Investors Still Waiting For A Pull Back In Xinjiang Bai Hua Cun Pharma Tech Co.,Ltd (SHSE:600721)

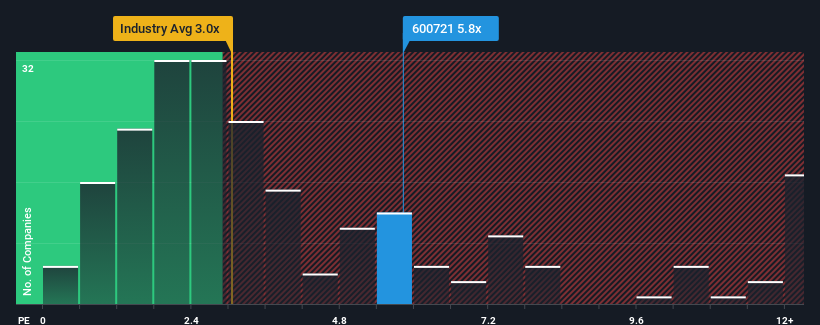

When you see that almost half of the companies in the Pharmaceuticals industry in China have price-to-sales ratios (or "P/S") below 3x, Xinjiang Bai Hua Cun Pharma Tech Co.,Ltd (SHSE:600721) looks to be giving off strong sell signals with its 5.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Xinjiang Bai Hua Cun Pharma TechLtd

How Xinjiang Bai Hua Cun Pharma TechLtd Has Been Performing

Xinjiang Bai Hua Cun Pharma TechLtd has been doing a decent job lately as it's been growing revenue at a reasonable pace. One possibility is that the P/S ratio is high because investors think this good revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Xinjiang Bai Hua Cun Pharma TechLtd will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Xinjiang Bai Hua Cun Pharma TechLtd's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 4.8%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, even though the last 12 months were fairly tame in comparison. Therefore, it's fair to say the revenue growth recently has been superb for the company.

This is in contrast to the rest of the industry, which is expected to grow by 18% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Xinjiang Bai Hua Cun Pharma TechLtd's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Xinjiang Bai Hua Cun Pharma TechLtd maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Xinjiang Bai Hua Cun Pharma TechLtd with six simple checks on some of these key factors.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600721

Xinjiang Bai Hua Cun Pharma TechLtd

Engages in the pharmaceutical research and development, clinical trials, biomedicine, commercial properties, and other businesses.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives