We Ran A Stock Scan For Earnings Growth And Chinese Universe Publishing and Media Group (SHSE:600373) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Chinese Universe Publishing and Media Group (SHSE:600373), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Chinese Universe Publishing and Media Group

How Quickly Is Chinese Universe Publishing and Media Group Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. We can see that in the last three years Chinese Universe Publishing and Media Group grew its EPS by 4.9% per year. This may not be setting the world alight, but it does show that EPS is on the upwards trend.

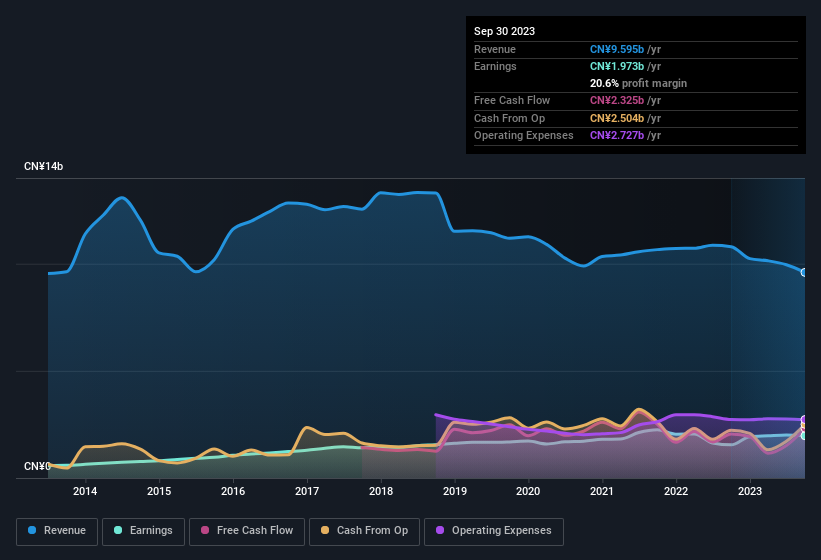

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. We note that while EBIT margins have improved from 11% to 13%, the company has actually reported a fall in revenue by 11%. That falls short of ideal.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Chinese Universe Publishing and Media Group's future profits.

Are Chinese Universe Publishing and Media Group Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Chinese Universe Publishing and Media Group insiders have a significant amount of capital invested in the stock. Indeed, they hold CN¥112m worth of its stock. That's a lot of money, and no small incentive to work hard. Even though that's only about 0.5% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. For companies with market capitalisations between CN¥14b and CN¥46b, like Chinese Universe Publishing and Media Group, the median CEO pay is around CN¥1.6m.

Chinese Universe Publishing and Media Group's CEO took home a total compensation package worth CN¥959k in the year leading up to December 2022. That seems pretty reasonable, especially given it's below the median for similar sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Should You Add Chinese Universe Publishing and Media Group To Your Watchlist?

One important encouraging feature of Chinese Universe Publishing and Media Group is that it is growing profits. The growth of EPS may be the eye-catching headline for Chinese Universe Publishing and Media Group, but there's more to bring joy for shareholders. With company insiders aligning themselves considerably with the company's success and modest CEO compensation, there's no arguments that this is a stock worth looking into. We should say that we've discovered 1 warning sign for Chinese Universe Publishing and Media Group that you should be aware of before investing here.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600373

Chinese Universe Publishing and Media Group

Chinese Universe Publishing and Media Group Co., Ltd.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives