- Taiwan

- /

- Tech Hardware

- /

- TWSE:2382

High Growth Tech Stocks To Consider In February 2025

Reviewed by Simply Wall St

In February 2025, global markets are witnessing a dynamic landscape with U.S. stock indexes climbing toward record highs, driven by the Nasdaq Composite's robust performance and growth stocks outpacing value shares. Amid this backdrop of rising inflation and interest rate expectations, small-cap stocks have lagged behind larger indices like the S&P 500, presenting both challenges and opportunities for investors seeking high-growth tech stocks that can thrive in such fluctuating conditions. Identifying promising tech stocks involves looking at companies with innovative potential and resilience to navigate economic uncertainties while capitalizing on market trends.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 25.35% | 25.09% | ★★★★★★ |

| CD Projekt | 27.11% | 39.37% | ★★★★★★ |

| Pharma Mar | 23.77% | 45.40% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1207 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Vobile Group (SEHK:3738)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vobile Group Limited is an investment holding company that offers software as a service for protecting and transacting digital content assets across the United States, Japan, Mainland China, and other international markets, with a market capitalization of approximately HK$9.09 billion.

Operations: Vobile Group generates revenue primarily through its software as a service (SaaS) offerings for digital content asset protection and transactions, with reported revenue of HK$2.18 billion.

Vobile Group Limited, amidst a transformative phase in the media and entertainment sector, is leveraging its technological prowess to address the burgeoning needs of the generative AI ecosystem. With a robust annual revenue growth forecast at 18.1%, outpacing Hong Kong's market average of 7.9%, Vobile is strategically positioned to capitalize on emerging opportunities. The company recently unveiled new copyright management services tailored for AI-generated content, highlighting its commitment to innovation and intellectual property rights protection in an industry projected by experts to reach $3 trillion. This move, coupled with leadership changes and active participation in key industry events like CES 2025 and NOBLECON20, underscores Vobile's proactive approach in navigating through tech-driven disruptions and securing its foothold in a rapidly evolving digital economy.

- Get an in-depth perspective on Vobile Group's performance by reading our health report here.

Examine Vobile Group's past performance report to understand how it has performed in the past.

Gan & Lee Pharmaceuticals (SHSE:603087)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Gan & Lee Pharmaceuticals is a biopharmaceutical company focused on the research, development, production, and sale of insulin analog APIs and injections in China, with a market cap of CN¥27.13 billion.

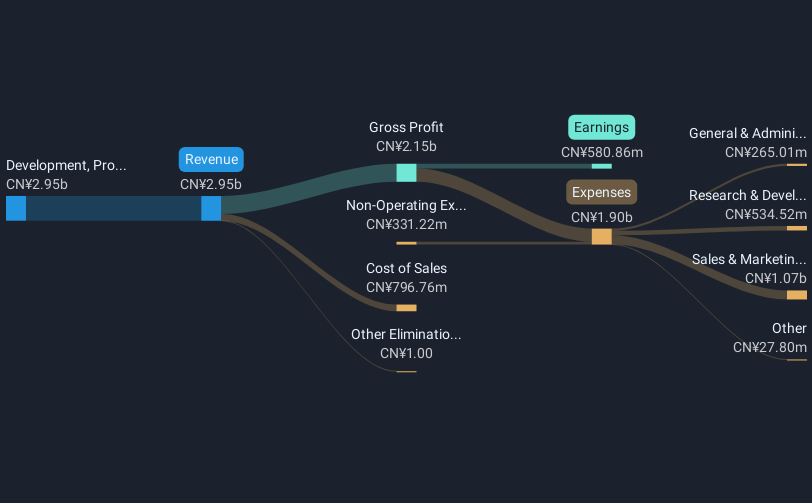

Operations: With a primary focus on insulin analog APIs and injections, Gan & Lee Pharmaceuticals generated CN¥2.95 billion from the development, production, and sales of insulin and related products.

Gan & Lee Pharmaceuticals is experiencing a dynamic phase with its revenue projected to grow at 27.7% annually, significantly outpacing the Chinese market average of 13.3%. This growth is complemented by an impressive earnings increase of 141.3% over the past year, highlighting its robust position in the biotech sector where it has exceeded industry growth rates. Despite recent challenges, including being dropped from a major index, Gan & Lee continues to innovate; however, it's noteworthy that no shares were repurchased in the latest quarter, reflecting a cautious approach towards capital allocation amidst expansion efforts. With R&D expenses notably high at CN¥174.9 million due to one-off gains impacting financial results, Gan & Lee's commitment to advancing pharmaceutical solutions remains evident as it navigates through market volatilities and regulatory landscapes.

- Click here to discover the nuances of Gan & Lee Pharmaceuticals with our detailed analytical health report.

Learn about Gan & Lee Pharmaceuticals' historical performance.

Quanta Computer (TWSE:2382)

Simply Wall St Growth Rating: ★★★★★★

Overview: Quanta Computer Inc. is a global manufacturer and seller of notebook computers with a market capitalization of NT$1.04 trillion.

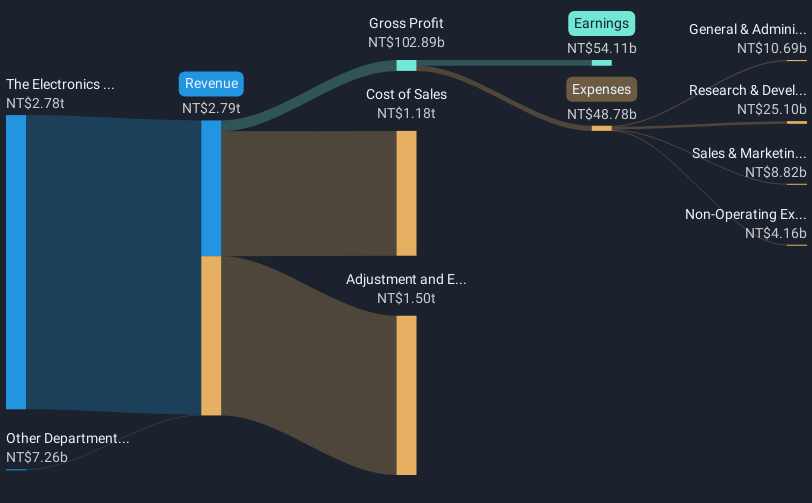

Operations: Quanta Computer Inc. focuses on the manufacturing and sale of notebook computers across Asia, the Americas, Europe, and internationally. The Electronics Sector contributes NT$2.78 billion to its revenue streams.

Quanta Computer is navigating a transformative phase with its revenue forecast to surge by 36.9% annually, outstripping the Taiwanese market's growth of 11.3%. This robust expansion is supported by an anticipated annual earnings increase of 20.8%, reflecting a strategic emphasis on innovation and market adaptation. Recent engagements, including presentations at multiple investment forums, underscore its active role in shaping tech dialogues and investor relations. Notably, Quanta's commitment to research and development is evident with significant investments amounting to TWD 482 million, positioning it well for sustained technological advancements despite not engaging in share repurchases this past year.

- Click to explore a detailed breakdown of our findings in Quanta Computer's health report.

Evaluate Quanta Computer's historical performance by accessing our past performance report.

Key Takeaways

- Embark on your investment journey to our 1207 High Growth Tech and AI Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quanta Computer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2382

Quanta Computer

Manufactures and sells notebook computers in Asia, the Americas, Europe, and internationally.

Very undervalued with exceptional growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives