- India

- /

- Electrical

- /

- NSEI:INDOTECH

Undiscovered Gems with Promising Potential In November 2024

Reviewed by Simply Wall St

As global markets navigate a period of volatility marked by cautious earnings reports and fluctuating economic indicators, small-cap stocks have shown resilience compared to their larger counterparts. Amidst this backdrop, the search for undiscovered gems becomes particularly compelling as investors seek opportunities that may offer growth potential despite broader market challenges. Identifying promising stocks often involves looking beyond current market noise to assess fundamental strengths such as financial health, competitive positioning, and adaptability to changing economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ruentex Interior Design | NA | 44.92% | 51.98% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Arab Banking Corporation (B.S.C.) | 190.18% | 16.52% | 21.58% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Kardemir Karabük Demir Çelik Sanayi Ve Ticaret (IBSE:KRDMD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kardemir Karabük Demir Çelik Sanayi Ve Ticaret A.S. is a company engaged in the production and sale of steel products, with a market cap of TRY27.05 billion.

Operations: Kardemir generates revenue primarily from the sale of steel products. The company's financial performance is influenced by its net profit margin, which reflects the efficiency in managing production costs relative to its revenue.

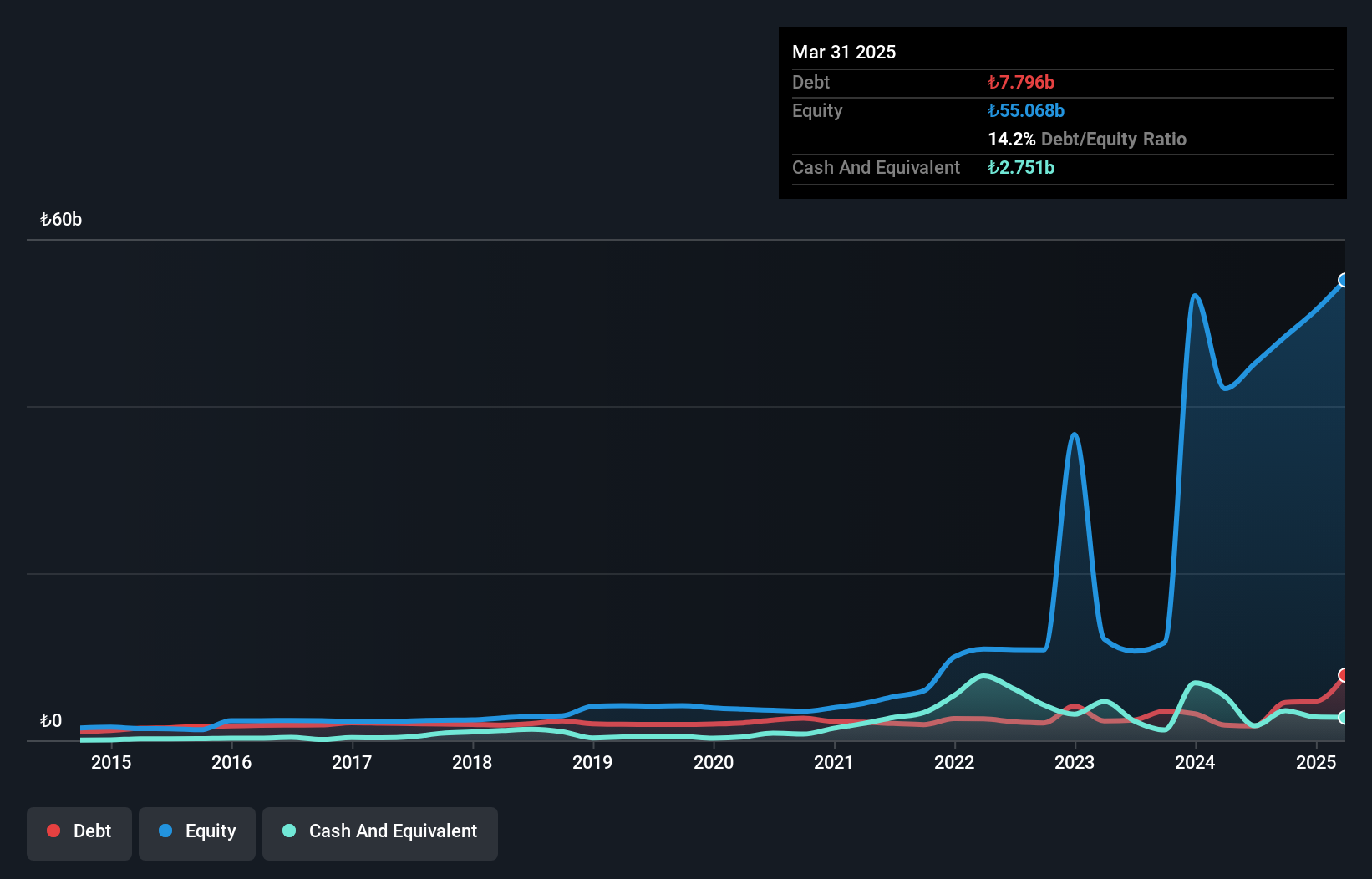

Kardemir Karabük Demir Çelik Sanayi Ve Ticaret, a notable player in the steel industry, seems to be navigating challenging waters. Despite trading at 73.6% below its estimated fair value and reducing its debt-to-equity ratio from 46.5% to 3.8% over five years, recent financials reveal hurdles. The company reported a net loss of TRY 927 million for Q2 2024 against a previous net income of TRY 298 million, with sales dropping from TRY 14 billion to TRY 11 billion year-on-year. While cash exceeds total debt, interest coverage remains weak at just 0.6x EBIT, suggesting potential liquidity pressures ahead despite forecasted earnings growth of over 85%.

Indo Tech Transformers (NSEI:INDOTECH)

Simply Wall St Value Rating: ★★★★★☆

Overview: Indo Tech Transformers Limited is engaged in the manufacturing and distribution of transformers both within India and internationally, with a market capitalization of ₹27.31 billion.

Operations: Indo Tech Transformers generates revenue primarily from the manufacture and sale of transformers, amounting to ₹4.93 billion. The company's net profit margin exhibits a noteworthy trend at 3.5%.

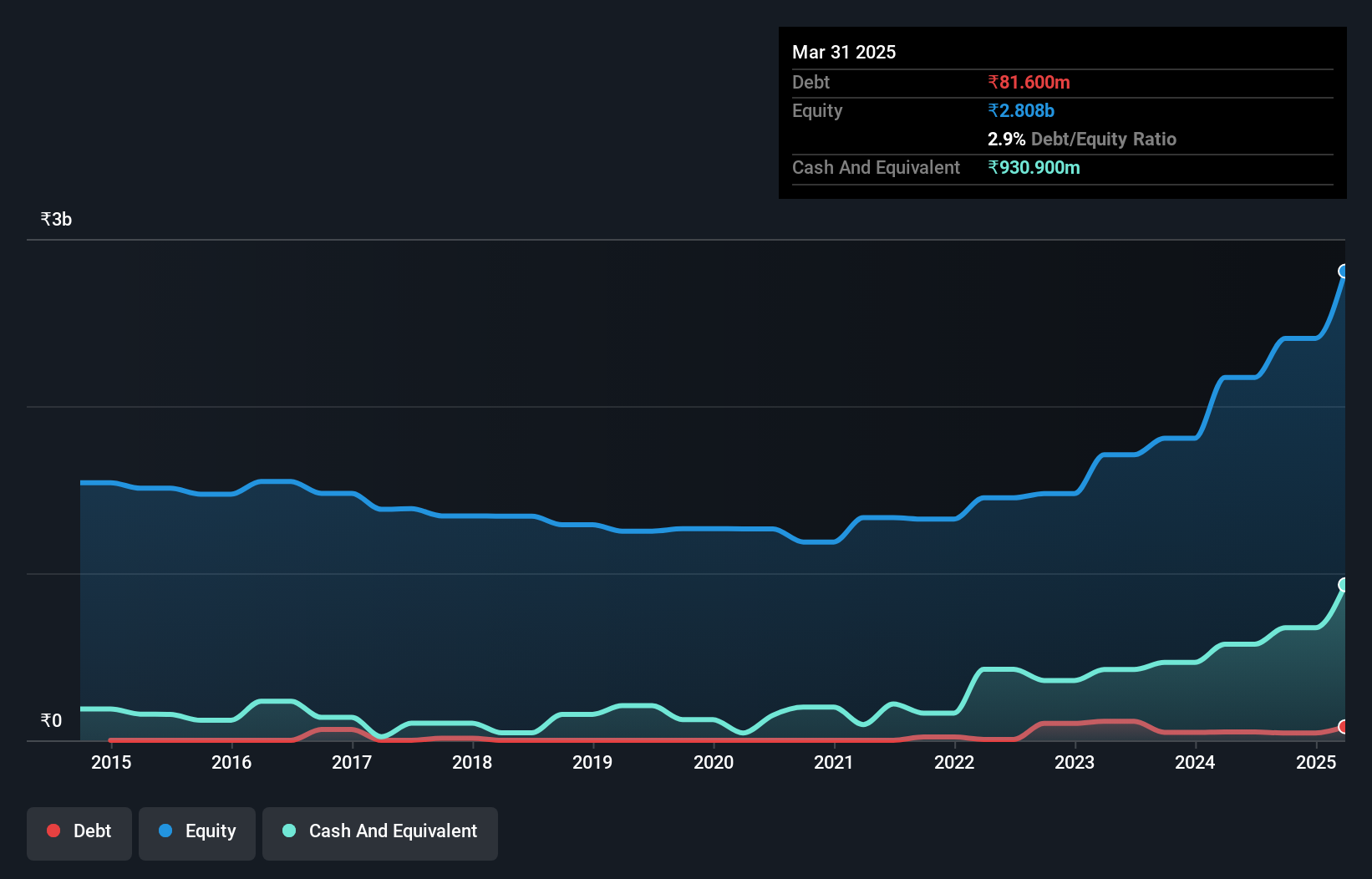

Indo Tech Transformers is capturing attention with its robust financial health, boasting more cash than total debt and a manageable debt-to-equity ratio of 2.3% over five years. Its earnings growth of 75.8% outpaces the electrical industry’s 37.9%, reflecting high-quality earnings and solid profitability. Recent earnings reports show net income climbing to INR 59 million from INR 35 million year-on-year, with basic EPS rising to INR 5.56 from INR 3.33, despite sales dipping slightly to INR 821 million from INR 932 million last year. A recent domestic order valued at INR 425 million further underscores its growth potential in the sector.

- Dive into the specifics of Indo Tech Transformers here with our thorough health report.

Gain insights into Indo Tech Transformers' past trends and performance with our Past report.

Shenzhen Jdd Tech New Material (SZSE:301538)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Jdd Tech New Material Co., Ltd focuses on the research, design, development, production, and sale of modified polymer protective materials in China with a market capitalization of CN¥4.71 billion.

Operations: Shenzhen Jdd Tech New Material Co., Ltd generates revenue primarily from the sale of modified polymer protective materials. The company has a market capitalization of CN¥4.71 billion, indicating its significant presence in the industry.

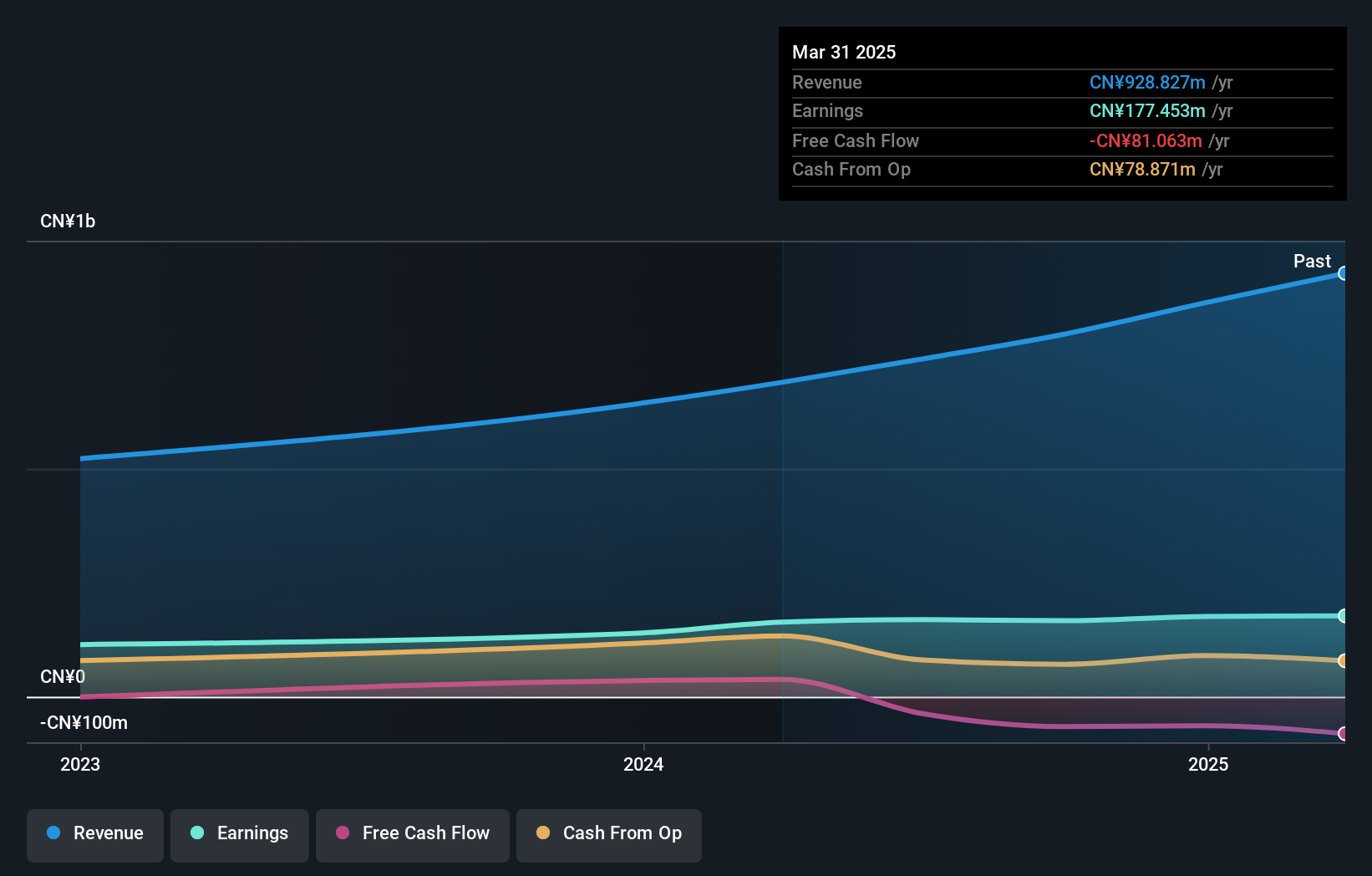

Shenzhen Jdd Tech New Material, operating in the chemicals sector, has demonstrated impressive growth with earnings increasing by 25% over the past year, outpacing the industry average of -4%. The company reported sales of CNY 589.5 million for the first nine months of 2024, a notable rise from CNY 438 million in the previous year. Despite its volatile share price recently, Shenzhen Jdd maintains a favorable price-to-earnings ratio of 28x compared to China's market average of 35x. With no debt on its books now versus five years ago when it had a debt-to-equity ratio of 0.3%, it seems well-positioned financially.

- Click here to discover the nuances of Shenzhen Jdd Tech New Material with our detailed analytical health report.

Learn about Shenzhen Jdd Tech New Material's historical performance.

Turning Ideas Into Actions

- Delve into our full catalog of 4705 Undiscovered Gems With Strong Fundamentals here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:INDOTECH

Indo Tech Transformers

Manufactures and distributes transformers in India and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives