- China

- /

- Entertainment

- /

- SZSE:300113

Optimistic Investors Push Hangzhou Shunwang Technology Co,Ltd (SZSE:300113) Shares Up 27% But Growth Is Lacking

Hangzhou Shunwang Technology Co,Ltd (SZSE:300113) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 3.0% in the last twelve months.

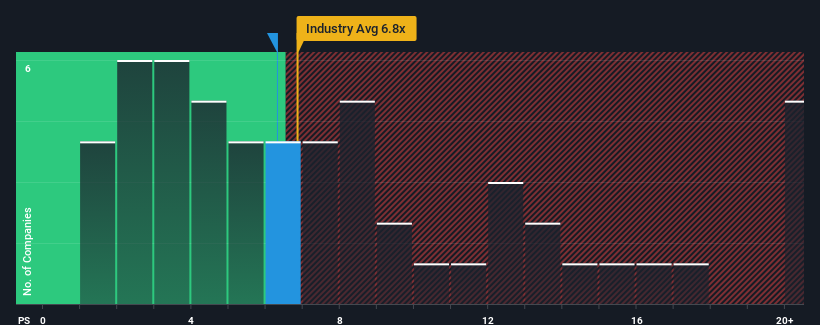

Even after such a large jump in price, it's still not a stretch to say that Hangzhou Shunwang Technology CoLtd's price-to-sales (or "P/S") ratio of 6.3x right now seems quite "middle-of-the-road" compared to the Entertainment industry in China, where the median P/S ratio is around 6.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Hangzhou Shunwang Technology CoLtd

How Has Hangzhou Shunwang Technology CoLtd Performed Recently?

Recent times have been advantageous for Hangzhou Shunwang Technology CoLtd as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think Hangzhou Shunwang Technology CoLtd's future stacks up against the industry? In that case, our free report is a great place to start.How Is Hangzhou Shunwang Technology CoLtd's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Hangzhou Shunwang Technology CoLtd's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 29% last year. The latest three year period has also seen a 22% overall rise in revenue, aided extensively by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 20% during the coming year according to the two analysts following the company. With the industry predicted to deliver 35% growth, the company is positioned for a weaker revenue result.

With this in mind, we find it intriguing that Hangzhou Shunwang Technology CoLtd's P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Hangzhou Shunwang Technology CoLtd's P/S Mean For Investors?

Hangzhou Shunwang Technology CoLtd's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Given that Hangzhou Shunwang Technology CoLtd's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Hangzhou Shunwang Technology CoLtd with six simple checks on some of these key factors.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Shunwang Technology CoLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300113

Hangzhou Shunwang Technology CoLtd

Engages in the Internet gaming business in China and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives