- China

- /

- Metals and Mining

- /

- SZSE:301217

Subdued Growth No Barrier To Anhui Tongguan Copper Foil Group Co., Ltd. (SZSE:301217) With Shares Advancing 29%

Those holding Anhui Tongguan Copper Foil Group Co., Ltd. (SZSE:301217) shares would be relieved that the share price has rebounded 29% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 28% over that time.

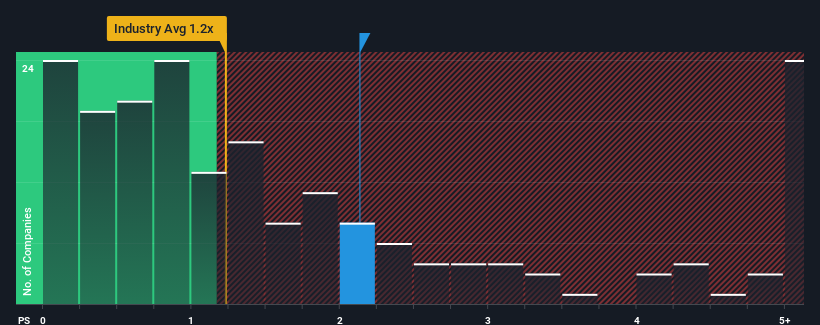

Following the firm bounce in price, you could be forgiven for thinking Anhui Tongguan Copper Foil Group is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.1x, considering almost half the companies in China's Metals and Mining industry have P/S ratios below 1.2x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Anhui Tongguan Copper Foil Group

How Has Anhui Tongguan Copper Foil Group Performed Recently?

Anhui Tongguan Copper Foil Group's revenue growth of late has been pretty similar to most other companies. Perhaps the market is expecting future revenue performance to improve, justifying the currently elevated P/S. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Anhui Tongguan Copper Foil Group.How Is Anhui Tongguan Copper Foil Group's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Anhui Tongguan Copper Foil Group's is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.2% last year. This was backed up an excellent period prior to see revenue up by 58% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 11% during the coming year according to the sole analyst following the company. With the industry predicted to deliver 15% growth, the company is positioned for a weaker revenue result.

With this information, we find it concerning that Anhui Tongguan Copper Foil Group is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Anhui Tongguan Copper Foil Group's P/S is on the rise since its shares have risen strongly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It comes as a surprise to see Anhui Tongguan Copper Foil Group trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

You should always think about risks. Case in point, we've spotted 3 warning signs for Anhui Tongguan Copper Foil Group you should be aware of, and 2 of them are significant.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301217

Anhui Tongguan Copper Foil Group

Engages in research and development, manufacture, and sales of various electronic copper foils in China.

Adequate balance sheet very low.