Hangzhou Onechance Tech Crop.'s (SZSE:300792) P/E Is Still On The Mark Following 36% Share Price Bounce

Hangzhou Onechance Tech Crop. (SZSE:300792) shareholders have had their patience rewarded with a 36% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 16% in the last twelve months.

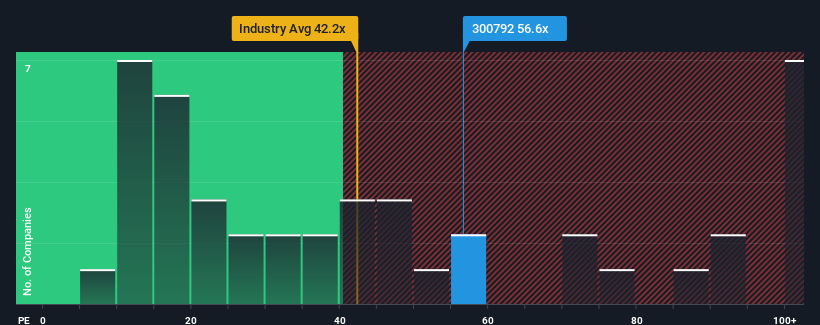

After such a large jump in price, Hangzhou Onechance Tech Crop's price-to-earnings (or "P/E") ratio of 56.6x might make it look like a strong sell right now compared to the market in China, where around half of the companies have P/E ratios below 29x and even P/E's below 18x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With earnings that are retreating more than the market's of late, Hangzhou Onechance Tech Crop has been very sluggish. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

View our latest analysis for Hangzhou Onechance Tech Crop

How Is Hangzhou Onechance Tech Crop's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as steep as Hangzhou Onechance Tech Crop's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 46% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 76% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 24% per annum as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 19% per annum growth forecast for the broader market.

In light of this, it's understandable that Hangzhou Onechance Tech Crop's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Shares in Hangzhou Onechance Tech Crop have built up some good momentum lately, which has really inflated its P/E. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Hangzhou Onechance Tech Crop's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Hangzhou Onechance Tech Crop that you should be aware of.

If these risks are making you reconsider your opinion on Hangzhou Onechance Tech Crop, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Onechance Tech Crop might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300792

Hangzhou Onechance Tech Crop

Provides brand online marketing and management services.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives