As global markets navigate mixed signals and trade discussions, Asian economies continue to capture investor attention with their dynamic growth stories. Penny stocks, though often considered a relic of past market eras, remain relevant due to their potential for significant returns when backed by strong financials. In this article, we explore three Asian penny stocks that stand out for their financial strength and potential to offer investors hidden value in the ever-evolving market landscape.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Advice IT Infinite (SET:ADVICE) | THB4.78 | THB2.96B | ✅ 4 ⚠️ 3 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.42 | THB2.65B | ✅ 4 ⚠️ 3 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.43 | SGD174.27M | ✅ 4 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.186 | SGD37.05M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.12 | SGD8.34B | ✅ 5 ⚠️ 0 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.90 | HK$3.28B | ✅ 5 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.09 | HK$46.82B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.15 | HK$725.59M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.39 | HK$2.32B | ✅ 3 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.18 | HK$1.82B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,177 stocks from our Asian Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Yunkang Group (SEHK:2325)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Yunkang Group Limited is a medical operation service provider in the People's Republic of China with a market cap of HK$2.03 billion.

Operations: The company generates revenue primarily through its Diagnostic Services segment, which accounted for CN¥711.88 million.

Market Cap: HK$2.03B

Yunkang Group Limited, with a market cap of HK$2.03 billion, operates in the medical services sector in China. The company reported significant revenue from its Diagnostic Services segment at CN¥711.88 million but remains unprofitable with increasing losses over five years and a negative return on equity of -68.98%. Recent earnings results showed a net loss of CN¥791.68 million for 2024, exacerbated by macroeconomic challenges and strategic restructuring efforts aimed at optimizing customer structures and product mixes. Despite financial setbacks, Yunkang has maintained positive cash flow from operations and is focusing on enhancing R&D capabilities to support long-term growth prospects.

- Click to explore a detailed breakdown of our findings in Yunkang Group's financial health report.

- Gain insights into Yunkang Group's historical outcomes by reviewing our past performance report.

NanJi E-Commerce (SZSE:002127)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NanJi E-Commerce Co., LTD operates in China by offering brand authorization, retail, and mobile Internet marketing services, with a market cap of CN¥10.84 billion.

Operations: NanJi E-Commerce Co., LTD does not report specific revenue segments.

Market Cap: CN¥10.84B

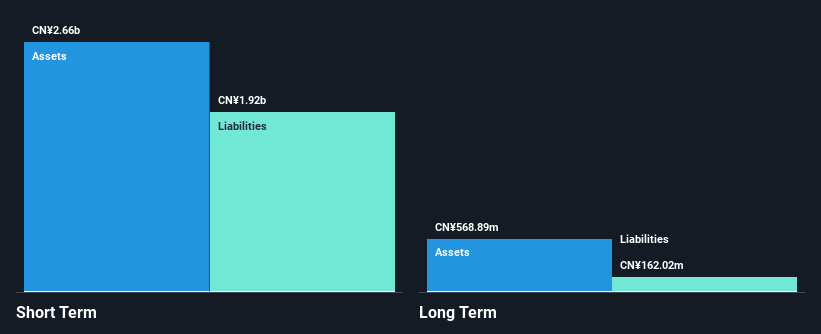

NanJi E-Commerce, with a market cap of CN¥10.84 billion, has experienced increasing losses over the past five years and reports a negative return on equity of -5.79%. Despite stable weekly volatility at 8%, the company remains unprofitable, with recent earnings showing a net loss of CN¥13.63 million for Q1 2025 compared to net income in the previous year. While short-term assets significantly exceed liabilities, providing some financial cushion, its dividend yield is not well covered by earnings or cash flow. The management team and board are considered experienced, though operating cash flow remains negative.

- Jump into the full analysis health report here for a deeper understanding of NanJi E-Commerce.

- Explore historical data to track NanJi E-Commerce's performance over time in our past results report.

Ourpalm (SZSE:300315)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ourpalm Co., Ltd. is engaged in the development, distribution, and operation of online games both in China and internationally, with a market cap of CN¥13.36 billion.

Operations: Ourpalm Co., Ltd. has not reported any specific revenue segments, focusing broadly on the development, distribution, and operation of online games domestically and abroad.

Market Cap: CN¥13.36B

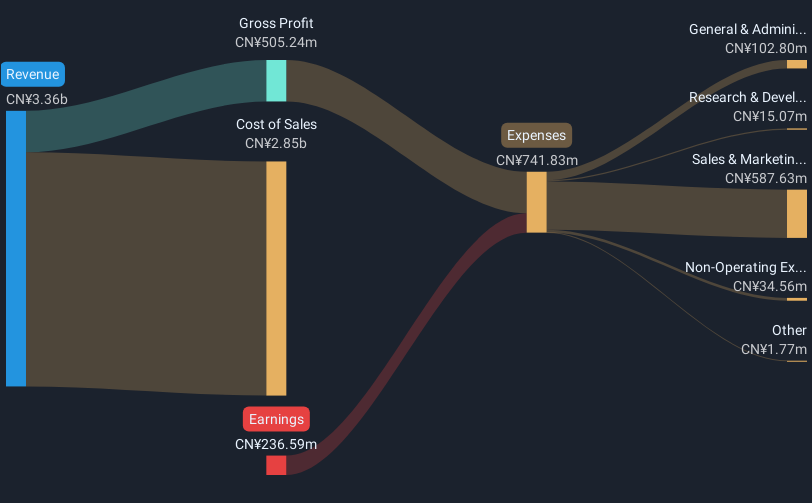

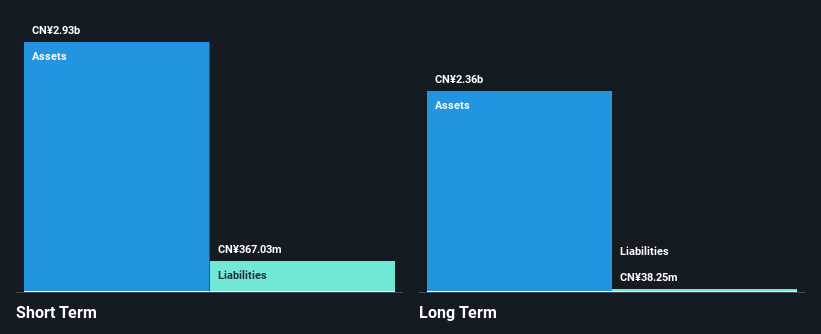

Ourpalm Co., Ltd. reported a decline in sales and net income for Q1 2025, with revenues at CN¥162.05 million, down from CN¥255.67 million the previous year, and net income falling to CN¥27.86 million from CN¥55.77 million. Despite these challenges, the company maintains strong financial health with short-term assets of CN¥2.9 billion exceeding both short- and long-term liabilities significantly, while having more cash than total debt ensures liquidity stability. Although profitability has decreased recently due to large one-off losses impacting earnings quality, Ourpalm's experienced management team provides some confidence in navigating market volatility effectively.

- Navigate through the intricacies of Ourpalm with our comprehensive balance sheet health report here.

- Evaluate Ourpalm's historical performance by accessing our past performance report.

Next Steps

- Access the full spectrum of 1,177 Asian Penny Stocks by clicking on this link.

- Contemplating Other Strategies? AI is about to change healthcare. These 23 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NanJi E-Commerce might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002127

NanJi E-Commerce

Provides brand authorization, retail, and mobile Internet marketing services in China.

Adequate balance sheet very low.

Market Insights

Community Narratives