- Hong Kong

- /

- Capital Markets

- /

- SEHK:612

3 Promising Penny Stocks With Market Caps Over US$40M

Reviewed by Simply Wall St

Global markets have experienced a turbulent start to the year, with U.S. equities facing challenges from inflation concerns and political uncertainties, while European stocks showed resilience amid expectations of interest rate adjustments. In such volatile conditions, investors often seek opportunities in lesser-known areas of the market that may offer growth potential at lower entry points. Penny stocks, despite their somewhat outdated label, continue to capture attention as they represent smaller or newer companies with the potential for significant returns when backed by strong financials.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.825 | £465.6M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| Foresight Group Holdings (LSE:FSG) | £3.55 | £411.08M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR293.77M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.76 | MYR449.66M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.83 | HK$526.87M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.42 | £177.02M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.53 | £67.32M | ★★★★☆☆ |

| Starflex (SET:SFLEX) | THB2.58 | THB2B | ★★★★☆☆ |

Click here to see the full list of 5,703 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Ding Yi Feng Holdings Group International (SEHK:612)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Ding Yi Feng Holdings Limited is a publicly owned investment manager with a market cap of HK$340.39 million.

Operations: The company's revenue segment for Investment Holding reported a negative HK$590.53 million.

Market Cap: HK$340.39M

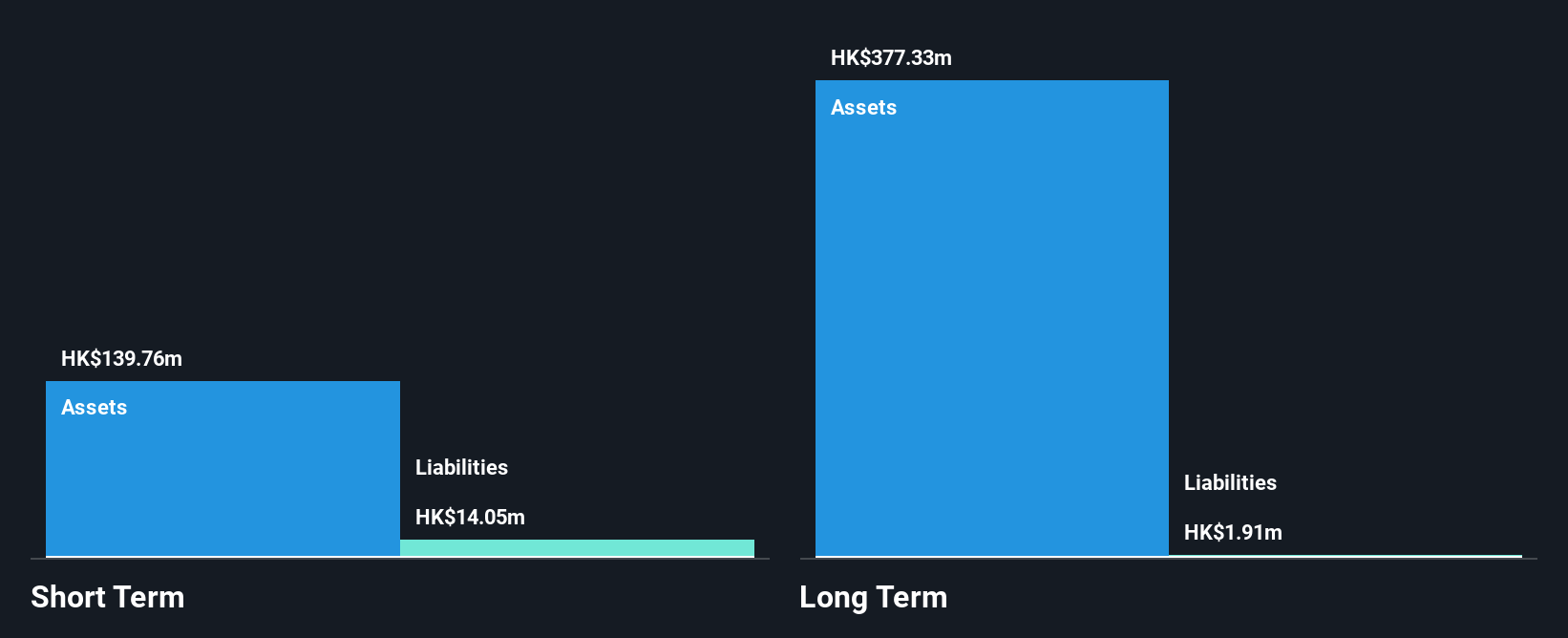

Ding Yi Feng Holdings Group International, with a market cap of HK$340.39 million, is currently pre-revenue and unprofitable, with significant losses reported at HK$590.53 million in its investment holding segment. The company's short-term assets of HK$164.1 million comfortably cover both its short-term and long-term liabilities, indicating financial stability despite the lack of revenue generation. Additionally, it benefits from being debt-free and has not experienced meaningful shareholder dilution over the past year. However, its share price remains highly volatile and earnings have declined significantly over the past five years by 35.9% annually.

- Click to explore a detailed breakdown of our findings in Ding Yi Feng Holdings Group International's financial health report.

- Evaluate Ding Yi Feng Holdings Group International's historical performance by accessing our past performance report.

Beijing Baination PicturesLtd (SZSE:300291)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Beijing Baination Pictures Co., Ltd. is a film and television company operating in China with a market cap of CN¥4.63 billion.

Operations: Beijing Baination Pictures Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥4.63B

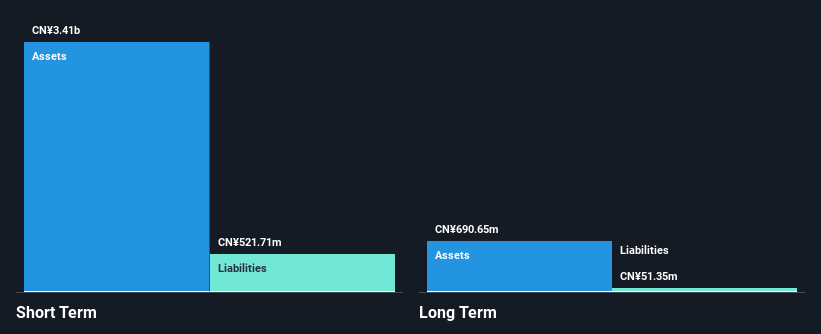

Beijing Baination Pictures Co., Ltd., with a market cap of CN¥4.63 billion, has demonstrated significant revenue growth, reporting sales of CN¥667.75 million for the first nine months of 2024 compared to CN¥183.69 million the previous year, despite remaining unprofitable with a net loss of CN¥54.08 million. The company benefits from strong financial stability, as its short-term assets (CN¥3.4 billion) exceed both short and long-term liabilities and it is debt-free. While its share price is highly volatile, Beijing Baination has not diluted shareholders recently and maintains a cash runway exceeding three years based on current free cash flow trends.

- Navigate through the intricacies of Beijing Baination PicturesLtd with our comprehensive balance sheet health report here.

- Understand Beijing Baination PicturesLtd's track record by examining our performance history report.

B-SOFTLtd (SZSE:300451)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: B-SOFT Co., Ltd. operates in the medical and health industry in China with a market cap of CN¥6.69 billion.

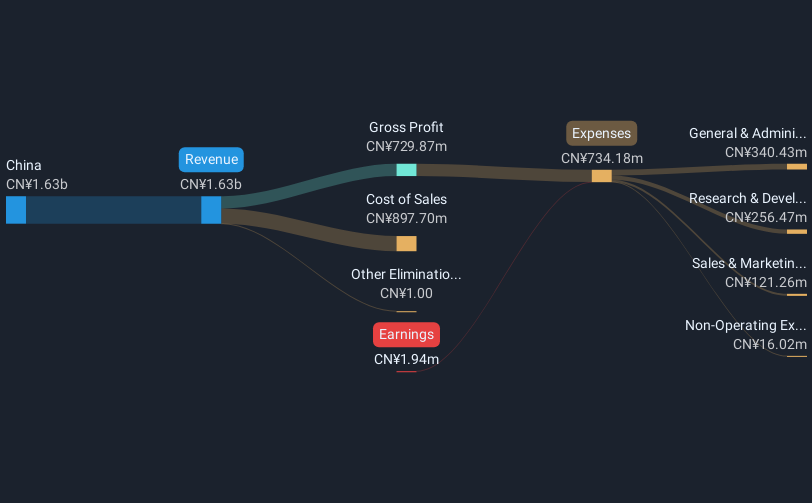

Operations: The company generates CN¥1.63 billion in revenue from its operations within China.

Market Cap: CN¥6.69B

B-SOFT Co., Ltd., with a market cap of CN¥6.69 billion, operates within China's medical and health sector, generating CN¥1.63 billion in revenue. Despite being unprofitable, the company has seen a slight increase in sales to CN¥1.17 billion for the first nine months of 2024 compared to the previous year. Its financial position is robust, with short-term assets (CN¥3.1 billion) surpassing both short and long-term liabilities and more cash than total debt, reducing financial risk. However, its management team is relatively new with an average tenure of 1.4 years, which may impact strategic direction stability.

- Click here and access our complete financial health analysis report to understand the dynamics of B-SOFTLtd.

- Examine B-SOFTLtd's earnings growth report to understand how analysts expect it to perform.

Next Steps

- Embark on your investment journey to our 5,703 Penny Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:612

Ding Yi Feng Holdings Group International

China Ding Yi Feng Holdings Limited is a publicly owned investment manager.

Flawless balance sheet slight.

Market Insights

Community Narratives