There's No Escaping Chengdu Shengbang Seals Co.,Ltd.'s (SZSE:301233) Muted Earnings Despite A 27% Share Price Rise

Chengdu Shengbang Seals Co.,Ltd. (SZSE:301233) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 31% in the last twelve months.

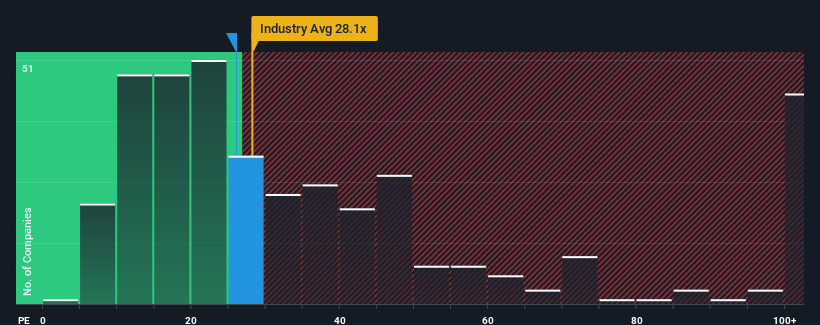

Even after such a large jump in price, Chengdu Shengbang SealsLtd may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 26x, since almost half of all companies in China have P/E ratios greater than 30x and even P/E's higher than 55x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Earnings have risen firmly for Chengdu Shengbang SealsLtd recently, which is pleasing to see. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Chengdu Shengbang SealsLtd

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Chengdu Shengbang SealsLtd would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 19% last year. Still, incredibly EPS has fallen 37% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 41% shows it's an unpleasant look.

In light of this, it's understandable that Chengdu Shengbang SealsLtd's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

What We Can Learn From Chengdu Shengbang SealsLtd's P/E?

Despite Chengdu Shengbang SealsLtd's shares building up a head of steam, its P/E still lags most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Chengdu Shengbang SealsLtd revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Chengdu Shengbang SealsLtd that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301233

Chengdu Shengbang SealsLtd

Researches and develops, produces, and sells rubber polymer products in China and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives