Amid a mixed performance in global markets, with major indices like the S&P 500 and Nasdaq Composite closing out another strong year despite recent fluctuations, investors are keeping a close eye on economic indicators such as the Chicago PMI and GDP forecasts that suggest potential headwinds for certain sectors. In this environment of cautious optimism, identifying promising small-cap stocks can offer unique opportunities for growth, particularly those that demonstrate resilience and innovation in challenging times.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahnhof | NA | 8.70% | 14.93% | ★★★★★★ |

| AB Traction | NA | 7.12% | 6.96% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Linc | NA | 12.52% | 16.39% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Ellaktor | 73.80% | -24.52% | 51.72% | ★★★★★☆ |

| Onde | 21.84% | 8.04% | 2.79% | ★★★★★☆ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

SIMONA (DB:SIM0)

Simply Wall St Value Rating: ★★★★★☆

Overview: SIMONA Aktiengesellschaft is a global company that specializes in the development, manufacturing, and marketing of semi-finished thermoplastics, pipes, fittings, and profiles with a market capitalization of €336 million.

Operations: SIMONA generates revenue primarily from its segment involving semi-finished plastics, pipes, fittings, and finished parts, amounting to €578.85 million.

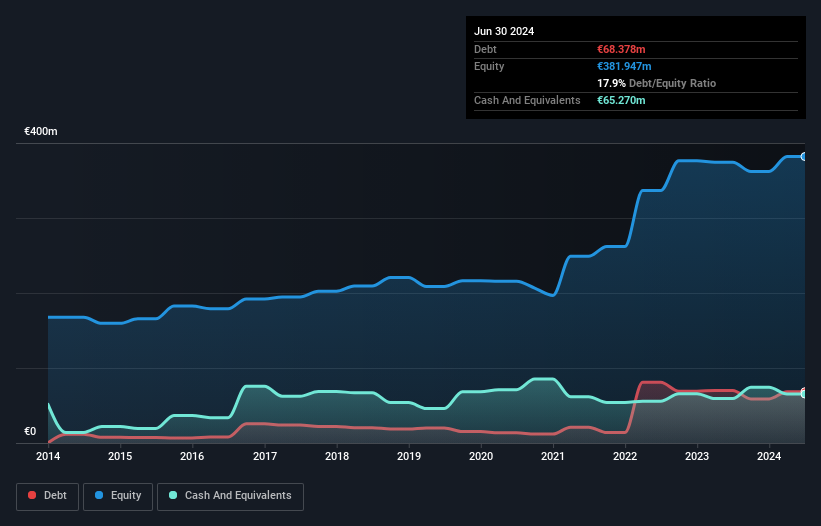

SIMONA, a notable player in the chemicals sector, is trading at 72.6% below its estimated fair value, suggesting potential undervaluation. The company's earnings grew by 9.6% over the past year, outpacing the industry average of 7.2%, highlighting robust performance within its market niche. Despite an increase in debt to equity from 9.6% to 17.9% over five years, interest payments remain well covered with EBIT covering interest expenses 22 times over, indicating strong financial health and management efficiency in handling debt obligations while maintaining high-quality earnings and positive free cash flow (US$31 million).

- Unlock comprehensive insights into our analysis of SIMONA stock in this health report.

Gain insights into SIMONA's past trends and performance with our Past report.

Al Taiseer Group TALCO Industrial (SASE:4143)

Simply Wall St Value Rating: ★★★★★☆

Overview: Al Taiseer Group TALCO Industrial Company specializes in the design, manufacture, and marketing of aluminum products, with a market capitalization of SAR2.28 billion.

Operations: Al Taiseer Group TALCO Industrial generates revenue primarily through its Forming and Aluminum segment, which accounts for SAR581.06 million, followed by Thermo-Set Coating at SAR67.60 million, and Aluminum Accessories at SAR39.39 million.

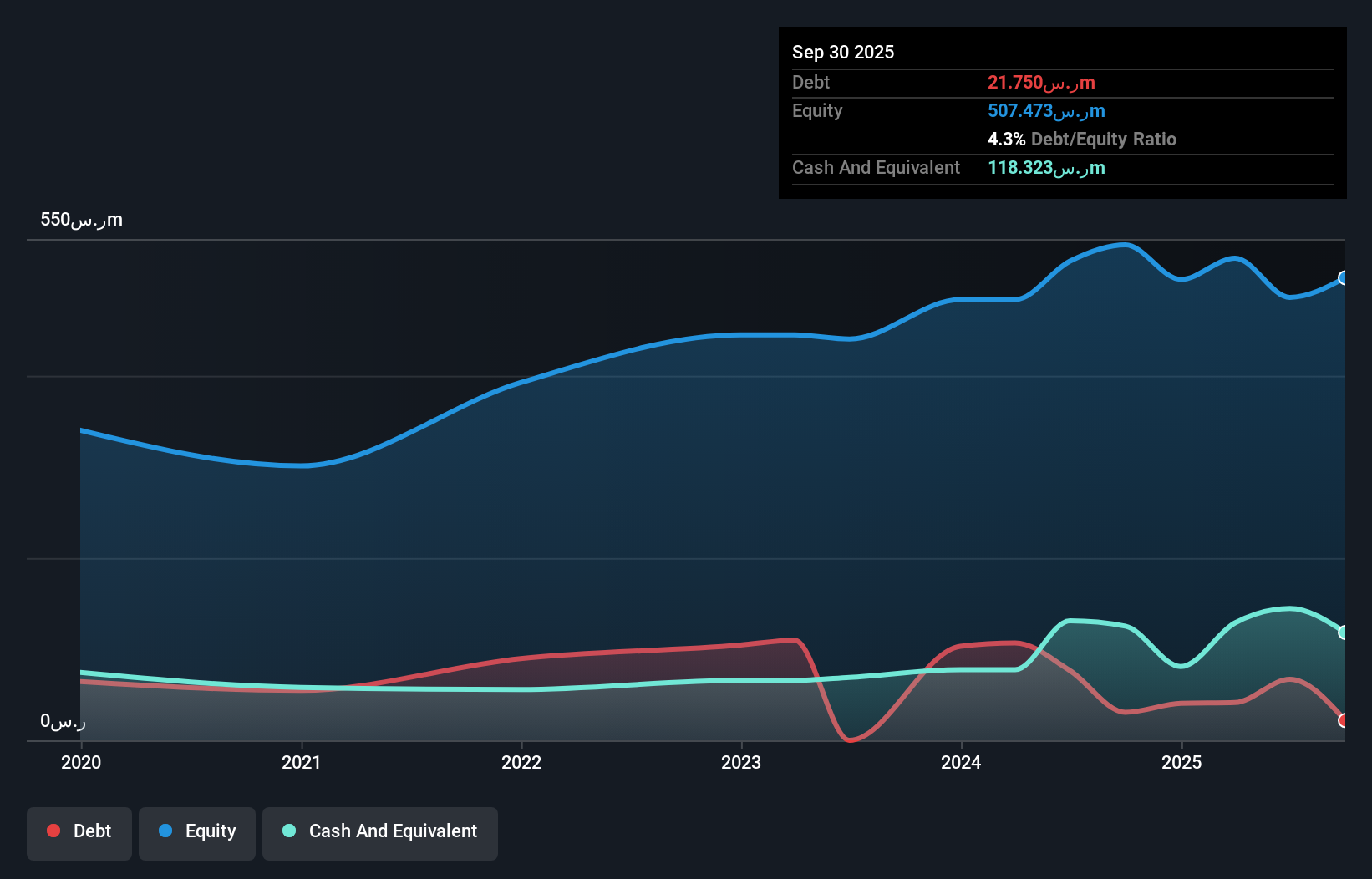

With a solid footing in the metals and mining sector, Al Taiseer Group TALCO Industrial has shown consistent earnings growth of 19% annually over the past five years. Despite a recent dip in quarterly net income to SAR 16.77 million from SAR 18.85 million, TALCO's price-to-earnings ratio stands at an attractive 27.7x, below industry averages. The company boasts high-quality earnings and maintains more cash than its total debt, indicating strong financial health. Recent additions to major indices like S&P Pan Arab Composite suggest growing recognition in the market, potentially enhancing its visibility among investors seeking promising opportunities.

- Get an in-depth perspective on Al Taiseer Group TALCO Industrial's performance by reading our health report here.

Understand Al Taiseer Group TALCO Industrial's track record by examining our Past report.

Longkou Union Chemical (SZSE:301209)

Simply Wall St Value Rating: ★★★★★★

Overview: Longkou Union Chemical Co., Ltd. is involved in the production and sale of organic pigments both within China and internationally, with a market cap of CN¥2.23 billion.

Operations: Longkou Union Chemical generates revenue primarily through the sale of organic pigments. The company has shown a gross profit margin trend, with recent figures indicating 35%.

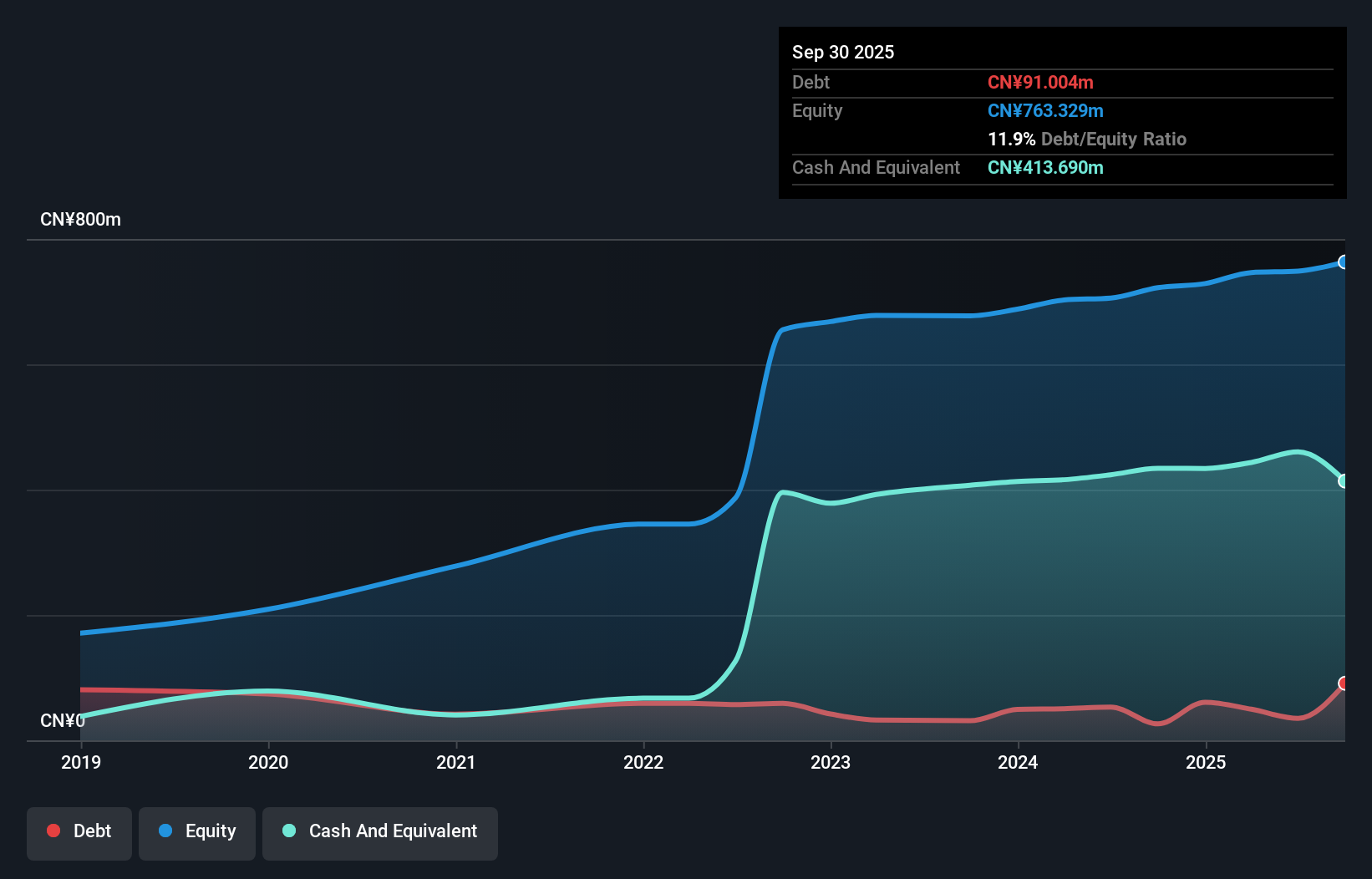

Longkou Union Chemical, a smaller player in the chemical industry, has shown impressive financial resilience. Over the past year, its earnings surged by 47.7%, outpacing the industry's -4.7% performance. The company's debt-to-equity ratio improved significantly from 37.9% to 3.6% over five years, indicating better financial health and reduced leverage risk. For the nine months ending September 2024, Longkou reported sales of CNY 392 million and net income of CNY 44 million, both up from last year’s figures of CNY 308 million and CNY 24 million respectively. These results suggest a promising trajectory amidst market volatility.

- Take a closer look at Longkou Union Chemical's potential here in our health report.

Evaluate Longkou Union Chemical's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4670 more companies for you to explore.Click here to unveil our expertly curated list of 4673 Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301209

Longkou Union Chemical

Engages in the production and sale of organic pigments in China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives