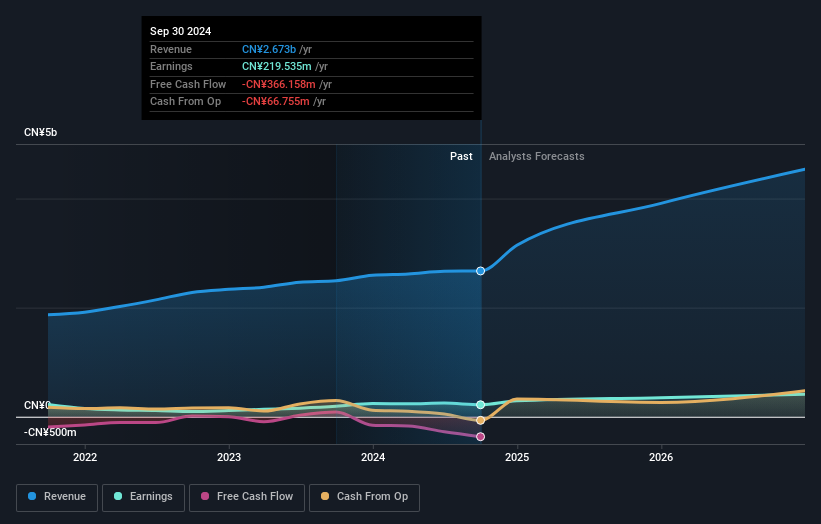

Nanjing Vazyme Biotech (SHSE:688105)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nanjing Vazyme Biotech Co., Ltd provides technology solutions in life science, biomedicine, and in vitro diagnostics with a market cap of approximately CN¥9.33 billion.

Operations: The company's revenue segments include life science technology solutions, biomedicine, and in vitro diagnostics.

Insider Ownership: 12.9%

Earnings Growth Forecast: 76.3% p.a.

Nanjing Vazyme Biotech's recent earnings report shows a return to profitability, with net income reaching CNY 18.16 million for the nine months ended September 2024, compared to a loss last year. The company has completed a share buyback worth CNY 104.01 million, indicating confidence in its valuation. Forecasts suggest robust annual earnings growth of over 76%, outpacing market averages, although the stock exhibits high price volatility and low projected return on equity at 7.7%.

- Delve into the full analysis future growth report here for a deeper understanding of Nanjing Vazyme Biotech.

- Our comprehensive valuation report raises the possibility that Nanjing Vazyme Biotech is priced lower than what may be justified by its financials.

Zhejiang Double Arrow Rubber (SZSE:002381)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhejiang Double Arrow Rubber Co., Ltd. manufactures and sells rubber conveyor belt products both in China and internationally, with a market cap of CN¥2.76 billion.

Operations: The company's revenue segments focus on the production and distribution of rubber conveyor belt products within domestic and international markets.

Insider Ownership: 36.5%

Earnings Growth Forecast: 24% p.a.

Zhejiang Double Arrow Rubber demonstrates potential with forecasted revenue growth of 22.2% annually, surpassing the Chinese market's average. Despite a recent dip in net income to CNY 139.62 million for the nine months ending September 2024, its price-to-earnings ratio of 12.7x suggests it is trading at a good value compared to peers. However, its dividend yield of 3.7% is not well covered by free cash flows, and return on equity is projected to remain low at 14.3%.

- Get an in-depth perspective on Zhejiang Double Arrow Rubber's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Zhejiang Double Arrow Rubber's current price could be quite moderate.

Make It Happen

- Delve into our full catalog of 1530 Fast Growing Companies With High Insider Ownership here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A338220

Vuno

Operates as a medical artificial intelligence (AI) solution development company.

Exceptional growth potential with adequate balance sheet.