- Philippines

- /

- Hospitality

- /

- PSE:PLUS

Undiscovered Gems Three Promising Stocks For November 2024

Reviewed by Simply Wall St

As global markets navigate a turbulent period marked by mixed economic signals and cautious investor sentiment, small-cap stocks have demonstrated resilience, holding up better than their larger counterparts. Amidst this backdrop of fluctuating indices and economic uncertainties, identifying promising small-cap stocks requires a keen focus on fundamentals such as strong earnings potential and solid market positioning.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Infinity Capital Investments | 0.61% | 8.72% | 14.99% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Watt's | 73.27% | 7.85% | -1.33% | ★★★★★☆ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 72.83% | 12.17% | 19.18% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

DigiPlus Interactive (PSE:PLUS)

Simply Wall St Value Rating: ★★★★★★

Overview: DigiPlus Interactive Corp. manages and operates general amusement, recreation enterprises, hotels, and gaming facilities in the Philippines with a market cap of approximately ₱91.68 billion.

Operations: DigiPlus Interactive generates revenue primarily from its Retail Group, contributing ₱49.90 billion, and its Casino Group, adding ₱471.82 million. The Network and License Group and Property Group provide smaller revenue streams of ₱385.49 million and ₱80.43 million respectively.

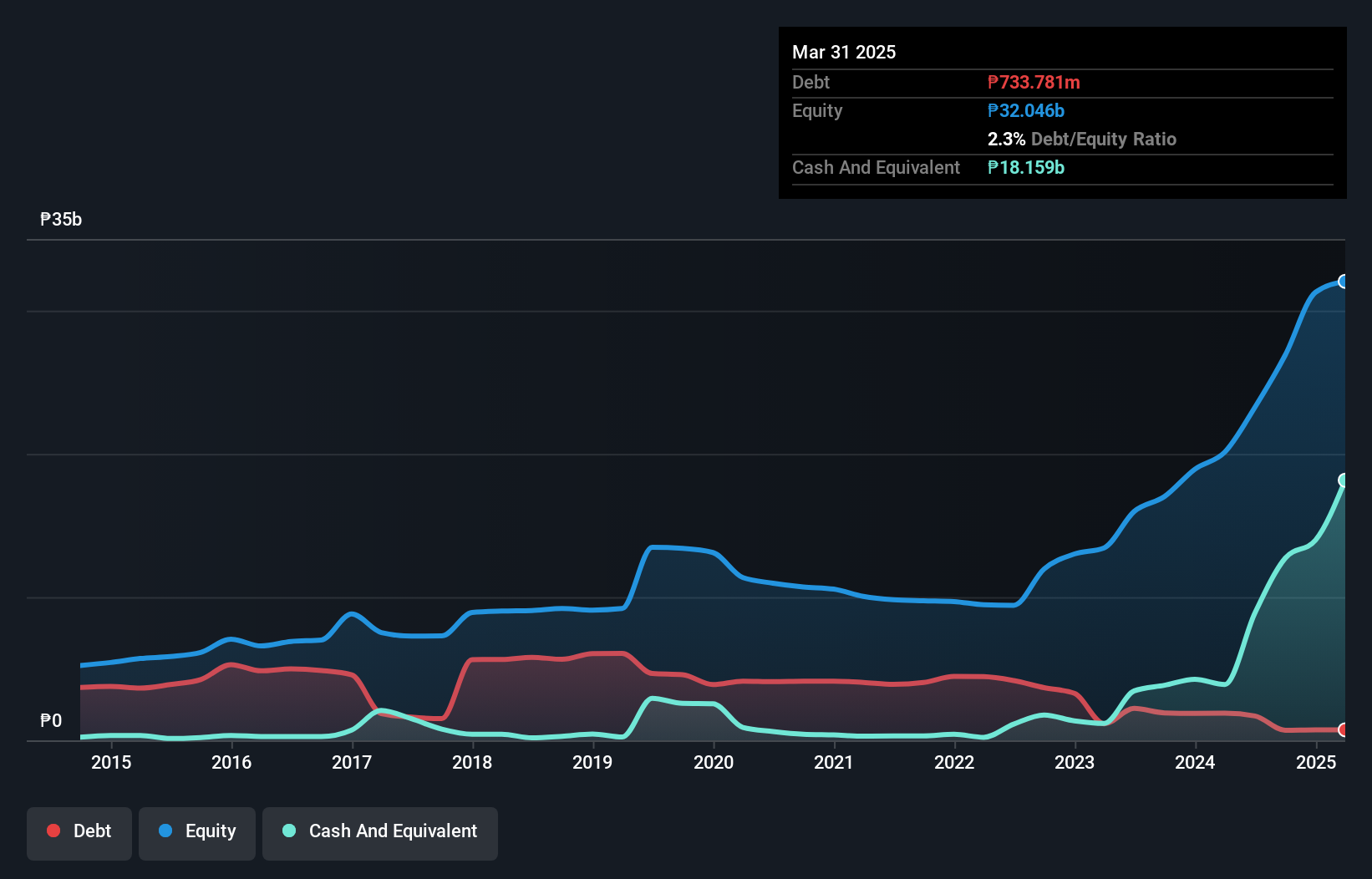

DigiPlus Interactive is making waves with its impressive earnings growth, surging 325.5% over the past year, outpacing the hospitality industry's downturn of 9.6%. Trading at a significant discount of 66.9% below its estimated fair value, DigiPlus seems to offer good relative value compared to peers. The company boasts high-quality earnings and has reduced its debt-to-equity ratio from 34.6% to 7.3% over five years, indicating improved financial health. Recent developments include being added to the S&P Global BMI Index and expanding into Brazil's gaming market, diversifying beyond its core operations in the Philippines.

- Take a closer look at DigiPlus Interactive's potential here in our health report.

Evaluate DigiPlus Interactive's historical performance by accessing our past performance report.

Xi'an Manareco New MaterialsLtd (SHSE:688550)

Simply Wall St Value Rating: ★★★★★★

Overview: Xi'an Manareco New Materials Co., Ltd specializes in the production and distribution of liquid crystal materials, OLED materials, and drug intermediates, with a market capitalization of CN¥5.77 billion.

Operations: Manareco generates revenue primarily from its specialty chemicals segment, amounting to CN¥1.37 billion.

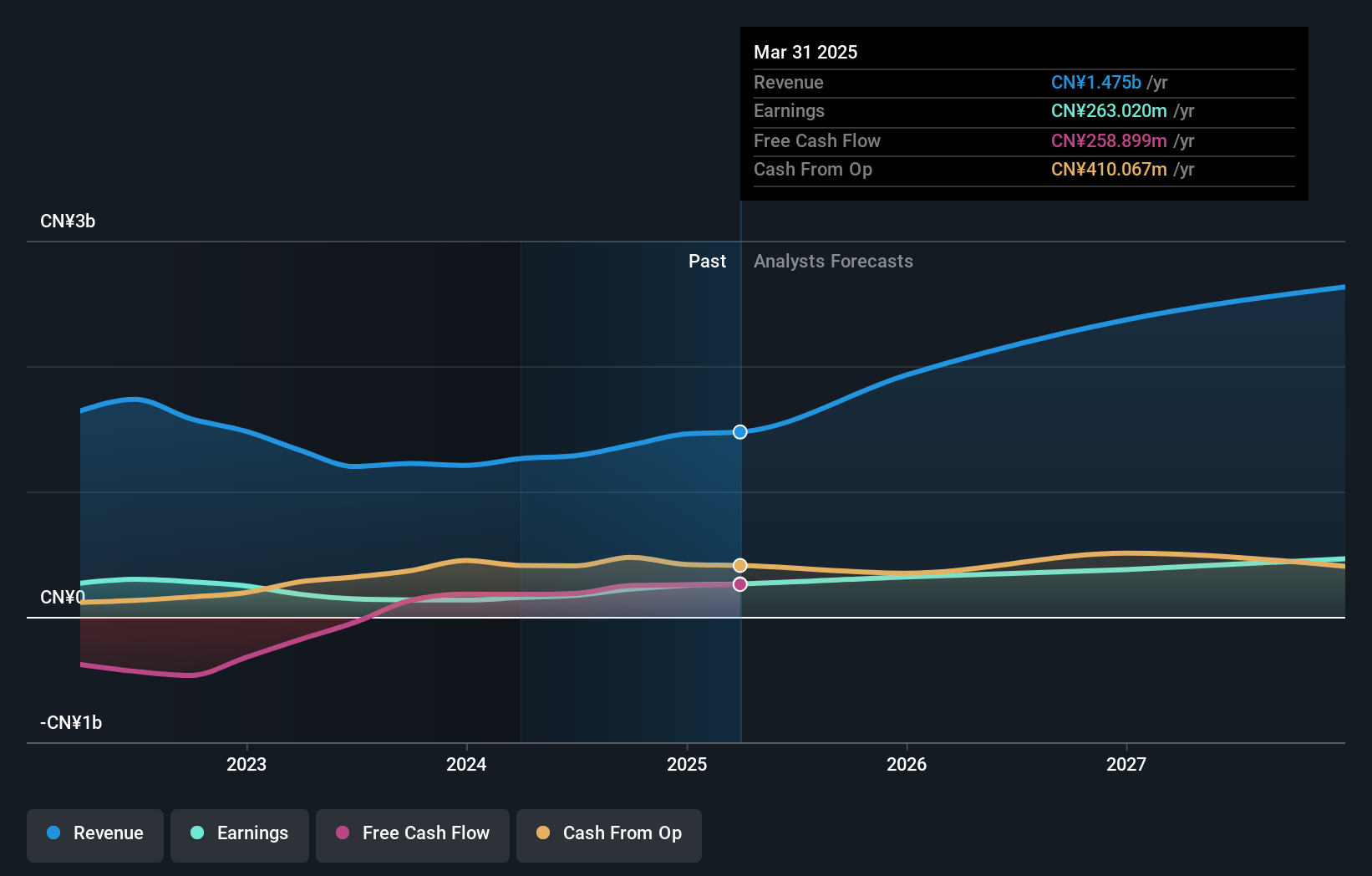

Xi'an Manareco New Materials Ltd, a smaller player in the chemicals sector, recently reported impressive earnings growth of 63.5% over the past year, significantly outpacing the industry's -3.8%. Their net income for the first nine months of 2024 reached CNY 185.3 million, up from CNY 98.06 million last year, reflecting strong operational performance and high-quality earnings. The company has been actively repurchasing shares, spending CNY 61.42 million to buy back approximately 1% of its stock this year alone. With a debt-to-equity ratio reduced to just 0.7%, financial health appears robust and promising for future endeavors.

Focus Technology (SZSE:002315)

Simply Wall St Value Rating: ★★★★★☆

Overview: Focus Technology Co., Ltd. operates e-commerce platforms both within the People’s Republic of China and internationally, with a market cap of CN¥10.08 billion.

Operations: Focus Technology generates revenue primarily through its e-commerce platforms. The company's net profit margin has shown variability, reflecting changes in operational efficiency and market conditions.

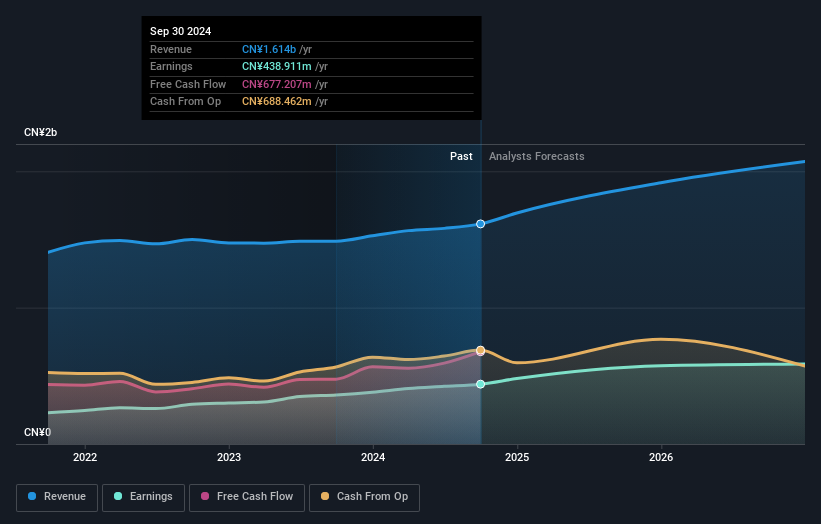

Focus Technology, a smaller player in the Interactive Media and Services sector, recently showcased robust earnings growth of 22.1%, outpacing the industry's 1.7%. Trading at 41% below its estimated fair value, this company seems undervalued given its high-quality earnings and positive free cash flow. Over five years, their debt to equity ratio climbed from 0.2 to 0.6, yet they maintain more cash than total debt, suggesting a solid financial footing. Recent announcements highlight an increase in sales to CNY 1.21 billion and net income reaching CNY 357 million for nine months ending September 2024, alongside approved dividends reflecting shareholder returns focus.

- Dive into the specifics of Focus Technology here with our thorough health report.

Understand Focus Technology's track record by examining our Past report.

Make It Happen

- Investigate our full lineup of 4735 Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:PLUS

DigiPlus Interactive

Through its subsidiaries, manages and operates general amusement, recreation enterprises, hotels, and gaming facilities in the Philippines.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives