- China

- /

- Hospitality

- /

- SHSE:605108

3 Growth Companies With Insider Ownership As High As 36%

Reviewed by Simply Wall St

As global markets continue to rally, driven by optimism surrounding potential trade deals and advancements in artificial intelligence, growth stocks have notably outperformed their value counterparts. In this environment of heightened investor enthusiasm, companies with substantial insider ownership can be particularly appealing, as such ownership often signals confidence in the company's long-term prospects and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 25.7% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.6% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| HANA Micron (KOSDAQ:A067310) | 18.2% | 119.4% |

Let's dive into some prime choices out of the screener.

Admicom Oyj (HLSE:ADMCM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Admicom Oyj provides cloud-based software and business process automation solutions in Finland with a market cap of €264.78 million.

Operations: The company's revenue is primarily derived from its software and programming segment, totaling €35.57 million.

Insider Ownership: 21.9%

Admicom Oyj is trading at 33.8% below its estimated fair value, presenting a potential opportunity for investors focused on growth companies with high insider ownership. The company's earnings are forecast to grow significantly at 21.6% annually over the next three years, outpacing the Finnish market's average of 14.6%. Despite large one-off items impacting financial results, Admicom's revenue is expected to grow faster than the market average, albeit slower than 20% per year.

- Get an in-depth perspective on Admicom Oyj's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Admicom Oyj implies its share price may be too high.

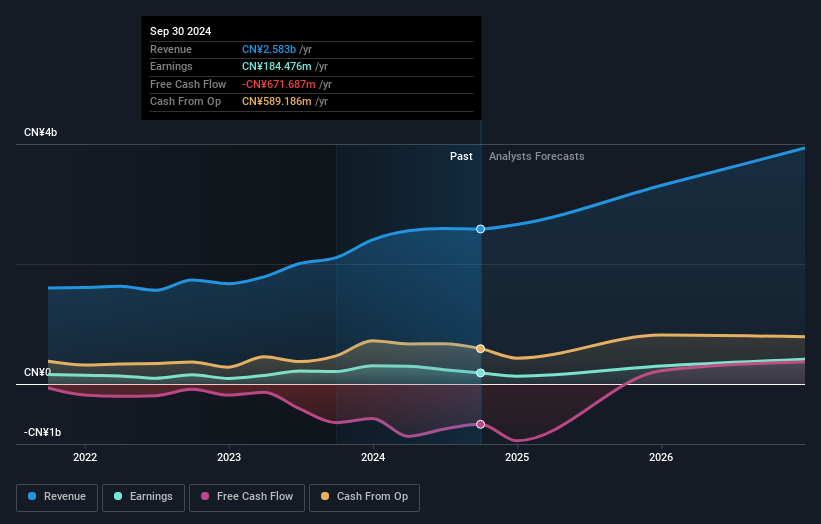

Tongqinglou Catering (SHSE:605108)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tongqinglou Catering Co., Ltd. operates in the catering services industry in China with a market capitalization of approximately CN¥5.61 billion.

Operations: Revenue Segments (in millions of CN¥):

Insider Ownership: 24.5%

Tongqinglou Catering is trading at 48.6% below its estimated fair value, offering potential for investors interested in growth companies with high insider ownership. The company's earnings are expected to grow significantly at 44.9% annually over the next three years, outpacing the Chinese market's average of 25%. However, its revenue growth forecast of 19.6% per year is slower than desired for a high-growth profile, and it maintains a high level of debt.

- Navigate through the intricacies of Tongqinglou Catering with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Tongqinglou Catering is priced lower than what may be justified by its financials.

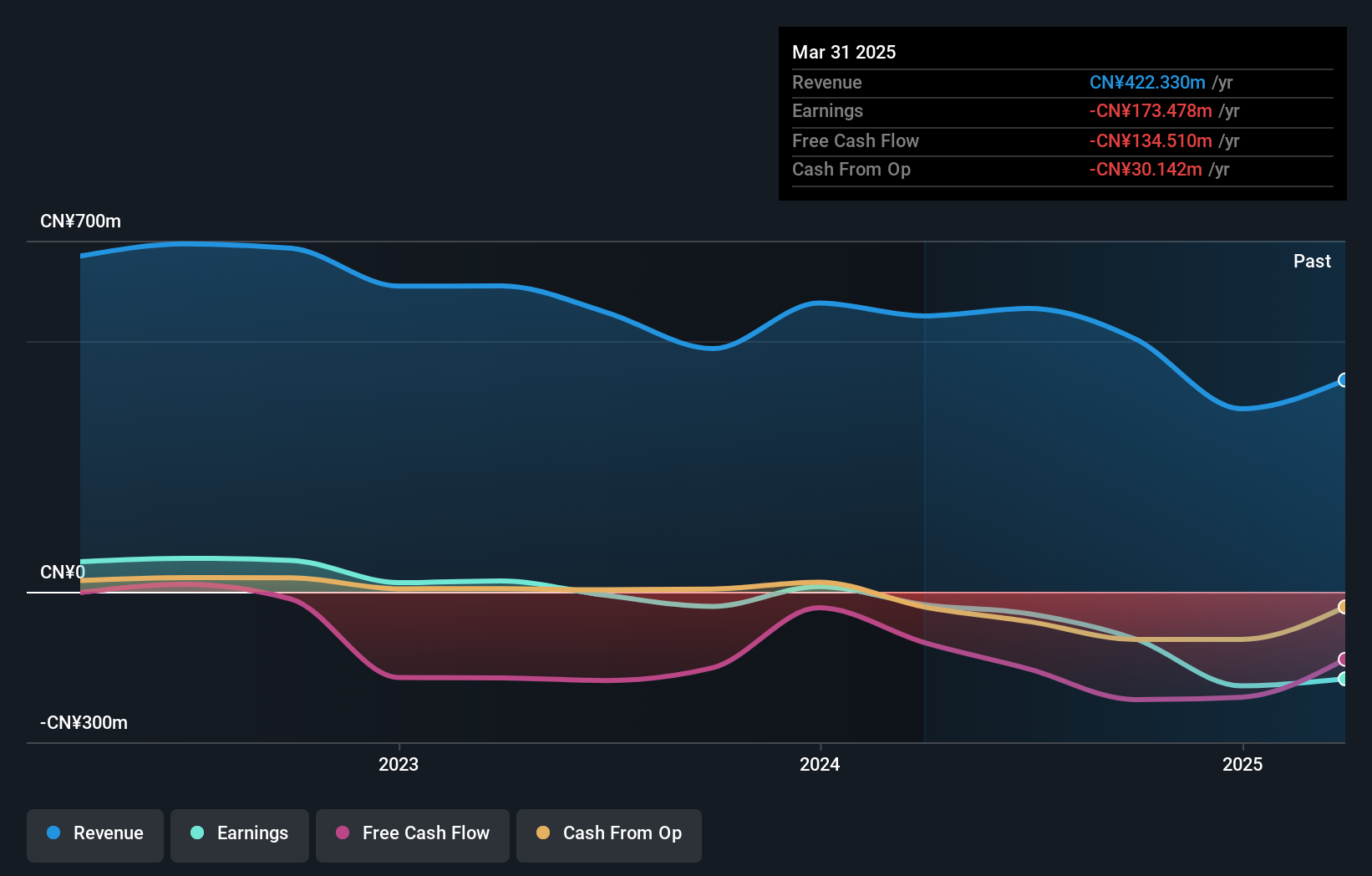

Guangzhou Frontop Digital Creative Technology (SZSE:301313)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangzhou Frontop Digital Creative Technology Corporation specializes in digital multimedia display services and technology, operating both in China and internationally, with a market cap of CN¥2.51 billion.

Operations: The company's revenue segments focus on the development and innovation of digital multimedia display services and technology across domestic and international markets.

Insider Ownership: 36.7%

Guangzhou Frontop Digital Creative Technology shows potential with an expected annual revenue growth of 23.9%, surpassing the Chinese market average. The company is forecast to become profitable within three years, indicating above-average market growth, although its Return on Equity is expected to be low at 6.4%. Despite these positives, the stock has experienced high volatility recently and offers a modest dividend yield of 0.62% that isn't well supported by earnings or cash flow.

- Dive into the specifics of Guangzhou Frontop Digital Creative Technology here with our thorough growth forecast report.

- Our valuation report here indicates Guangzhou Frontop Digital Creative Technology may be overvalued.

Next Steps

- Embark on your investment journey to our 1482 Fast Growing Companies With High Insider Ownership selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Tongqinglou Catering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605108

Undervalued with reasonable growth potential.

Market Insights

Community Narratives