COL Group Co.,Ltd. (SZSE:300364) Looks Just Right With A 42% Price Jump

COL Group Co.,Ltd. (SZSE:300364) shareholders would be excited to see that the share price has had a great month, posting a 42% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 70% in the last year.

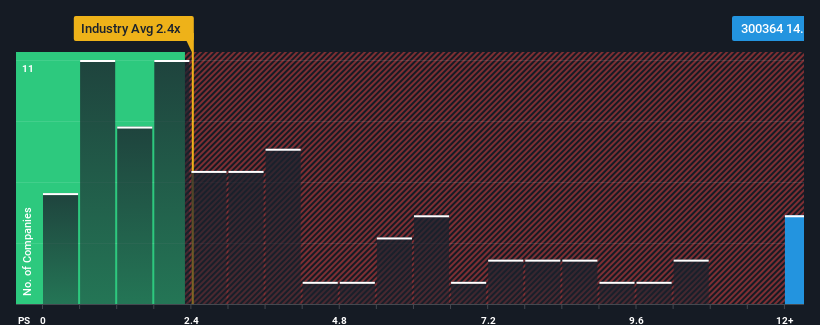

After such a large jump in price, you could be forgiven for thinking COL GroupLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 14.6x, considering almost half the companies in China's Media industry have P/S ratios below 2.4x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for COL GroupLtd

How COL GroupLtd Has Been Performing

COL GroupLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on COL GroupLtd.How Is COL GroupLtd's Revenue Growth Trending?

In order to justify its P/S ratio, COL GroupLtd would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 9.4%. Regardless, revenue has managed to lift by a handy 12% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 51% as estimated by the three analysts watching the company. With the industry only predicted to deliver 13%, the company is positioned for a stronger revenue result.

With this information, we can see why COL GroupLtd is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

The strong share price surge has lead to COL GroupLtd's P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into COL GroupLtd shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

You need to take note of risks, for example - COL GroupLtd has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300364

COL GroupLtd

Engages in the provision of digital reading products, digital publishing operation, and digital content value-added services in China and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives