Some Confidence Is Lacking In Gan & Lee Pharmaceuticals.'s (SHSE:603087) P/S

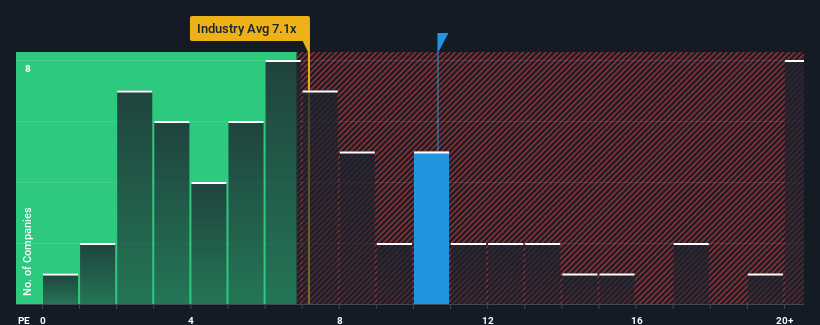

When close to half the companies in the Biotechs industry in China have price-to-sales ratios (or "P/S") below 7.1x, you may consider Gan & Lee Pharmaceuticals. (SHSE:603087) as a stock to potentially avoid with its 10.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Gan & Lee Pharmaceuticals

What Does Gan & Lee Pharmaceuticals' Recent Performance Look Like?

Gan & Lee Pharmaceuticals could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Gan & Lee Pharmaceuticals will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Gan & Lee Pharmaceuticals?

In order to justify its P/S ratio, Gan & Lee Pharmaceuticals would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 26% drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 30% over the next year. Meanwhile, the rest of the industry is forecast to expand by 158%, which is noticeably more attractive.

In light of this, it's alarming that Gan & Lee Pharmaceuticals' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It comes as a surprise to see Gan & Lee Pharmaceuticals trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

You should always think about risks. Case in point, we've spotted 3 warning signs for Gan & Lee Pharmaceuticals you should be aware of, and 2 of them are significant.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603087

Gan & Lee Pharmaceuticals

A biopharmaceutical company, engages in the research, development, production, and sale of insulin analog active pharmaceutical ingredients (APIs) and injections in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives