Inmyshow Digital Technology(Group)Co.,Ltd. (SHSE:600556) Screens Well But There Might Be A Catch

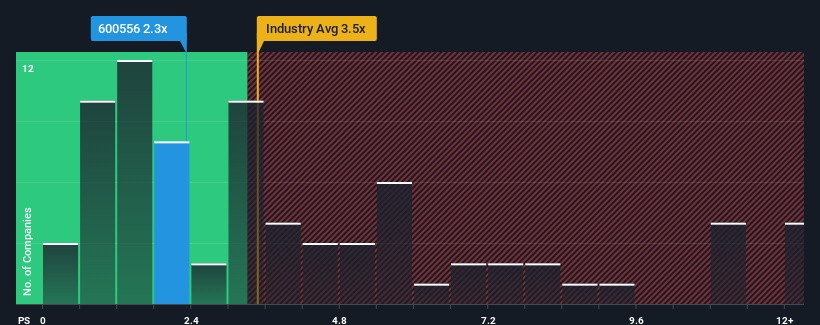

Inmyshow Digital Technology(Group)Co.,Ltd.'s (SHSE:600556) price-to-sales (or "P/S") ratio of 2.3x might make it look like a buy right now compared to the Media industry in China, where around half of the companies have P/S ratios above 3.5x and even P/S above 6x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Inmyshow Digital Technology(Group)Co.Ltd

How Has Inmyshow Digital Technology(Group)Co.Ltd Performed Recently?

While the industry has experienced revenue growth lately, Inmyshow Digital Technology(Group)Co.Ltd's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Inmyshow Digital Technology(Group)Co.Ltd will help you uncover what's on the horizon.How Is Inmyshow Digital Technology(Group)Co.Ltd's Revenue Growth Trending?

Inmyshow Digital Technology(Group)Co.Ltd's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 2.7%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Looking ahead now, revenue is anticipated to climb by 11% during the coming year according to the only analyst following the company. With the industry predicted to deliver 10% growth , the company is positioned for a comparable revenue result.

With this information, we find it odd that Inmyshow Digital Technology(Group)Co.Ltd is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It looks to us like the P/S figures for Inmyshow Digital Technology(Group)Co.Ltd remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

You should always think about risks. Case in point, we've spotted 2 warning signs for Inmyshow Digital Technology(Group)Co.Ltd you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600556

Inmyshow Digital Technology(Group)Co.Ltd

Inmyshow Digital Technology(Group)Co.,Ltd.

Excellent balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.