- China

- /

- Professional Services

- /

- SHSE:603030

3 Asian Penny Stocks With Market Caps Below US$10B

Reviewed by Simply Wall St

Amid a backdrop of favorable trade deals and positive market sentiment, Asian markets have been buoyed by renewed optimism. This environment provides a fertile ground for penny stocks, which, despite the outdated terminology, continue to offer intriguing opportunities for investors. These stocks typically represent smaller or newer companies that can combine affordability with growth potential when supported by strong financials and fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB4.02 | THB3.97B | ✅ 4 ⚠️ 0 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.46 | HK$921.19M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.51 | HK$2.09B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.485 | SGD196.57M | ✅ 4 ⚠️ 1 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.20 | HK$2B | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.60 | THB2.76B | ✅ 3 ⚠️ 3 View Analysis > |

| China Sunsine Chemical Holdings (SGX:QES) | SGD0.70 | SGD667.37M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.54 | SGD10B | ✅ 5 ⚠️ 0 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.95 | THB1.4B | ✅ 2 ⚠️ 2 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

Click here to see the full list of 970 stocks from our Asian Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Alibaba Health Information Technology (SEHK:241)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Alibaba Health Information Technology Limited is an investment holding company that operates in pharmaceutical direct sales, pharmaceutical e-commerce platforms, and healthcare and digital services in Mainland China and Hong Kong, with a market cap of approximately HK$77.99 billion.

Operations: The company's revenue from the distribution and development of pharmaceutical and healthcare products is CN¥30.60 billion.

Market Cap: HK$77.99B

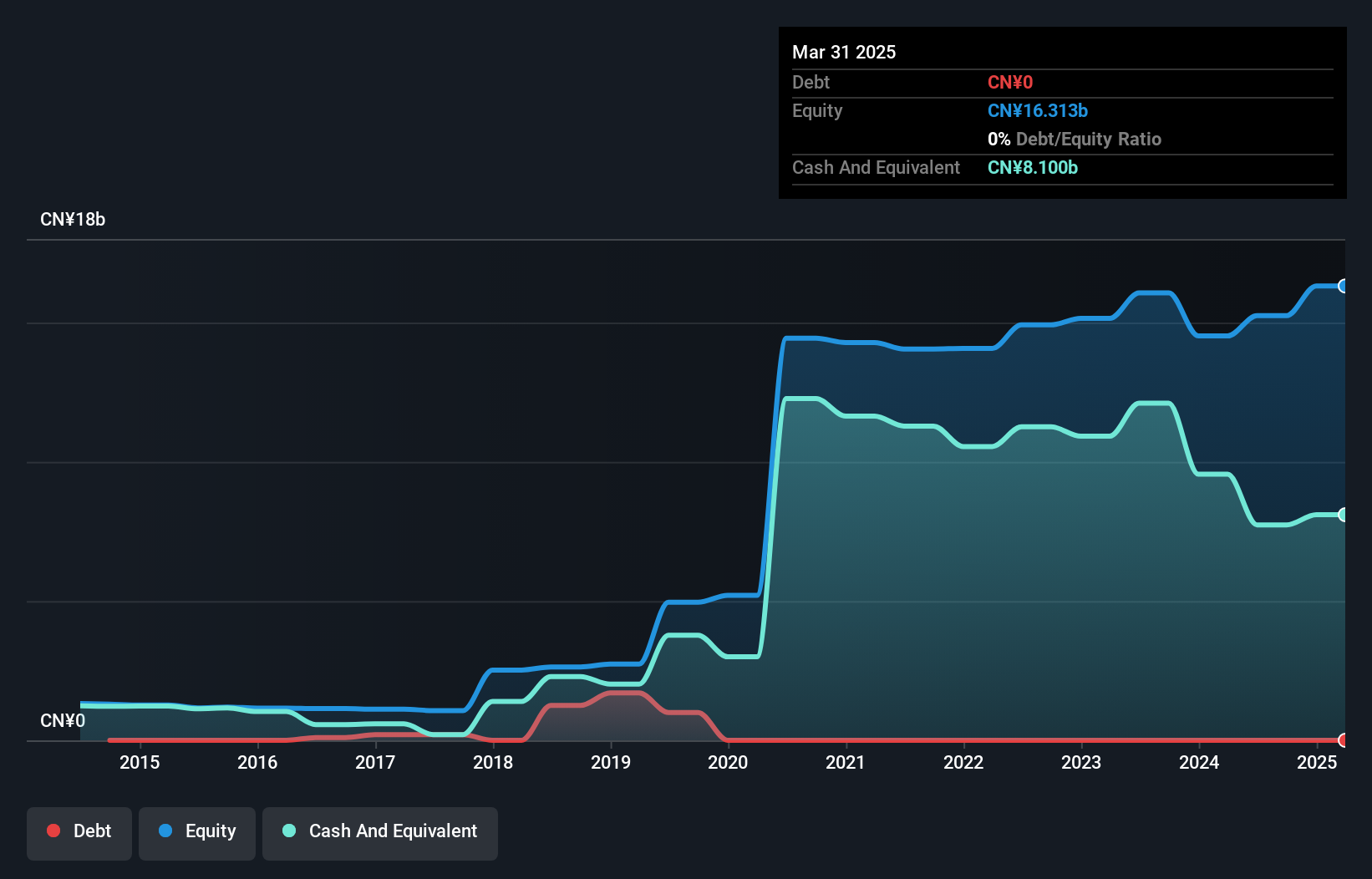

Alibaba Health Information Technology has demonstrated significant earnings growth, with a notable increase of 62.1% over the past year, surpassing its five-year average of 52.2%. The company reported revenues of CN¥30.60 billion for the fiscal year ending March 31, 2025, and improved net profit margins to 4.7%. Despite a one-off loss impacting recent results, Alibaba Health remains debt-free and trades below its estimated fair value by approximately 12.6%. Its short-term assets comfortably cover both short- and long-term liabilities, although the board's average tenure is relatively inexperienced at three years.

- Click here and access our complete financial health analysis report to understand the dynamics of Alibaba Health Information Technology.

- Gain insights into Alibaba Health Information Technology's future direction by reviewing our growth report.

Shanghai Trendzone Holdings GroupLtd (SHSE:603030)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shanghai Trendzone Holdings Group Co., Ltd, with a market cap of CN¥3.74 billion, offers integrated solutions in design, construction, production, and services both in China and internationally.

Operations: No specific revenue segments have been reported for Shanghai Trendzone Holdings Group Co., Ltd.

Market Cap: CN¥3.74B

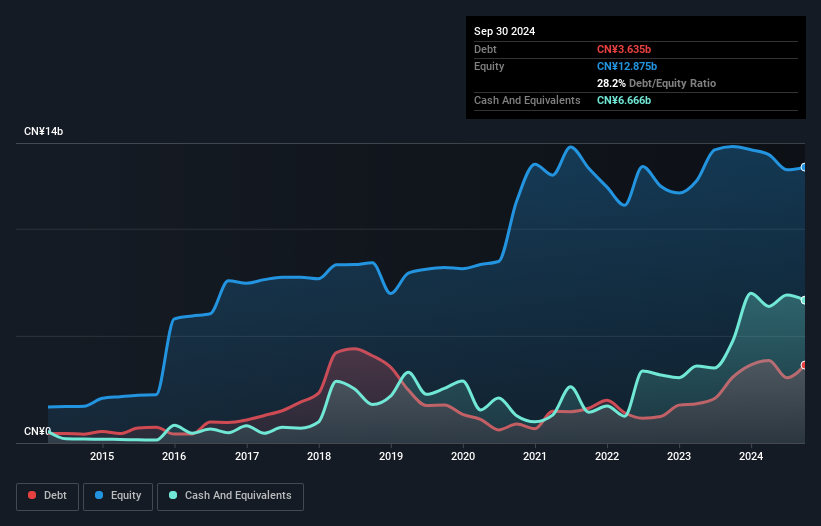

Shanghai Trendzone Holdings Group Co., Ltd, with a market cap of CN¥3.74 billion, has shown some financial resilience despite being unprofitable. Its short-term assets of CN¥1.3 billion comfortably cover both short- and long-term liabilities, indicating solid liquidity management. The company's debt to equity ratio has improved over five years to 42.5%, suggesting prudent debt management, while its net debt to equity ratio is satisfactory at 35.3%. However, the firm remains unprofitable with a negative return on equity of -9.78% and faces high share price volatility alongside less than one year of cash runway based on current free cash flow trends.

- Dive into the specifics of Shanghai Trendzone Holdings GroupLtd here with our thorough balance sheet health report.

- Assess Shanghai Trendzone Holdings GroupLtd's previous results with our detailed historical performance reports.

Leo Group (SZSE:002131)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Leo Group Co., Ltd. operates in China through its subsidiaries, focusing on the research, development, manufacture, and sale of pumps and garden machinery products with a market cap of CN¥24.94 billion.

Operations: No specific revenue segments are reported for Leo Group Co., Ltd.

Market Cap: CN¥24.94B

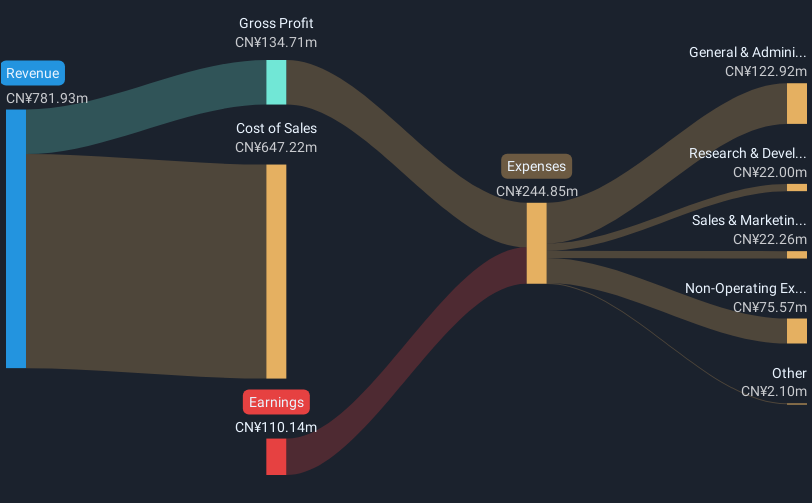

Leo Group Co., Ltd. has a market cap of CN¥24.94 billion and operates in China, focusing on pumps and garden machinery products. Despite having more cash than total debt, its operating cash flow covers only 12.3% of the debt, indicating potential liquidity concerns. The company's net profit margin decreased to 0.4% from 5.6% last year, with earnings declining by 33.2% annually over five years due to a significant one-off loss of CN¥388.7M affecting recent results as of March 2025. While short-term assets exceed liabilities significantly, the dividend yield remains poorly covered by earnings or free cash flows.

- Unlock comprehensive insights into our analysis of Leo Group stock in this financial health report.

- Evaluate Leo Group's historical performance by accessing our past performance report.

Key Takeaways

- Embark on your investment journey to our 970 Asian Penny Stocks selection here.

- Looking For Alternative Opportunities? The latest GPUs need a type of rare earth metal called Neodymium and there are only 25 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603030

Shanghai Trendzone Holdings GroupLtd

Provides integrated solutions across design, construction, production, and services in China and internationally.

Adequate balance sheet low.

Market Insights

Community Narratives