- China

- /

- Entertainment

- /

- SZSE:300027

Huayi Brothers Media Corporation (SZSE:300027) Looks Just Right With A 39% Price Jump

Huayi Brothers Media Corporation (SZSE:300027) shareholders would be excited to see that the share price has had a great month, posting a 39% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 26% in the last twelve months.

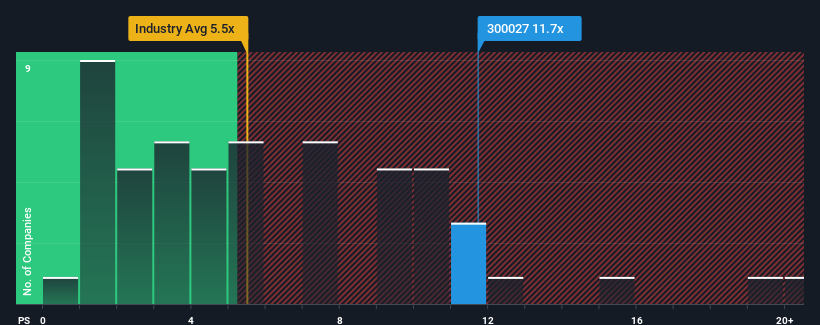

After such a large jump in price, when almost half of the companies in China's Entertainment industry have price-to-sales ratios (or "P/S") below 5.5x, you may consider Huayi Brothers Media as a stock not worth researching with its 11.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Huayi Brothers Media

What Does Huayi Brothers Media's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Huayi Brothers Media has been relatively sluggish. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

Keen to find out how analysts think Huayi Brothers Media's future stacks up against the industry? In that case, our free report is a great place to start.How Is Huayi Brothers Media's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Huayi Brothers Media's to be considered reasonable.

Retrospectively, the last year delivered a decent 4.9% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 66% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 125% as estimated by the dual analysts watching the company. That's shaping up to be materially higher than the 23% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Huayi Brothers Media's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Huayi Brothers Media's P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Huayi Brothers Media's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Huayi Brothers Media you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Huayi Brothers Media might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300027

Huayi Brothers Media

Operates as an entertainment media company in China and internationally.

Exceptional growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives