- China

- /

- Entertainment

- /

- SZSE:300027

Huayi Brothers Media Corporation's (SZSE:300027) 26% Jump Shows Its Popularity With Investors

Those holding Huayi Brothers Media Corporation (SZSE:300027) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 3.2% over the last year.

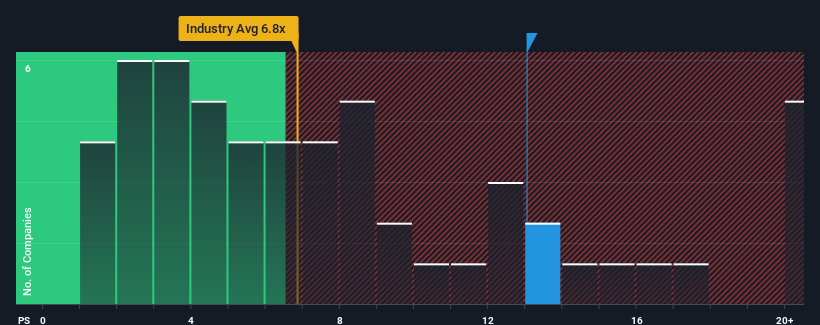

Since its price has surged higher, Huayi Brothers Media's price-to-sales (or "P/S") ratio of 13x might make it look like a strong sell right now compared to other companies in the Entertainment industry in China, where around half of the companies have P/S ratios below 6.8x and even P/S below 3x are quite common. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Huayi Brothers Media

What Does Huayi Brothers Media's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Huayi Brothers Media's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Huayi Brothers Media will help you uncover what's on the horizon.How Is Huayi Brothers Media's Revenue Growth Trending?

Huayi Brothers Media's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 37%. As a result, revenue from three years ago have also fallen 70% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 188% over the next year. With the industry only predicted to deliver 35%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Huayi Brothers Media's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Huayi Brothers Media's P/S?

Shares in Huayi Brothers Media have seen a strong upwards swing lately, which has really helped boost its P/S figure. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Huayi Brothers Media maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Entertainment industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Huayi Brothers Media with six simple checks will allow you to discover any risks that could be an issue.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Huayi Brothers Media might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300027

Huayi Brothers Media

Operates as an entertainment media company in China and internationally.

Exceptional growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives