- China

- /

- Entertainment

- /

- SZSE:002739

Investors Aren't Buying Wanda Film Holding Co., Ltd.'s (SZSE:002739) Revenues

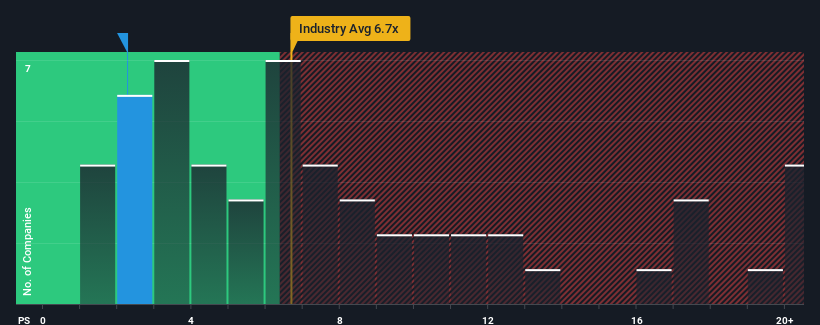

Wanda Film Holding Co., Ltd.'s (SZSE:002739) price-to-sales (or "P/S") ratio of 2.3x might make it look like a strong buy right now compared to the Entertainment industry in China, where around half of the companies have P/S ratios above 6.7x and even P/S above 12x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Wanda Film Holding

What Does Wanda Film Holding's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Wanda Film Holding has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Wanda Film Holding's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Wanda Film Holding's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered an exceptional 22% gain to the company's top line. The latest three year period has also seen an excellent 89% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 22% over the next year. With the industry predicted to deliver 30% growth, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Wanda Film Holding's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Wanda Film Holding's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of Wanda Film Holding's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Wanda Film Holding with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Wanda Film Holding's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Wanda Film Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wanda Film Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002739

Wanda Film Holding

Engages in the investment, construction, and operation of movie theaters in China, Australia, and New Zealand.

Very undervalued with adequate balance sheet.