- China

- /

- Interactive Media and Services

- /

- SZSE:300785

Beijing Zhidemai Technology Co., Ltd. (SZSE:300785) Held Back By Insufficient Growth Even After Shares Climb 29%

Despite an already strong run, Beijing Zhidemai Technology Co., Ltd. (SZSE:300785) shares have been powering on, with a gain of 29% in the last thirty days. The last 30 days bring the annual gain to a very sharp 37%.

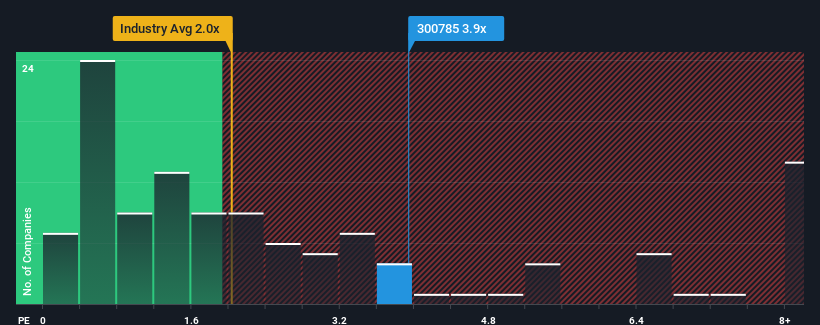

In spite of the firm bounce in price, when close to half the companies operating in China's Interactive Media and Services industry have price-to-sales ratios (or "P/S") above 7.4x, you may still consider Beijing Zhidemai Technology as an enticing stock to check out with its 3.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Beijing Zhidemai Technology

How Beijing Zhidemai Technology Has Been Performing

Recent times have been pleasing for Beijing Zhidemai Technology as its revenue has risen in spite of the industry's average revenue going into reverse. One possibility is that the P/S ratio is low because investors think the company's revenue is going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Beijing Zhidemai Technology will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Beijing Zhidemai Technology?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Beijing Zhidemai Technology's to be considered reasonable.

Retrospectively, the last year delivered a decent 9.7% gain to the company's revenues. The solid recent performance means it was also able to grow revenue by 17% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 18% over the next year. With the industry predicted to deliver 20% growth, the company is positioned for a weaker revenue result.

With this information, we can see why Beijing Zhidemai Technology is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Despite Beijing Zhidemai Technology's share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Beijing Zhidemai Technology maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

You always need to take note of risks, for example - Beijing Zhidemai Technology has 1 warning sign we think you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Beijing Zhidemai Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Beijing Zhidemai Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300785

Beijing Zhidemai Technology

Engages in the Internet information promotion activities in China and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives