Global markets have been experiencing fluctuations amid policy uncertainties and economic data releases, with U.S. stocks recently giving back some gains as investors react to potential changes under the incoming administration. In this context, penny stocks—often representing smaller or newer companies—remain a relevant investment area for those seeking affordability and growth potential. Despite being considered a somewhat outdated term, these stocks can offer opportunities when backed by strong financials, providing a unique avenue for investors to explore promising prospects in today's market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.48 | MYR2.39B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.775 | MYR134.24M | ★★★★★★ |

| Seafco (SET:SEAFCO) | THB1.97 | THB1.6B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.585 | A$68.57M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.87 | MYR288.79M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.225 | £838.3M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$539.57M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.67 | £365M | ★★★★☆☆ |

Click here to see the full list of 5,818 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

China Zheshang Bank (SEHK:2016)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Zheshang Bank Co., Ltd. offers a range of commercial banking products and services in Mainland China and has a market cap of HK$81.59 billion.

Operations: The bank generates revenue of CN¥38.47 billion from its operations in Mainland China.

Market Cap: HK$81.59B

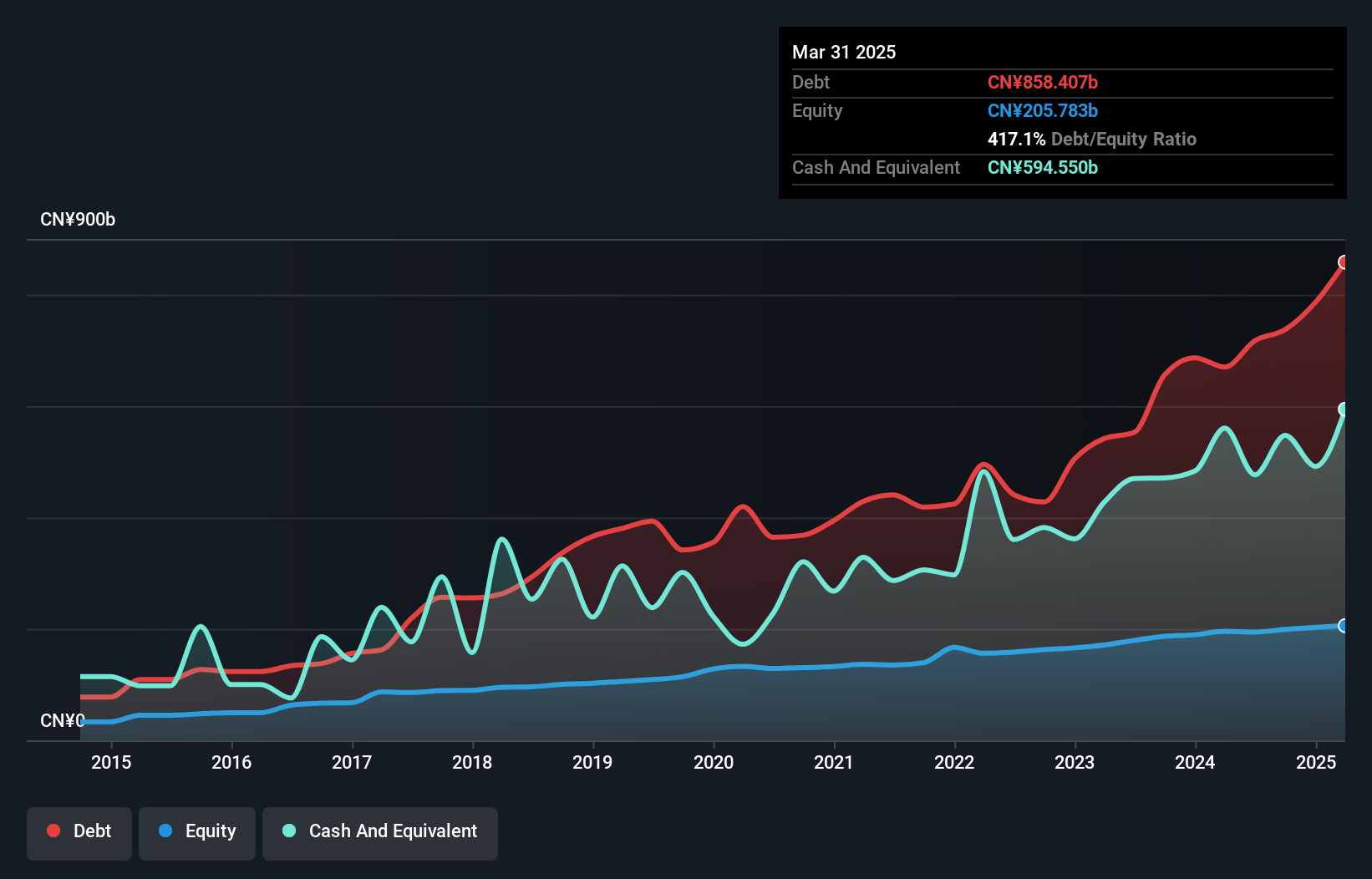

China Zheshang Bank, with a market cap of HK$81.59 billion, reported stable net income growth for the nine months ending September 2024 at CN¥12.91 billion, slightly up from CN¥12.75 billion the previous year. The bank's funding is primarily low-risk customer deposits, maintaining an appropriate loans-to-deposits ratio of 78%. Despite its relatively low return on equity of 7.9%, it trades at a good value compared to peers and industry standards. Recent board changes may impact governance stability temporarily as new independent directors are yet to be approved following resignations due to term limits.

- Click here and access our complete financial health analysis report to understand the dynamics of China Zheshang Bank.

- Gain insights into China Zheshang Bank's future direction by reviewing our growth report.

Shenzhen Hemei GroupLTD (SZSE:002356)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shenzhen Hemei Group Co., LTD. operates in the sale of clothing, accessories, and instrumentation products both in China and internationally, with a market cap of CN¥5.22 billion.

Operations: No specific revenue segments are reported for Shenzhen Hemei Group Co., LTD.

Market Cap: CN¥5.22B

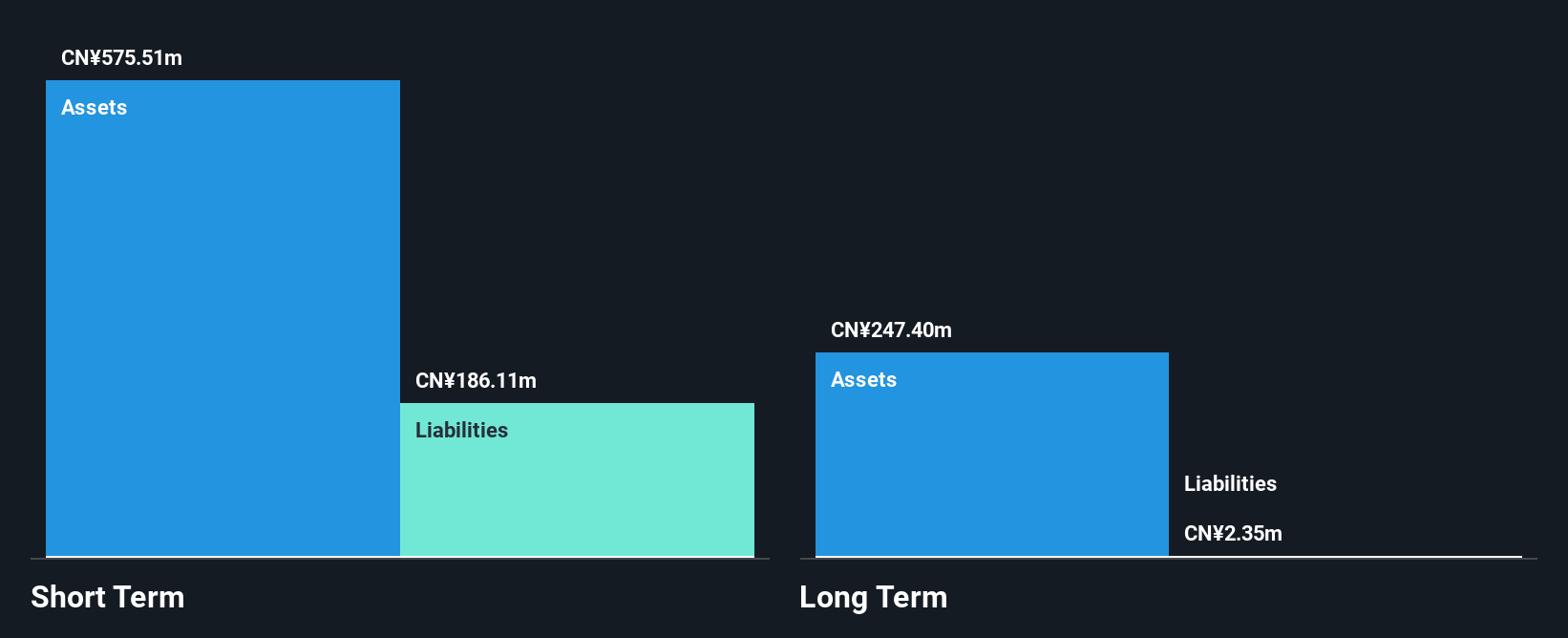

Shenzhen Hemei Group Co., LTD. has shown revenue growth over the past year, with sales rising to CN¥157.14 million for the nine months ending September 2024, up from CN¥125.4 million a year ago, though it remains unprofitable with a net loss of CN¥31.89 million. The company benefits from having no debt and sufficient short-term assets (CN¥649.8M) to cover its liabilities (CN¥210.1M). Despite a relatively inexperienced board and ongoing losses, Shenzhen Hemei's cash runway is adequate for more than a year if current free cash flow trends persist without significant shareholder dilution recently observed.

- Get an in-depth perspective on Shenzhen Hemei GroupLTD's performance by reading our balance sheet health report here.

- Understand Shenzhen Hemei GroupLTD's track record by examining our performance history report.

FS Development Investment Holdings (SZSE:300071)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: FS Development Investment Holdings offers marketing services in China, with a market capitalization of CN¥4.73 billion.

Operations: The company generates revenue of CN¥1.46 billion from its operations in China.

Market Cap: CN¥4.73B

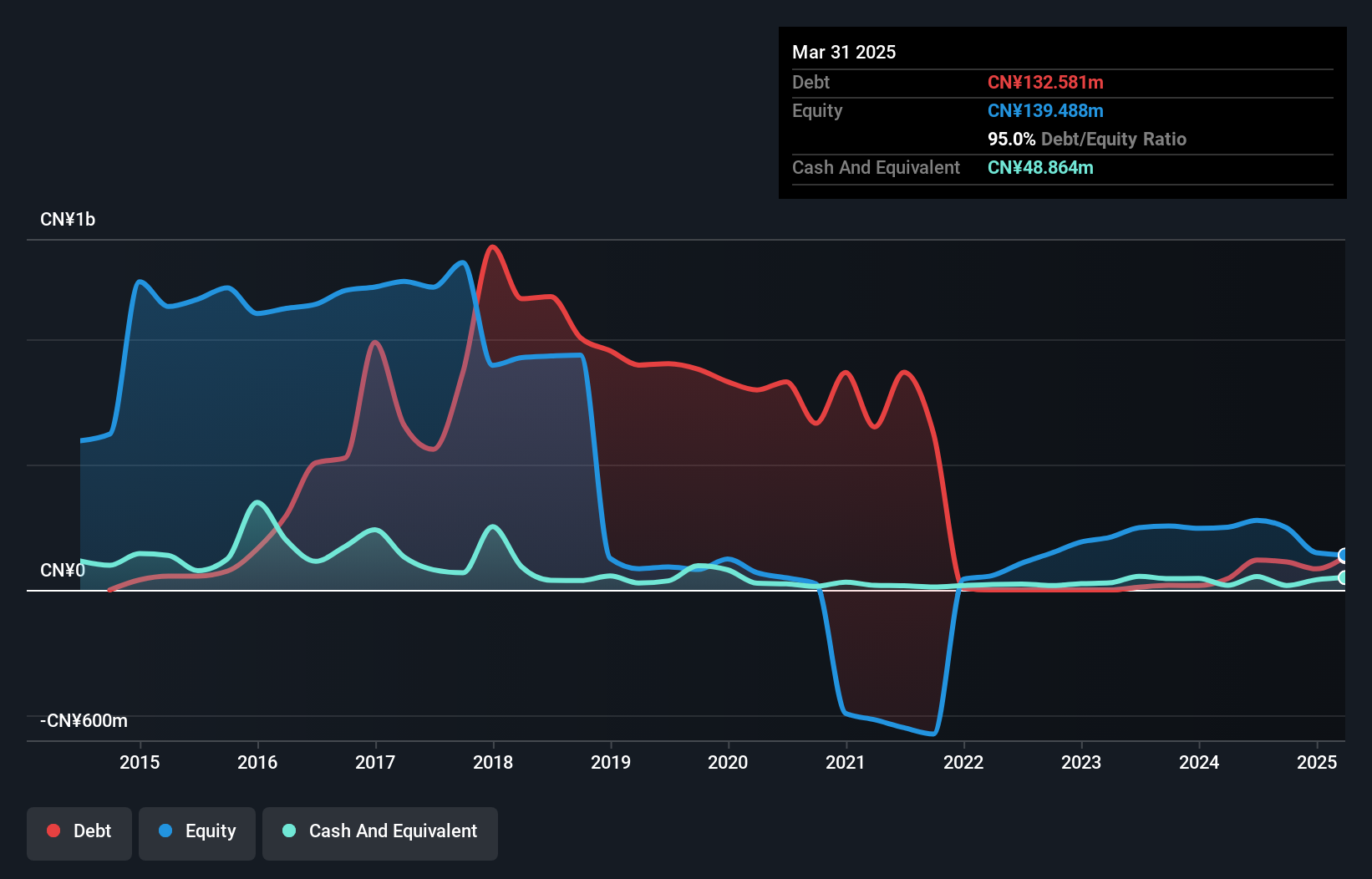

FS Development Investment Holdings has reported revenue growth, with sales reaching CN¥1.05 billion for the nine months ending September 2024, compared to CN¥960.34 million a year ago. Despite this, the company remains unprofitable with a net loss of CN¥29.89 million and negative return on equity at -18.19%. The company's financial position is supported by short-term assets of CN¥1.2 billion exceeding both short-term and long-term liabilities, though it faces high share price volatility and less than a year of cash runway if free cash flow continues to decline at historical rates without meaningful shareholder dilution recently observed.

- Navigate through the intricacies of FS Development Investment Holdings with our comprehensive balance sheet health report here.

- Gain insights into FS Development Investment Holdings' past trends and performance with our report on the company's historical track record.

Key Takeaways

- Embark on your investment journey to our 5,818 Penny Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300071

Mediocre balance sheet minimal.

Similar Companies

Market Insights

Community Narratives