- China

- /

- Electronic Equipment and Components

- /

- SHSE:688522

High Growth Tech Stocks to Watch in December 2025

Reviewed by Simply Wall St

As global markets anticipate a potential interest rate cut from the Federal Reserve, major U.S. stock indexes have continued their upward trajectory, with technology and small-cap stocks leading the charge. In this environment of cautious optimism, where manufacturing activity contracts but services expand robustly, identifying high-growth tech stocks involves looking for companies that can leverage innovation to thrive amid economic fluctuations and evolving market conditions.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Suzhou TFC Optical Communication | 35.80% | 36.87% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| CD Projekt | 37.90% | 51.75% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Guangdong Naruida Technology (SHSE:688522)

Simply Wall St Growth Rating: ★★★★★★

Overview: Guangdong Naruida Technology Co., Ltd. is a Chinese company that specializes in the manufacturing and sale of polarized multifunctional active phased array radars, with a market capitalization of CN¥11.79 billion.

Operations: The company focuses on the production and distribution of polarized multifunctional active phased array radars, generating revenue primarily from its Scientific & Technical Instruments segment, which amounts to CN¥463.09 million.

Guangdong Naruida Technology has demonstrated robust growth, with a notable surge in earnings by 120.7% over the past year, outpacing the electronic industry's average of 9%. This performance is underscored by significant revenue and net income increases reported in the recent nine-month period, with sales more than doubling from CNY 136.2 million to CNY 254.02 million and net income rising from CNY 26.01 million to CNY 73.16 million. The company's commitment to innovation is evident from its strategic R&D investments which are aligned with its impressive forecasted annual earnings growth of 58.3% and revenue growth at an annual rate of 50.8%. These figures not only highlight Naruida's strong market position but also suggest a promising trajectory compared to the broader CN market projections of 27.4% for earnings and 14.6% for revenue growth.

Hubei Century Network Technology (SZSE:300494)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hubei Century Network Technology Inc. operates an online entertainment platform in China and internationally, with a market cap of CN¥5.79 billion.

Operations: The company focuses on providing an online entertainment platform, generating revenue from digital content and related services. Its operations extend both within China and internationally, leveraging its market presence to attract a diverse user base. The business model emphasizes the monetization of digital content through various channels, contributing to its financial performance.

Hubei Century Network Technology has shown a significant turnaround, with its recent nine-month earnings report revealing an impressive leap in net income to CNY 30.71 million from CNY 2.45 million the previous year, alongside a steady increase in sales to CNY 937.95 million. This growth trajectory is bolstered by the company's strategic R&D investments, which are crucial as it navigates the competitive tech landscape. Despite not engaging in share repurchases this quarter, Hubei's focus on innovation and market expansion is evident, aligning with an anticipated annual revenue growth of 17.6% and profit growth forecasts of 71.5%. These figures not only underscore its recovery but also position it favorably within China's bustling tech sector where it competes against giants in interactive media and services.

Accton Technology (TWSE:2345)

Simply Wall St Growth Rating: ★★★★★★

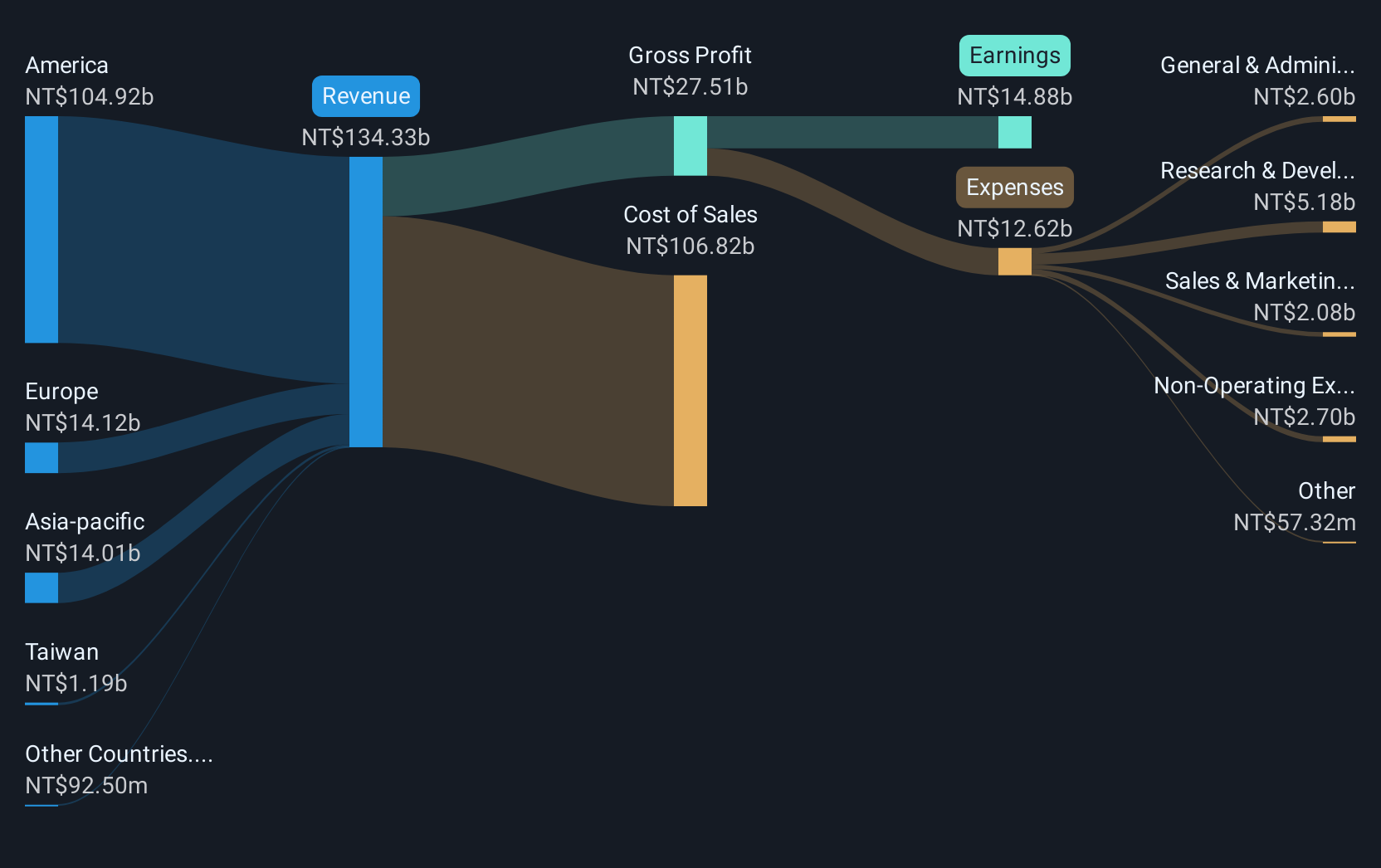

Overview: Accton Technology Corporation is engaged in the development, manufacturing, and sale of computer network systems and wireless LAN hardware and software products across Taiwan, the United States, the Asian-Pacific region, Europe, and other international markets with a market cap of NT$556.11 billion.

Operations: The company generates revenue primarily from its computer networks segment, amounting to NT$215.27 billion. Gross profit margin trends are noteworthy, reflecting the company's efficiency in managing production costs relative to sales within this segment.

Accton Technology's recent performance underscores its robust position in the tech sector, with third-quarter sales soaring to TWD 72.95 billion from TWD 28.19 billion a year earlier, reflecting a dynamic revenue growth of 158%. This surge is complemented by net income for the same period increasing to TWD 7.83 billion, up from TWD 2.65 billion, indicating a profit rise of nearly 196%. These financial achievements are pivotal as Accton continues to innovate within the datacenter solutions space through strategic alliances like the recent collaboration with Edgecore Networks and Liqid. This partnership aims to revolutionize photonic network connectivity, enhancing data transmission across extensive distances without degradation—a critical advancement for modern datacenters striving for efficiency and scalability in resource distribution across global networks.

- Click here to discover the nuances of Accton Technology with our detailed analytical health report.

Understand Accton Technology's track record by examining our Past report.

Make It Happen

- Unlock more gems! Our Global High Growth Tech and AI Stocks screener has unearthed 241 more companies for you to explore.Click here to unveil our expertly curated list of 244 Global High Growth Tech and AI Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688522

Guangdong Naruida Technology

Manufactures and sells polarized multifunctional active phased array radars in China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A buy recommendation

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026