- China

- /

- Metals and Mining

- /

- SHSE:600725

October 2024's Standout Penny Stocks

Reviewed by Simply Wall St

As global markets grapple with rising U.S. Treasury yields, the S&P 500 Index has experienced a downturn after a streak of gains, while growth stocks have managed to outperform value stocks. In such uncertain conditions, identifying promising investment opportunities becomes crucial. Penny stocks, despite being an outdated term, continue to offer potential for growth when backed by strong financials and fundamentals. These smaller or newer companies can provide unique opportunities for investors looking to uncover hidden value in quality companies poised for long-term success.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.585 | MYR2.91B | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.85 | £176.31M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.735 | MYR127.31M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.77 | HK$488.79M | ★★★★★★ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.53 | CN¥2.15B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.92 | MYR305.39M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.255 | £304.09M | ★★★★★★ |

| Hume Cement Industries Berhad (KLSE:HUMEIND) | MYR3.38 | MYR2.45B | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$127.64M | ★★★★☆☆ |

Click here to see the full list of 5,811 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Yunnan Yunwei (SHSE:600725)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Yunnan Yunwei Company Limited operates in the production and distribution of coal coke and chemical products in China, with a market cap of CN¥4.24 billion.

Operations: The company's revenue is primarily generated from its operations in China, amounting to CN¥960.89 million.

Market Cap: CN¥4.24B

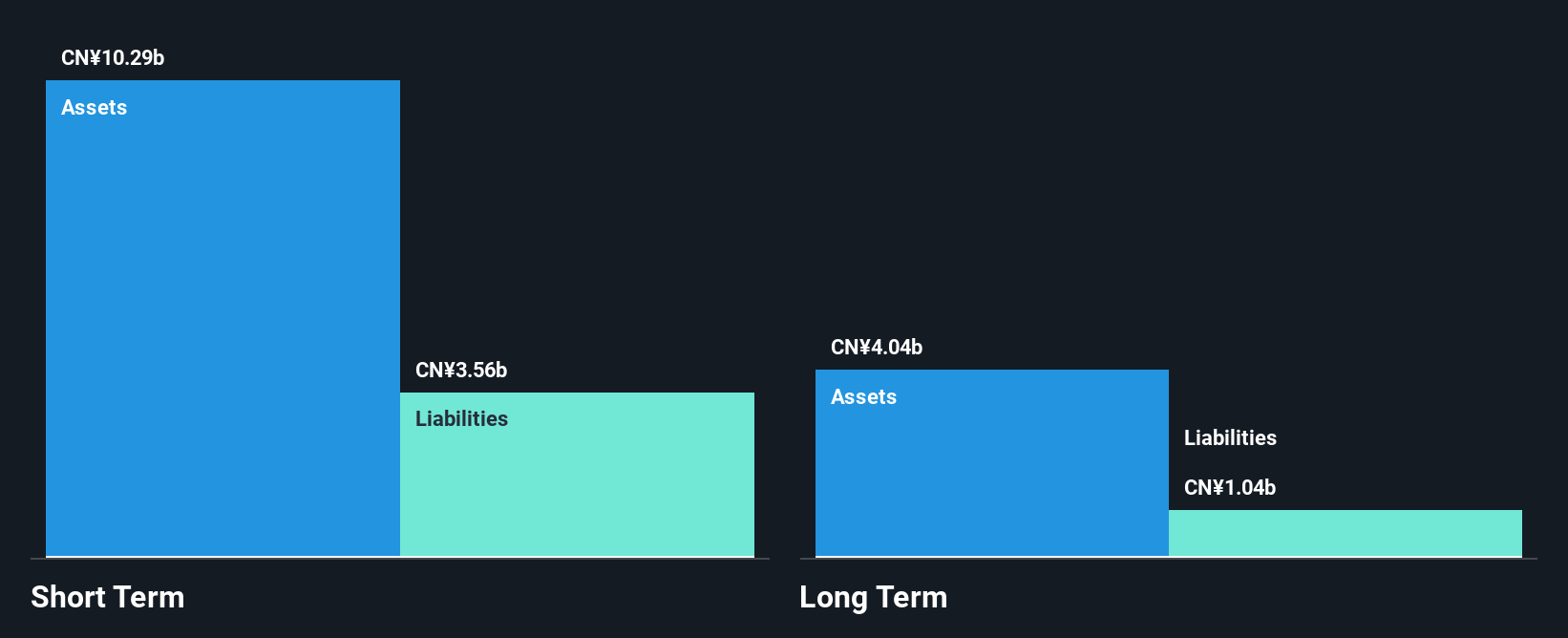

Yunnan Yunwei Company Limited, with a market cap of CN¥4.24 billion, operates in the coal coke and chemical sectors in China. The company remains unprofitable, with a net loss of CN¥9.11 million for the nine months ended September 2024, despite sales increasing to CN¥550.82 million from CN¥488.41 million year-on-year. It boasts a solid asset position where short-term assets significantly exceed both short-term and long-term liabilities, providing some financial stability amid its losses. The board is experienced with an average tenure of 5.9 years; however, earnings have been declining over the past five years by 18.5% annually.

- Click to explore a detailed breakdown of our findings in Yunnan Yunwei's financial health report.

- Explore historical data to track Yunnan Yunwei's performance over time in our past results report.

Suning UniversalLtd (SZSE:000718)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Suning Universal Co., Ltd is a real estate development company based in China with a market capitalization of CN¥6.80 billion.

Operations: The company generates revenue primarily from its Real Estate Business, which accounts for CN¥1.89 billion, followed by its Medical Beauty and Biomedicine segment at CN¥192.36 million and Hotels contributing CN¥108.24 million.

Market Cap: CN¥6.8B

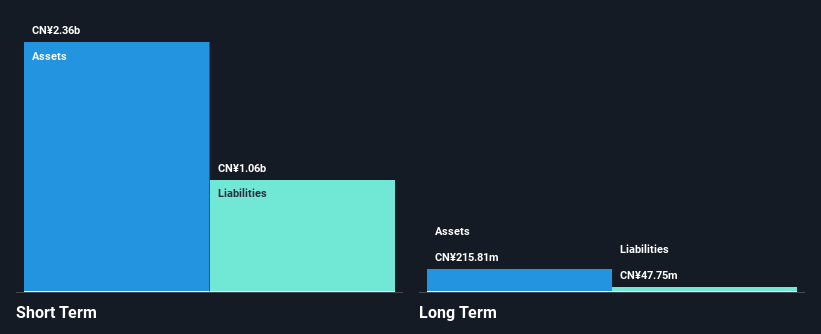

Suning Universal Co., Ltd, with a market cap of CN¥6.80 billion, faces challenges despite its diverse revenue streams from real estate, medical beauty, and hotels. Earnings have declined by 38.5% annually over five years, and recent results show reduced net profit margins at 5.5%, down from 15.5% last year. The company maintains a satisfactory net debt to equity ratio of 10.5%, but operating cash flow coverage is weak at only 4.4%. While short-term assets exceed liabilities significantly, indicating some financial stability, Suning has been dropped from the FTSE All-World Index recently due to performance concerns.

- Navigate through the intricacies of Suning UniversalLtd with our comprehensive balance sheet health report here.

- Gain insights into Suning UniversalLtd's historical outcomes by reviewing our past performance report.

Simei MediaLtd (SZSE:002712)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Simei Media Co., Ltd. is an advertising company operating in China with a market capitalization of approximately CN¥2.56 billion.

Operations: The company generates revenue of CN¥5.65 billion from its operations in China.

Market Cap: CN¥2.56B

Simei Media Co., Ltd. has a market cap of CN¥2.56 billion and reported half-year sales of CN¥2.81 billion, showing slight growth from the previous year. However, net income significantly decreased to CN¥1.16 million from CN¥10.07 million last year, highlighting profitability challenges as the company remains unprofitable overall. Despite stable weekly volatility and satisfactory net debt levels at 22.3%, its management team is relatively inexperienced with an average tenure of 1.6 years, which may impact strategic direction and execution efficiency in the competitive advertising sector in China.

- Unlock comprehensive insights into our analysis of Simei MediaLtd stock in this financial health report.

- Gain insights into Simei MediaLtd's past trends and performance with our report on the company's historical track record.

Taking Advantage

- Navigate through the entire inventory of 5,811 Penny Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600725

Yunnan Yunwei

Engages in the production and operation of coal coke and chemical products in China.

Adequate balance sheet very low.