- China

- /

- Entertainment

- /

- SZSE:300027

After Leaping 29% Huayi Brothers Media Corporation (SZSE:300027) Shares Are Not Flying Under The Radar

Huayi Brothers Media Corporation (SZSE:300027) shares have continued their recent momentum with a 29% gain in the last month alone. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 6.2% over the last year.

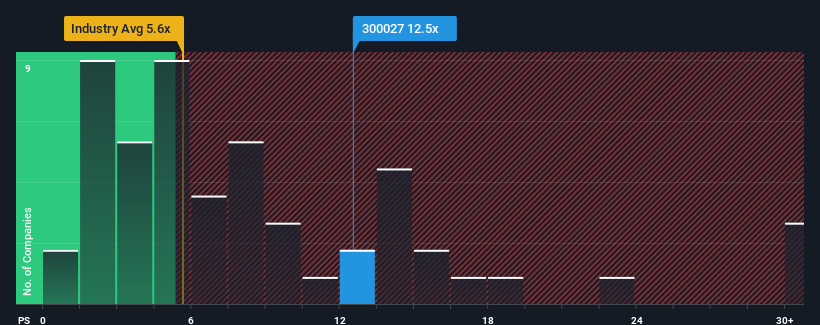

Following the firm bounce in price, given around half the companies in China's Entertainment industry have price-to-sales ratios (or "P/S") below 5.6x, you may consider Huayi Brothers Media as a stock to avoid entirely with its 12.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Huayi Brothers Media

How Huayi Brothers Media Has Been Performing

Huayi Brothers Media's revenue growth of late has been pretty similar to most other companies. Perhaps the market is expecting future revenue performance to improve, justifying the currently elevated P/S. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Huayi Brothers Media's future stacks up against the industry? In that case, our free report is a great place to start.How Is Huayi Brothers Media's Revenue Growth Trending?

In order to justify its P/S ratio, Huayi Brothers Media would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 20% last year. Still, revenue has fallen 61% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 92% during the coming year according to the dual analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 28%, which is noticeably less attractive.

In light of this, it's understandable that Huayi Brothers Media's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Huayi Brothers Media's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Huayi Brothers Media shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 1 warning sign for Huayi Brothers Media you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Huayi Brothers Media might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300027

Huayi Brothers Media

Operates as an entertainment media company in China and internationally.

Exceptional growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives