Global Growth Companies With High Insider Ownership And 62 Percent Earnings Growth

Reviewed by Simply Wall St

As global markets navigate a landscape marked by easing inflation in the U.S. and ongoing trade uncertainties, investors are increasingly focused on identifying robust opportunities amid the volatility. In such an environment, growth companies with high insider ownership can present compelling prospects, as they often indicate strong confidence from those closest to the business and can be well-positioned to capitalize on favorable economic shifts.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Vow (OB:VOW) | 13.1% | 120.9% |

| Pharma Mar (BME:PHM) | 11.8% | 40.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 45.7% |

| CD Projekt (WSE:CDR) | 29.7% | 39.1% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Nordic Halibut (OB:NOHAL) | 29.8% | 56.3% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 125.9% |

| Fulin Precision (SZSE:300432) | 13.6% | 78.6% |

| Ascentage Pharma Group International (SEHK:6855) | 17.9% | 60.9% |

| Synspective (TSE:290A) | 13.2% | 37.4% |

Let's take a closer look at a couple of our picks from the screened companies.

Newborn Town (SEHK:9911)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Newborn Town Inc. is an investment holding company that operates in the global social networking sector with a market cap of HK$9.16 billion.

Operations: The company's revenue primarily comes from its Social Networking Business, generating CN¥3.80 billion, with an additional CN¥406.28 million from its Innovative Business segment.

Insider Ownership: 22.1%

Earnings Growth Forecast: 22.4% p.a.

Newborn Town's earnings are forecast to grow at 22.4% annually, outpacing the Hong Kong market. Despite recent shareholder dilution, the company trades below its estimated fair value and offers good relative value compared to peers. Recent guidance indicates a significant revenue increase driven by AI-powered social apps and acquisitions, though net profit growth is more modest due to prior one-off gains. Leadership changes bring new expertise in capital markets and technology investment.

- Click here to discover the nuances of Newborn Town with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Newborn Town is trading behind its estimated value.

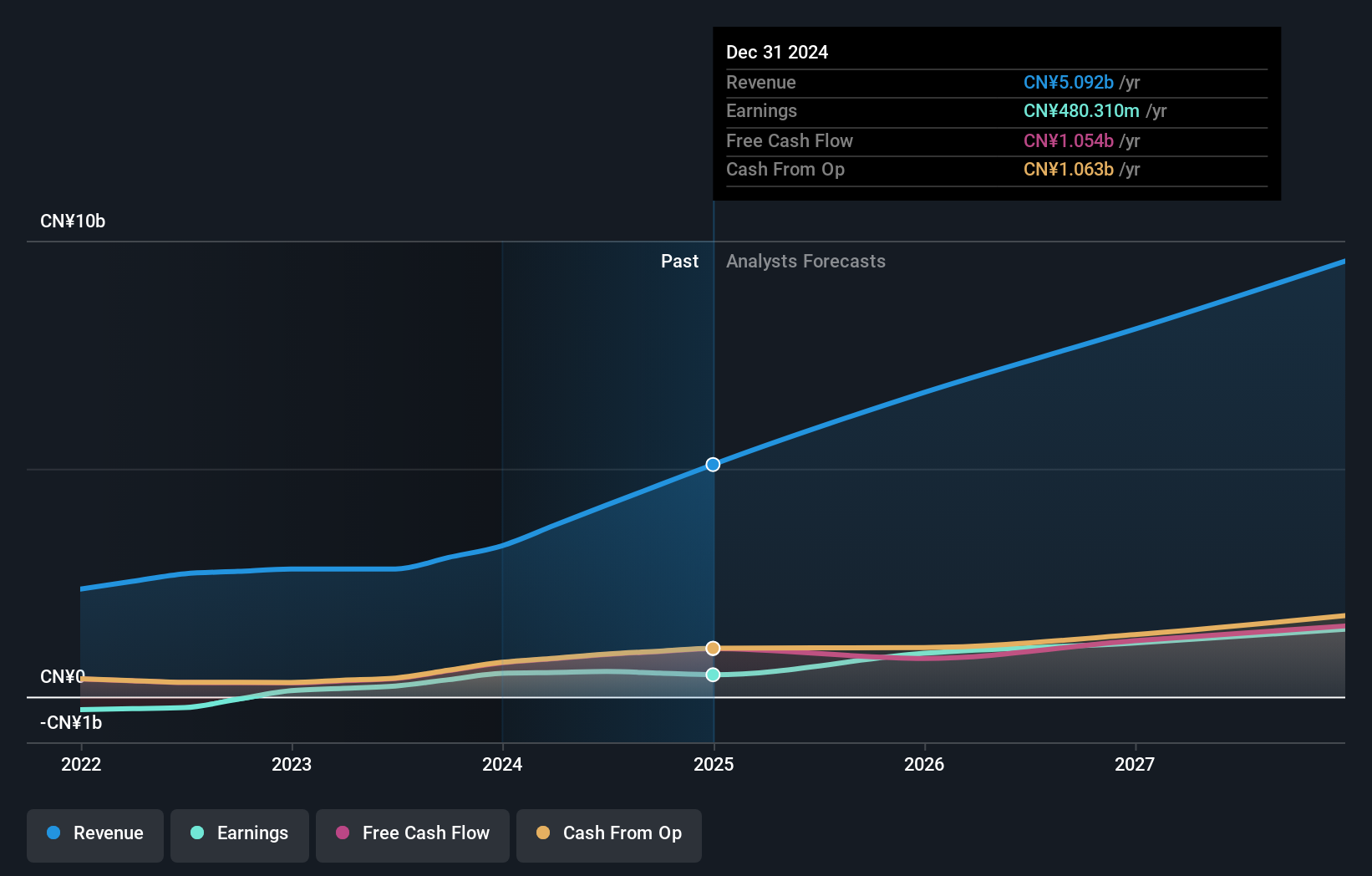

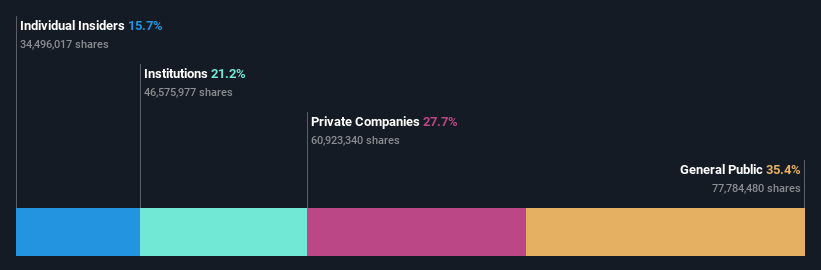

Jiangsu Sinopep-Allsino Biopharmaceutical (SHSE:688076)

Simply Wall St Growth Rating: ★★★★★★

Overview: Jiangsu Sinopep-Allsino Biopharmaceutical Co., Ltd. is a biomedical company involved in the R&D, production, sale, and technical service of peptides and small molecule drugs in China, with a market cap of CN¥12.96 billion.

Operations: The company's revenue is primarily derived from its Medicine Manufacturing segment, which generated CN¥1.62 billion.

Insider Ownership: 15.4%

Earnings Growth Forecast: 35.1% p.a.

Jiangsu Sinopep-Allsino Biopharmaceutical's earnings grew substantially by 145.9% last year, with revenue reaching CNY 1.62 billion. Forecasts suggest continued robust growth, with earnings expected to rise significantly at 35.1% annually, surpassing the Chinese market average. The stock trades well below its estimated fair value, indicating potential undervaluation despite no recent insider trading activity reported over the past three months. This positions it as a compelling option for growth-focused investors seeking high insider ownership dynamics.

- Unlock comprehensive insights into our analysis of Jiangsu Sinopep-Allsino Biopharmaceutical stock in this growth report.

- Our expertly prepared valuation report Jiangsu Sinopep-Allsino Biopharmaceutical implies its share price may be lower than expected.

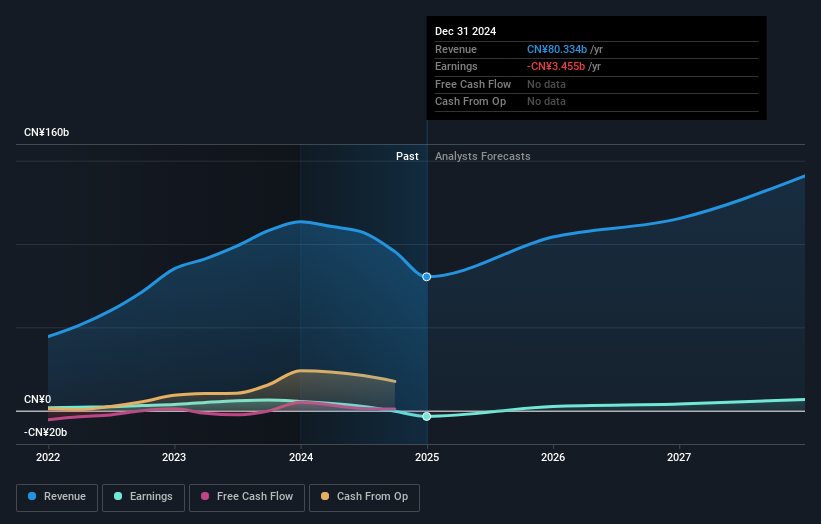

Trina Solar (SHSE:688599)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Trina Solar Co., Ltd. is involved in the research, development, production, and sales of photovoltaic modules across various global markets including China, Europe, North America, and others; it has a market cap of approximately CN¥38.27 billion.

Operations: Trina Solar generates revenue through the research, development, production, and sales of photovoltaic modules in diverse international markets such as China, Europe, North America, South America, Japan, the Asia Pacific region, the Middle East, and North Africa.

Insider Ownership: 33.2%

Earnings Growth Forecast: 62.3% p.a.

Trina Solar's recent collaboration with Smart Commercial Solar highlights its commitment to renewable energy, evidenced by the successful solar installation at AstraZeneca's Macquarie Park. While the company's revenue is expected to grow 16.1% annually, it trades 42.3% below estimated fair value and faces high debt levels. Despite a forecasted profit growth of 62.26% per year, insider trading activity remains minimal over the past three months, and its dividend coverage is weak relative to earnings and cash flows.

- Get an in-depth perspective on Trina Solar's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Trina Solar shares in the market.

Summing It All Up

- Delve into our full catalog of 886 Fast Growing Global Companies With High Insider Ownership here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Jiangsu Sinopep-Allsino Biopharmaceutical, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688076

Jiangsu Sinopep-Allsino Biopharmaceutical

A biomedical company, engages in the research and development, production, sale, and technical service of peptides and small molecule drugs in China.

Exceptional growth potential with solid track record.