- China

- /

- Entertainment

- /

- SZSE:300528

Omnijoi Media Corporation (SZSE:300528) Stock Catapults 37% Though Its Price And Business Still Lag The Industry

Despite an already strong run, Omnijoi Media Corporation (SZSE:300528) shares have been powering on, with a gain of 37% in the last thirty days. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 5.1% in the last twelve months.

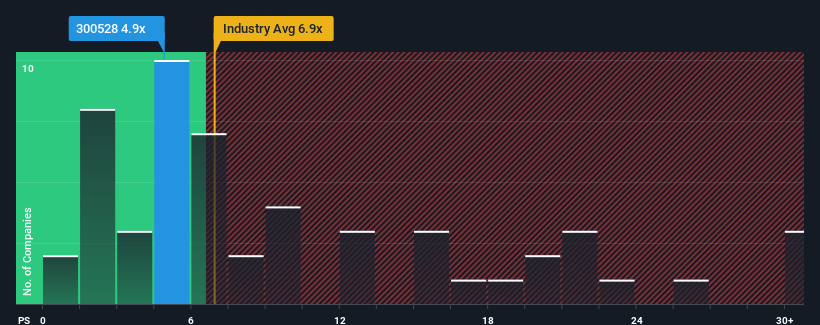

Although its price has surged higher, Omnijoi Media may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 4.9x, considering almost half of all companies in the Entertainment industry in China have P/S ratios greater than 6.9x and even P/S higher than 16x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Omnijoi Media

What Does Omnijoi Media's Recent Performance Look Like?

As an illustration, revenue has deteriorated at Omnijoi Media over the last year, which is not ideal at all. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Omnijoi Media will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Omnijoi Media?

The only time you'd be truly comfortable seeing a P/S as low as Omnijoi Media's is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 9.7%. This means it has also seen a slide in revenue over the longer-term as revenue is down 9.0% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 34% shows it's an unpleasant look.

With this in mind, we understand why Omnijoi Media's P/S is lower than most of its industry peers. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

What We Can Learn From Omnijoi Media's P/S?

The latest share price surge wasn't enough to lift Omnijoi Media's P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's no surprise that Omnijoi Media maintains its low P/S off the back of its sliding revenue over the medium-term. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 1 warning sign for Omnijoi Media that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300528

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives