Revenues Not Telling The Story For CITIC Guoan Information Industry Co., Ltd. (SZSE:000839)

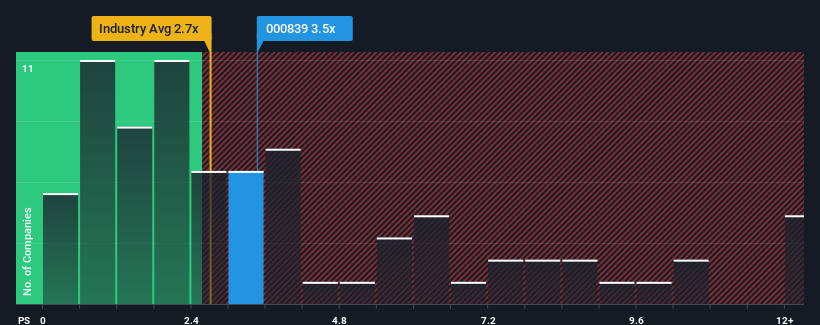

When you see that almost half of the companies in the Media industry in China have price-to-sales ratios (or "P/S") below 2.7x, CITIC Guoan Information Industry Co., Ltd. (SZSE:000839) looks to be giving off some sell signals with its 3.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for CITIC Guoan Information Industry

What Does CITIC Guoan Information Industry's P/S Mean For Shareholders?

Revenue has risen firmly for CITIC Guoan Information Industry recently, which is pleasing to see. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on CITIC Guoan Information Industry will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For CITIC Guoan Information Industry?

The only time you'd be truly comfortable seeing a P/S as high as CITIC Guoan Information Industry's is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.3% last year. Pleasingly, revenue has also lifted 49% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 13% shows it's about the same on an annualised basis.

In light of this, it's curious that CITIC Guoan Information Industry's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as a continuation of recent revenue trends would weigh down the share price eventually.

What Does CITIC Guoan Information Industry's P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into CITIC Guoan Information Industry has shown that it currently trades on a higher than expected P/S since its recent three-year growth is only in line with the wider industry forecast. When we see average revenue with industry-like growth combined with a high P/S, we suspect the share price is at risk of declining, bringing the P/S back in line with the industry too. Unless there is a significant improvement in the company's medium-term trends, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

It is also worth noting that we have found 2 warning signs for CITIC Guoan Information Industry that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000839

CITIC Guoan Information Industry

CITIC Guoan Information Industry Co., Ltd.

Slightly overvalued with questionable track record.

Market Insights

Community Narratives