- China

- /

- Electrical

- /

- SHSE:603530

Undiscovered Gems in Asia to Watch This July 2025

Reviewed by Simply Wall St

As global markets experience dynamic shifts, with U.S. small-cap indices like the S&P MidCap 400 and Russell 2000 showing notable gains, investor attention is increasingly turning towards emerging opportunities in Asia. In this environment, identifying stocks with strong fundamentals and growth potential becomes crucial for those looking to capitalize on the evolving economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ohashi Technica | NA | 5.69% | -10.83% | ★★★★★★ |

| Shantou Institute of Ultrasonic Instrument | NA | 17.40% | 16.47% | ★★★★★★ |

| Hiconics Eco-energy Technology | NA | 30.59% | 27.60% | ★★★★★★ |

| ShenZhen QiangRui Precision Technology | 18.68% | 41.36% | 14.12% | ★★★★★☆ |

| FCE | 7.92% | 26.91% | 26.05% | ★★★★★☆ |

| Jiangxi Jiangnan New Material Technology | 61.91% | 25.72% | 15.23% | ★★★★★☆ |

| KC | 2.19% | 8.76% | -0.47% | ★★★★★☆ |

| KinjiroLtd | 22.32% | 10.69% | 21.02% | ★★★★★☆ |

| DYPNFLtd | 37.74% | 7.21% | -14.42% | ★★★★☆☆ |

| Tibet TourismLtd | 27.63% | 9.10% | 17.00% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Hankook (KOSE:A000240)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hankook & Company Co., Ltd. is engaged in the manufacturing and sale of storage batteries, with a market capitalization of ₩1.99 trillion.

Operations: Hankook & Company Co., Ltd. generates revenue primarily from its Storage Battery Division, contributing ₩1.04 trillion, while the Investment Business Division adds ₩393.32 billion.

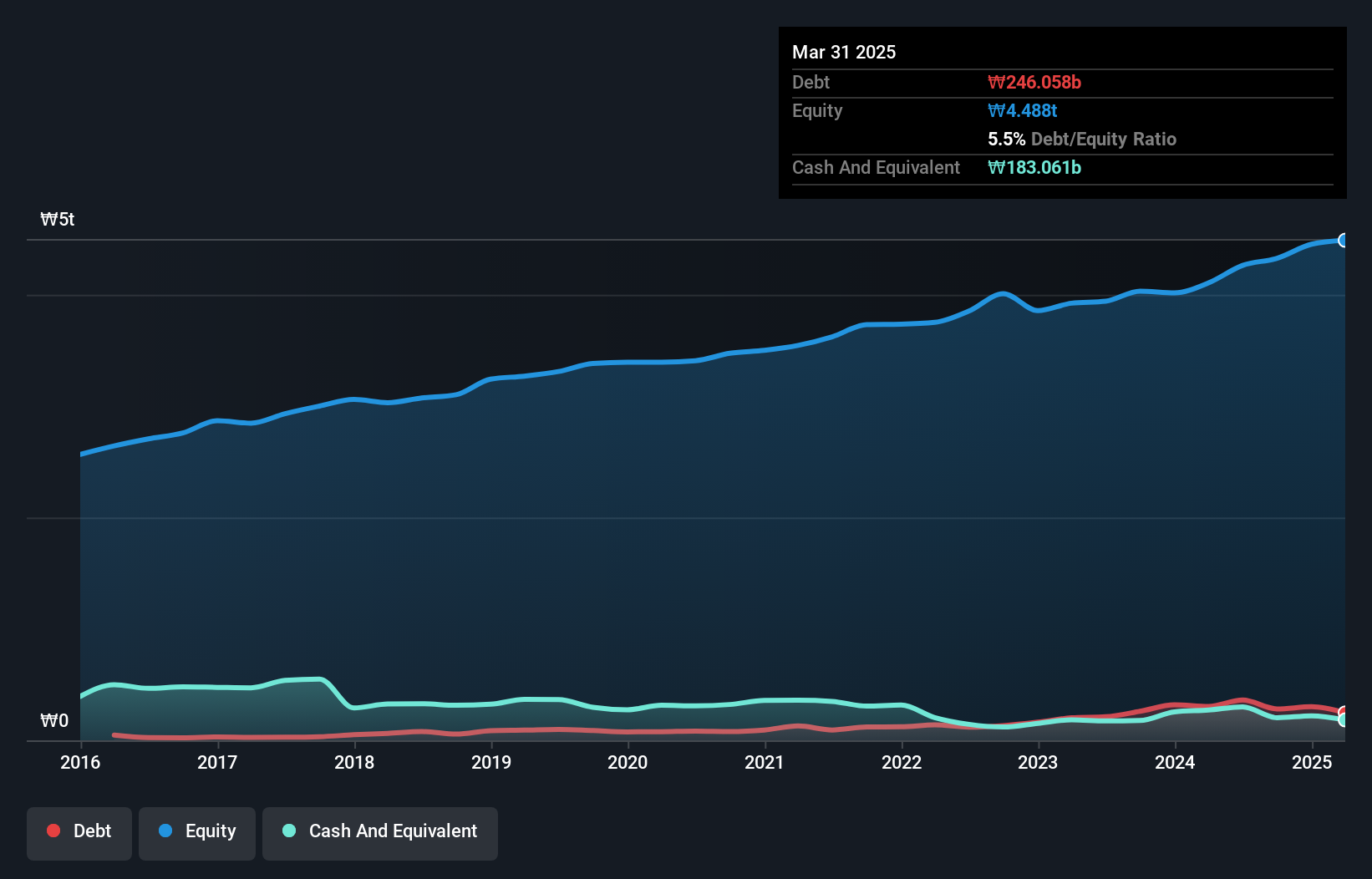

Hankook, a notable player in the auto components sector, has been making waves with its impressive earnings growth of 30.9% over the past year, outpacing the industry's 8.4%. Despite a rise in its debt to equity ratio from 2.3% to 5.5% over five years, it maintains satisfactory net debt levels at just 1.4%. The company's high-quality earnings and robust interest coverage ratio of 52x EBIT suggest strong financial health. Trading at nearly 40% below estimated fair value and with positive free cash flow, Hankook presents an intriguing opportunity for investors seeking value in Asia's market landscape.

- Get an in-depth perspective on Hankook's performance by reading our health report here.

Explore historical data to track Hankook's performance over time in our Past section.

Jiangsu Shemar ElectricLtd (SHSE:603530)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jiangsu Shemar Electric Co., Ltd specializes in the R&D, production, and sale of power system substation composite external insulation, transmission and distribution lines, and rubber seals in China with a market cap of CN¥11.53 billion.

Operations: Shemar Electric generates revenue primarily from the sale of power system substation composite external insulation, transmission and distribution lines, and rubber seals. The company's financial performance is highlighted by a market cap of CN¥11.53 billion.

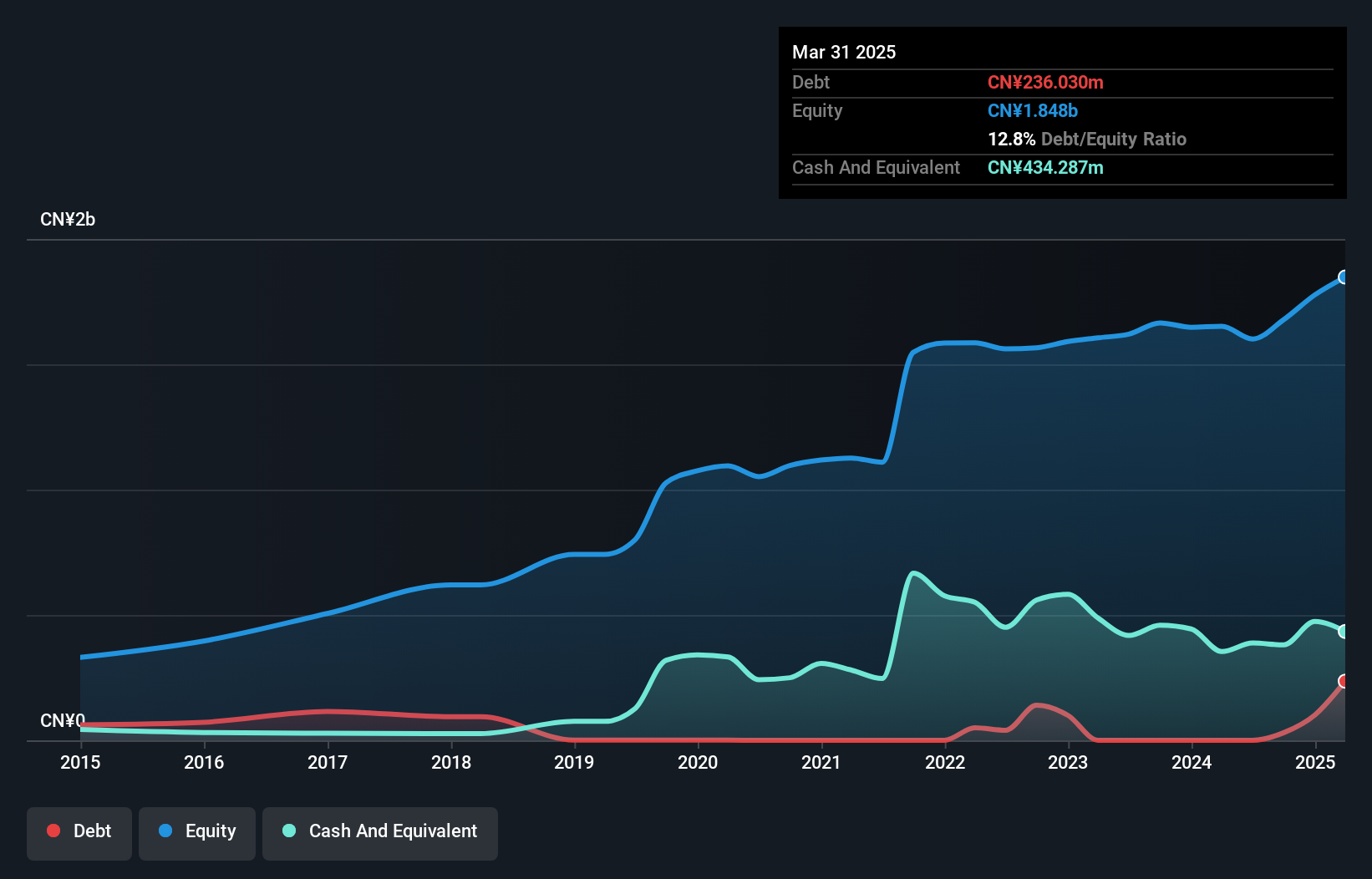

Jiangsu Shemar Electric seems to be carving out a niche with its robust financial performance, highlighted by a 52% earnings growth over the past year, far surpassing the Electrical industry's -1.4%. The company reported first-quarter sales of CNY 285.22 million, up from CNY 231.15 million last year, and net income rose to CNY 68.21 million from CNY 63.74 million. With a price-to-earnings ratio of 36.6x below the CN market average of 39.6x and more cash than total debt, Shemar Electric appears well-positioned in its sector despite not being free cash flow positive recently due to increased capital expenditures.

- Take a closer look at Jiangsu Shemar ElectricLtd's potential here in our health report.

Gain insights into Jiangsu Shemar ElectricLtd's past trends and performance with our Past report.

Hefei Hengxin Life Science and Technology (SZSE:301501)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hefei Hengxin Life Science and Technology Co., Ltd. operates in the life sciences sector and has a market capitalization of CN¥8.07 billion.

Operations: Hefei Hengxin Life Science and Technology Co., Ltd. generates revenue primarily through its operations in the life sciences sector, with a market capitalization of CN¥8.07 billion. The company's financial performance includes key metrics such as gross profit margin and net profit margin, which are essential for evaluating profitability trends over time.

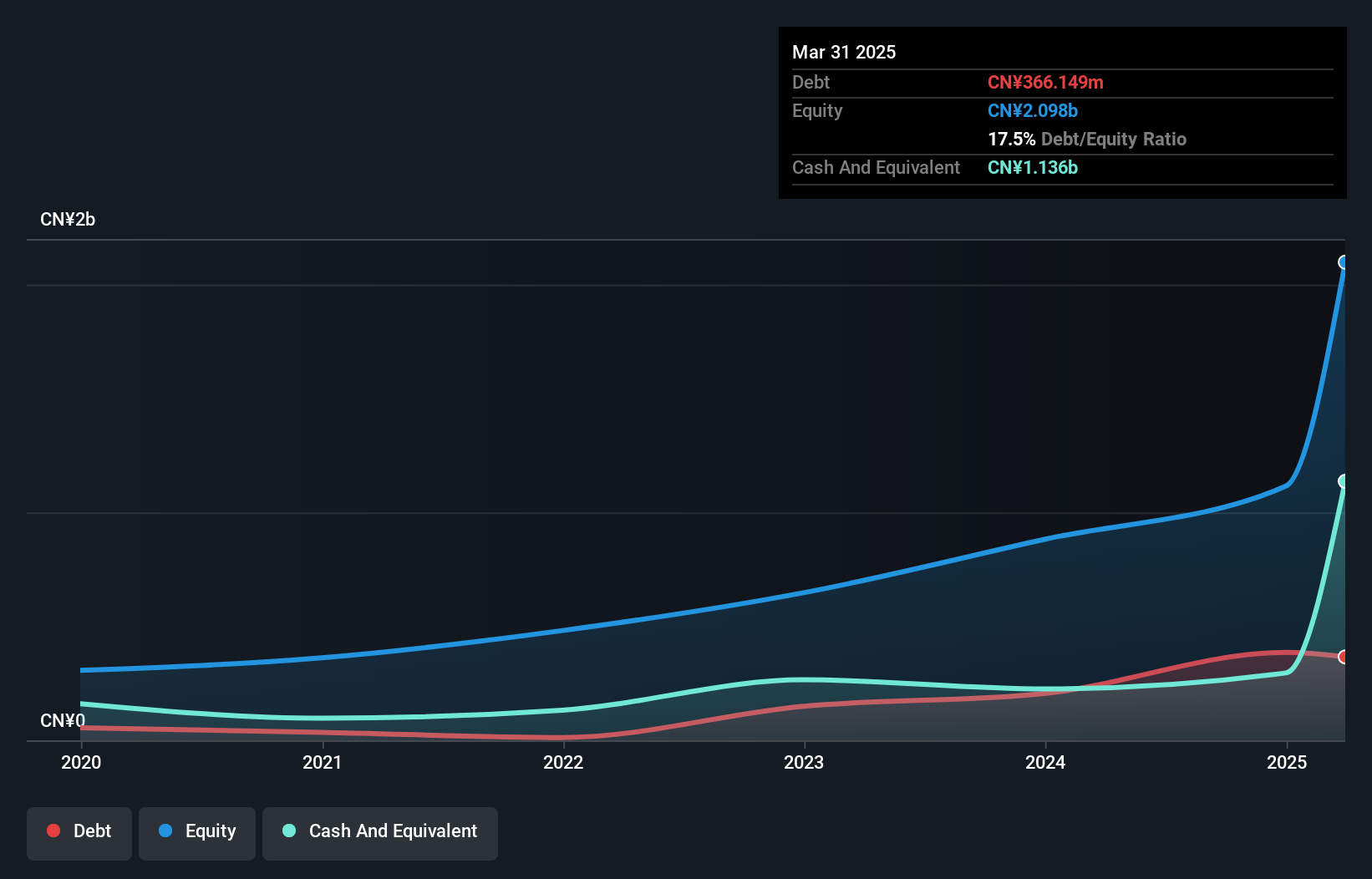

Hefei Hengxin Life Science and Technology has shown robust performance, with earnings growth of 19% over the past year, outpacing the Packaging industry's 3.2%. The company's debt to equity ratio increased slightly from 15.6% to 17.5% over five years, yet it remains manageable with EBIT covering interest payments by a substantial 31.5 times. Although not free cash flow positive recently, its profitability is evident in net income rising to CNY 81.86 million for Q1 2025 from CNY 45.53 million a year prior, alongside an attractive price-to-earnings ratio of 31.5x compared to the CN market's average of 39.6x.

Seize The Opportunity

- Dive into all 2615 of the Asian Undiscovered Gems With Strong Fundamentals we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603530

Jiangsu Shemar ElectricLtd

Engages in the research and development, production, and sale of power system substation composite external insulation, transmission and distribution lines, and rubber seals in China.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives