It's A Story Of Risk Vs Reward With Zhejiang CONBA Pharmaceutical Co.,Ltd. (SHSE:600572)

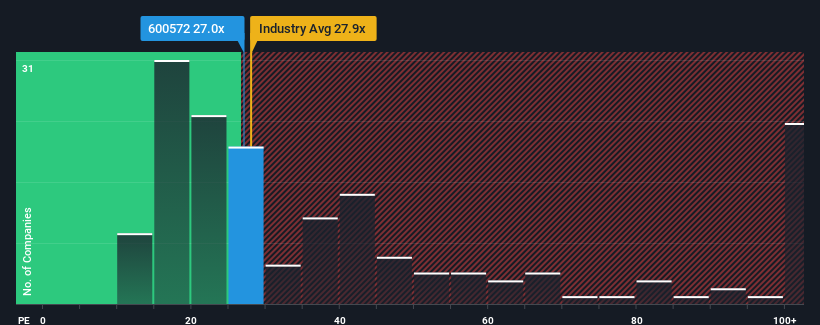

It's not a stretch to say that Zhejiang CONBA Pharmaceutical Co.,Ltd.'s (SHSE:600572) price-to-earnings (or "P/E") ratio of 27x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 30x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings that are retreating more than the market's of late, Zhejiang CONBA PharmaceuticalLtd has been very sluggish. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Check out our latest analysis for Zhejiang CONBA PharmaceuticalLtd

Does Growth Match The P/E?

Zhejiang CONBA PharmaceuticalLtd's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered a frustrating 31% decrease to the company's bottom line. Even so, admirably EPS has lifted 112% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 30% per annum during the coming three years according to the two analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 19% each year, which is noticeably less attractive.

With this information, we find it interesting that Zhejiang CONBA PharmaceuticalLtd is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Zhejiang CONBA PharmaceuticalLtd's P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Zhejiang CONBA PharmaceuticalLtd currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Zhejiang CONBA PharmaceuticalLtd you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang CONBA PharmaceuticalLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600572

Zhejiang CONBA PharmaceuticalLtd

Engages in the research and development, manufacturing, and sales of medicines and general health products in China.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives