As global markets navigate a mixed landscape of rising treasury yields, fluctuating consumer confidence, and varied economic data across regions, investors are seeking opportunities that align with these dynamic conditions. Penny stocks, often smaller or newer companies, remain an intriguing option for those willing to explore beyond established market giants. Despite the term's outdated connotations, these stocks can offer significant potential when underpinned by strong financials and growth prospects; we will spotlight three such promising penny stocks that stand out for their balance sheet resilience and potential for long-term success.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.73 | MYR431.91M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.03 | HK$44.38B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.955 | £490.66M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.928 | £146.07M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.60 | £68.66M | ★★★★☆☆ |

Click here to see the full list of 5,823 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

Powerlong Commercial Management Holdings (SEHK:9909)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Powerlong Commercial Management Holdings Limited operates in the People's Republic of China, offering commercial operational and residential property management services, with a market cap of HK$1.50 billion.

Operations: The company generates revenue from Commercial Operational Services amounting to CN¥2.17 billion and Residential Property Management Services totaling CN¥527.49 million.

Market Cap: HK$1.5B

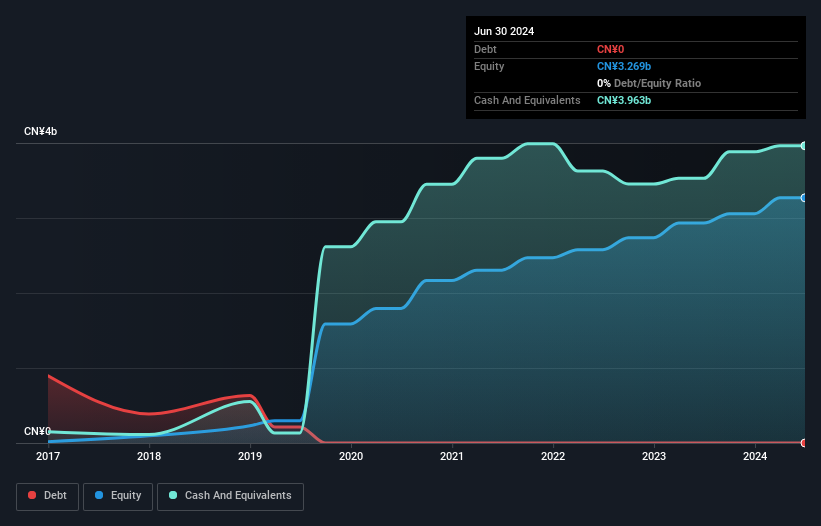

Powerlong Commercial Management Holdings, with a market cap of HK$1.50 billion, operates in China's commercial and residential property management sectors. The company has stable weekly volatility at 9% and is debt-free, which reduces financial risk. Short-term assets of CN¥4.8 billion comfortably cover both short-term and long-term liabilities, indicating sound liquidity management. However, recent executive changes with Mr. Hoi Wa Fong assuming dual roles as CEO and Chairman may impact strategic continuity despite his extensive industry experience. Additionally, the company's earnings growth has been negative over the past year but forecasts suggest modest future growth potential at 5.38% annually.

- Navigate through the intricacies of Powerlong Commercial Management Holdings with our comprehensive balance sheet health report here.

- Learn about Powerlong Commercial Management Holdings' future growth trajectory here.

Zhejiang CONBA PharmaceuticalLtd (SHSE:600572)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang CONBA Pharmaceutical Co., Ltd. is involved in the research, development, manufacturing, and sales of medicines and general health products in China, with a market cap of CN¥11.86 billion.

Operations: The company generates revenue of CN¥6.46 billion from its operations in China.

Market Cap: CN¥11.86B

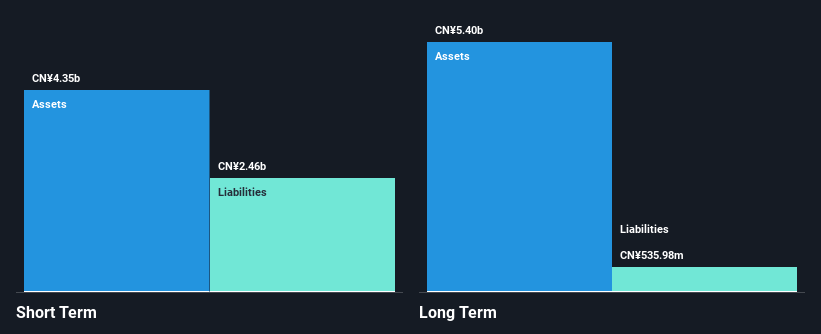

Zhejiang CONBA Pharmaceutical Ltd., with a market cap of CN¥11.86 billion, has demonstrated financial resilience despite challenges. The company maintains more cash than its total debt, ensuring strong liquidity and reducing financial risk. Earnings have grown significantly over the past five years, though recent performance shows a decline in net income and profit margins compared to last year. Its short-term assets exceed both short-term and long-term liabilities, indicating robust financial health. However, the board's lack of experience could affect strategic decisions moving forward. The stock trades at a favorable value compared to peers within the industry.

- Click here to discover the nuances of Zhejiang CONBA PharmaceuticalLtd with our detailed analytical financial health report.

- Evaluate Zhejiang CONBA PharmaceuticalLtd's prospects by accessing our earnings growth report.

Heidelberg Pharma (XTRA:HPHA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Heidelberg Pharma AG is a biopharmaceutical company specializing in oncology and antibody targeted amanitin conjugates (ATAC) with operations in Germany, other European countries, the United States, and internationally, and has a market cap of €113.72 million.

Operations: The company generates revenue primarily from its ADC Technology and Customer Specific Research segment, totaling €8.47 million.

Market Cap: €113.72M

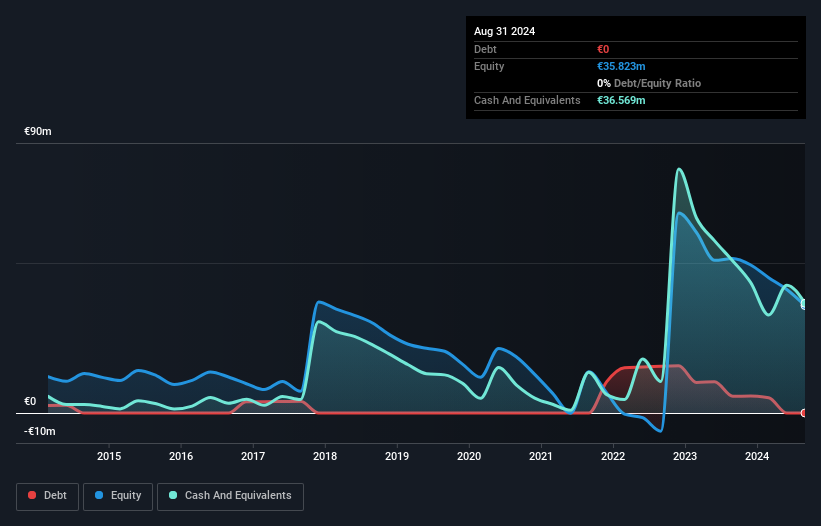

Heidelberg Pharma AG, with a market cap of €113.72 million, operates in the biopharmaceutical sector focusing on oncology. The company reported nine-month revenue of €7.62 million, down from €13.89 million the previous year, and a net loss of €14.26 million. Despite having no debt and sufficient short-term assets (€52.4M) to cover liabilities (€29.9M), it remains unprofitable with declining earnings forecasts over the next three years and high share price volatility recently observed in German stocks. The board is experienced; however, management has limited tenure which may impact strategic execution moving forward.

- Take a closer look at Heidelberg Pharma's potential here in our financial health report.

- Examine Heidelberg Pharma's earnings growth report to understand how analysts expect it to perform.

Make It Happen

- Take a closer look at our Penny Stocks list of 5,823 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heidelberg Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HPHA

Heidelberg Pharma

A biopharmaceutical company, focuses on oncology and antibody targeted amanitin conjugates (ATAC) in Germany, other European countries, the United States, and internationally.

Excellent balance sheet low.

Market Insights

Community Narratives