As global markets continue to navigate the complexities of political developments and economic shifts, U.S. stocks have reached record highs, buoyed by optimism around trade policies and artificial intelligence investments. In such a vibrant market landscape, identifying promising investment opportunities becomes crucial for investors seeking growth potential. Although the term "penny stocks" may seem outdated, it still signifies smaller or newer companies with unique prospects. By focusing on those with strong financial foundations, investors can uncover potential gems in this intriguing segment of the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.525 | MYR2.59B | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.70 | £176.46M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.75 | HK$43.09B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.11 | HK$704.62M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.945 | £465.11M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR285.47M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.72 | MYR423.03M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.78 | A$142.2M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £4.32 | £84.3M | ★★★★☆☆ |

Click here to see the full list of 5,711 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

PropNex (SGX:OYY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PropNex Limited offers real estate services in Singapore and internationally, with a market cap of SGD799.20 million.

Operations: The company generates revenue through various segments, including Agency Services (SGD793.97 million), Project Marketing Services (SGD220.11 million), Training Services (SGD2.69 million), and Administrative Support Services (SGD4.41 million).

Market Cap: SGD799.2M

PropNex Limited, with a market cap of SGD799.20 million, has demonstrated financial stability by maintaining a debt-free status for the past five years. Its short-term assets of SGD269.4 million comfortably cover both short-term and long-term liabilities, indicating strong liquidity. Despite high-quality past earnings and a robust Return on Equity of 38.7%, recent profit margins have declined to 5.5% from 6.2%. The company is trading significantly below its estimated fair value but faces challenges with negative earnings growth over the past year and an inexperienced management team averaging just 0.2 years in tenure, which may impact future performance stability.

- Navigate through the intricacies of PropNex with our comprehensive balance sheet health report here.

- Assess PropNex's future earnings estimates with our detailed growth reports.

Fanli Digital TechnologyLtd (SHSE:600228)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fanli Digital Technology Co., Ltd operates Fanli.com, an e-commerce shopping guide platform in China, with a market cap of CN¥2.00 billion.

Operations: The company's revenue is primarily derived from its Internet and Related Services segment, amounting to CN¥302.33 million.

Market Cap: CN¥2B

Fanli Digital Technology Ltd, with a market cap of CN¥2 billion, has shown significant earnings growth of 356.5% over the past year despite a declining trend over five years. The company is debt-free and maintains strong liquidity, with short-term assets of CN¥475.6 million covering both short- and long-term liabilities. Its recent share buyback program reflects management's confidence but follows its removal from the S&P Global BMI Index in December 2024. Although Fanli boasts high-quality earnings and improved profit margins, its return on equity remains low at 6.9%, indicating room for operational efficiency improvements amidst high share price volatility.

- Unlock comprehensive insights into our analysis of Fanli Digital TechnologyLtd stock in this financial health report.

- Gain insights into Fanli Digital TechnologyLtd's past trends and performance with our report on the company's historical track record.

Jiangsu Huifeng Bio Agriculture (SZSE:002496)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Jiangsu Huifeng Bio Agriculture Co., Ltd. operates in the agrochemical industry, focusing on the research, development, and production of pesticides and other agricultural products, with a market cap of approximately CN¥2.13 billion.

Operations: Jiangsu Huifeng Bio Agriculture Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥2.13B

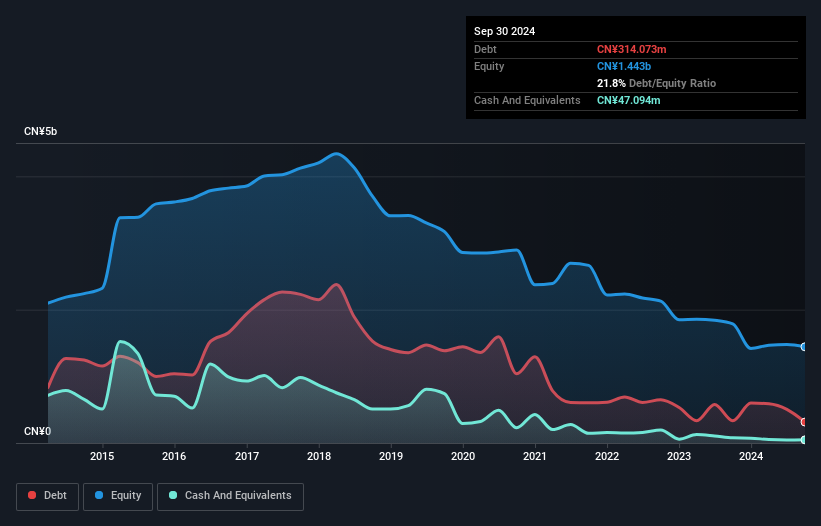

Jiangsu Huifeng Bio Agriculture, with a market cap of CN¥2.13 billion, faces financial challenges as it remains unprofitable and its earnings have declined by 5.1% annually over the past five years. Despite reducing its debt to equity ratio from 43.7% to 21.8%, the company struggles with high share price volatility and short-term liabilities exceeding short-term assets (CN¥321.6M vs CN¥906.4M). Although it has a satisfactory net debt to equity ratio of 18.5%, the cash runway is limited if free cash flow continues decreasing at historical rates, highlighting potential liquidity concerns amidst an experienced management team.

- Dive into the specifics of Jiangsu Huifeng Bio Agriculture here with our thorough balance sheet health report.

- Explore historical data to track Jiangsu Huifeng Bio Agriculture's performance over time in our past results report.

Seize The Opportunity

- Navigate through the entire inventory of 5,711 Penny Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002496

Jiangsu Huifeng Bio Agriculture

Jiangsu Huifeng Bio Agriculture Co., Ltd.

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives