Shanghai LongYun Cultural Creation & Technology Group (SHSE:603729 shareholders incur further losses as stock declines 19% this week, taking one-year losses to 60%

Shanghai LongYun Cultural Creation & Technology Group Co., Ltd. (SHSE:603729) shareholders will doubtless be very grateful to see the share price up 37% in the last quarter. But that's small comfort given the dismal price performance over the last year. Specifically, the stock price slipped by 60% in that time. Some might say the recent bounce is to be expected after such a bad drop. It may be that the fall was an overreaction.

Since Shanghai LongYun Cultural Creation & Technology Group has shed CN¥352m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Check out our latest analysis for Shanghai LongYun Cultural Creation & Technology Group

Because Shanghai LongYun Cultural Creation & Technology Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last twelve months, Shanghai LongYun Cultural Creation & Technology Group increased its revenue by 0.1%. That's not a very high growth rate considering it doesn't make profits. Without profits, and with revenue growth sluggish, you get a 60% loss for shareholders, over the year. We'd want to see evidence that future revenue growth will be stronger before getting too interested. When a stock falls hard like this, it can signal an over-reaction. Our preference is to wait for a fundamental improvements before buying, but now could be a good time for some research.

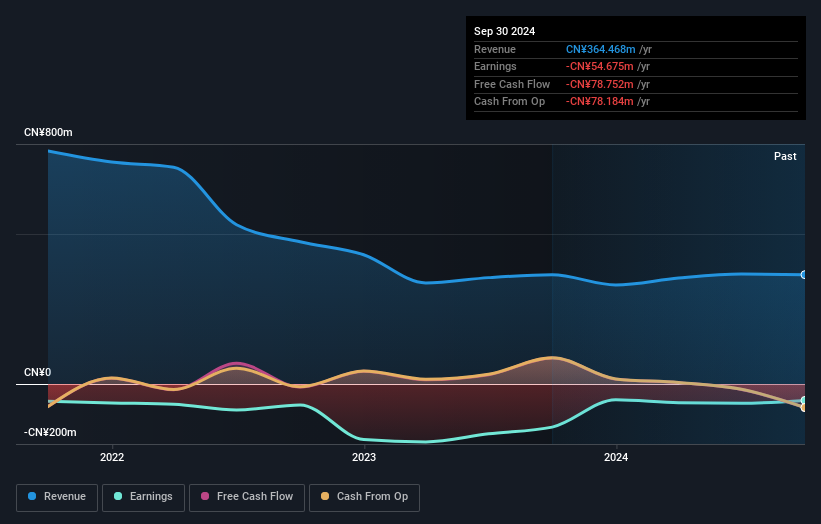

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Shanghai LongYun Cultural Creation & Technology Group's earnings, revenue and cash flow.

A Different Perspective

Investors in Shanghai LongYun Cultural Creation & Technology Group had a tough year, with a total loss of 60%, against a market gain of about 14%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 0.6%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Shanghai LongYun Cultural Creation & Technology Group better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Shanghai LongYun Cultural Creation & Technology Group , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

If you're looking to trade Shanghai LongYun Cultural Creation & Technology Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603729

Shanghai LongYun Cultural Creation & Technology Group

Shanghai LongYun Cultural Creation & Technology Group Co., Ltd.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives