Beijing Yuanlong Yato Culture DisseminationLtd's (SZSE:002878) Weak Earnings May Only Reveal A Part Of The Whole Picture

Despite Beijing Yuanlong Yato Culture Dissemination Co.,Ltd.'s (SZSE:002878) recent earnings report having lackluster headline numbers, the market responded positively. Sometimes, shareholders are willing to ignore soft numbers with the hope that they will improve, but our analysis suggests this is unlikely for Beijing Yuanlong Yato Culture DisseminationLtd.

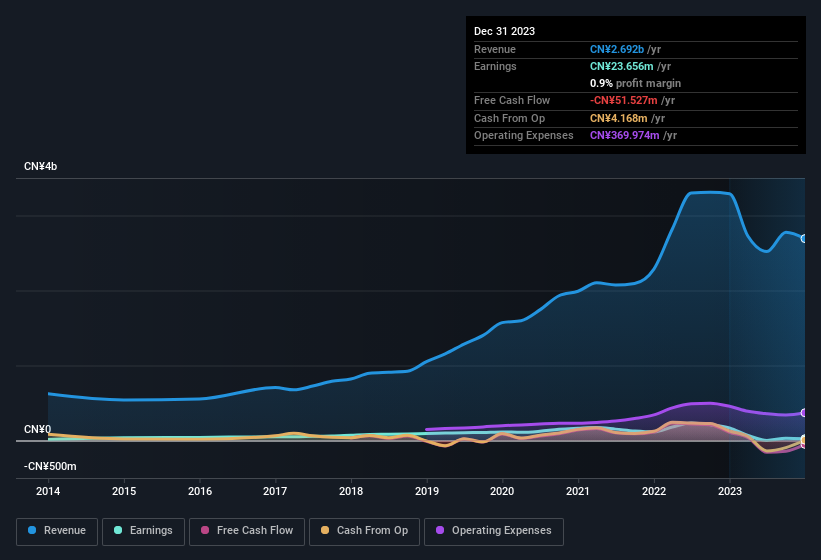

View our latest analysis for Beijing Yuanlong Yato Culture DisseminationLtd

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. As it happens, Beijing Yuanlong Yato Culture DisseminationLtd issued 17% more new shares over the last year. That means its earnings are split among a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out Beijing Yuanlong Yato Culture DisseminationLtd's historical EPS growth by clicking on this link.

How Is Dilution Impacting Beijing Yuanlong Yato Culture DisseminationLtd's Earnings Per Share (EPS)?

Unfortunately, Beijing Yuanlong Yato Culture DisseminationLtd's profit is down 85% per year over three years. And even focusing only on the last twelve months, we see profit is down 86%. Sadly, earnings per share fell further, down a full 85% in that time. So you can see that the dilution has had a bit of an impact on shareholders.

If Beijing Yuanlong Yato Culture DisseminationLtd's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

How Do Unusual Items Influence Profit?

Alongside that dilution, it's also important to note that Beijing Yuanlong Yato Culture DisseminationLtd's profit was boosted by unusual items worth CN¥4.3m in the last twelve months. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. If Beijing Yuanlong Yato Culture DisseminationLtd doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

Our Take On Beijing Yuanlong Yato Culture DisseminationLtd's Profit Performance

To sum it all up, Beijing Yuanlong Yato Culture DisseminationLtd got a nice boost to profit from unusual items; without that, its statutory results would have looked worse. On top of that, the dilution means that its earnings per share performance is worse than its profit performance. For the reasons mentioned above, we think that a perfunctory glance at Beijing Yuanlong Yato Culture DisseminationLtd's statutory profits might make it look better than it really is on an underlying level. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. For example - Beijing Yuanlong Yato Culture DisseminationLtd has 3 warning signs we think you should be aware of.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Yuanlong Yato Culture DisseminationLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002878

Beijing Yuanlong Yato Culture DisseminationLtd

Beijing Yuanlong Yato Culture Dissemination Co.,Ltd.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives