- China

- /

- Entertainment

- /

- SZSE:300860

Investors Shouldn't Be Too Comfortable With Funshine Culture GroupLtd's (SZSE:300860) Earnings

Last week's profit announcement from Funshine Culture Group Co.,Ltd. (SZSE:300860) was underwhelming for investors, despite headline numbers being robust. We did some digging and found some worrying underlying problems.

Check out our latest analysis for Funshine Culture GroupLtd

A Closer Look At Funshine Culture GroupLtd's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

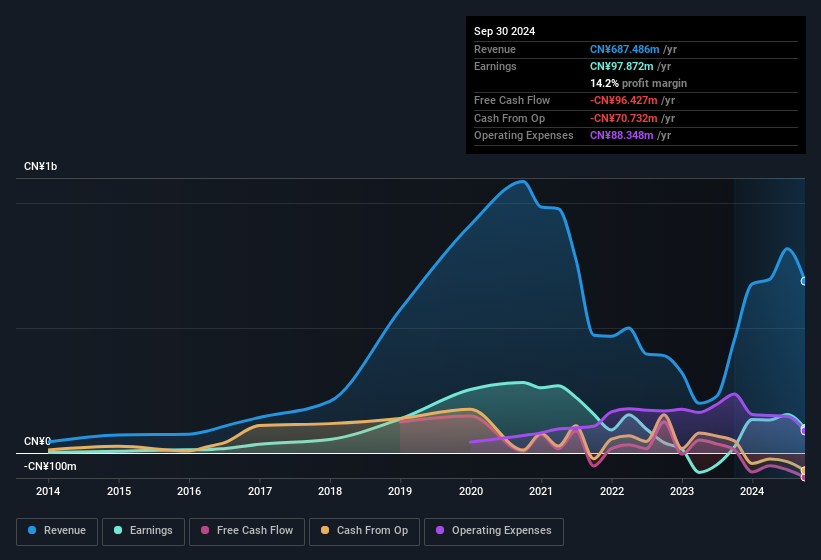

For the year to September 2024, Funshine Culture GroupLtd had an accrual ratio of 0.72. Statistically speaking, that's a real negative for future earnings. And indeed, during the period the company didn't produce any free cash flow whatsoever. Even though it reported a profit of CN¥97.9m, a look at free cash flow indicates it actually burnt through CN¥96m in the last year. It's worth noting that Funshine Culture GroupLtd generated positive FCF of CN¥13m a year ago, so at least they've done it in the past. Having said that, there is more to the story. The accrual ratio is reflecting the impact of unusual items on statutory profit, at least in part.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

The Impact Of Unusual Items On Profit

Unfortunately (in the short term) Funshine Culture GroupLtd saw its profit reduced by unusual items worth CN¥18m. If this was a non-cash charge, it would have made the accrual ratio better, if cashflow had stayed strong, so it's not great to see in combination with an uninspiring accrual ratio. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. If Funshine Culture GroupLtd doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

Our Take On Funshine Culture GroupLtd's Profit Performance

Funshine Culture GroupLtd saw unusual items weigh on its profit, which should have made it easier to show high cash conversion, which it did not do, according to its accrual ratio. Having considered these factors, we don't think Funshine Culture GroupLtd's statutory profits give an overly harsh view of the business. If you want to do dive deeper into Funshine Culture GroupLtd, you'd also look into what risks it is currently facing. Our analysis shows 2 warning signs for Funshine Culture GroupLtd (1 can't be ignored!) and we strongly recommend you look at these bad boys before investing.

Our examination of Funshine Culture GroupLtd has focussed on certain factors that can make its earnings look better than they are. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

If you're looking to trade Funshine Culture GroupLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300860

Funshine Culture GroupLtd

Engages in cultural performing events, cultural tourism, and public artistic lighting business in China.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives