Amid a backdrop of mixed performances in global markets, smaller-cap indexes like the S&P MidCap 400 and Russell 2000 have shown resilience, outpacing larger counterparts despite ongoing trade uncertainties and economic headwinds. As investors navigate these turbulent waters, identifying stocks with strong fundamentals and growth potential becomes crucial in uncovering undiscovered gems that can thrive even when broader market sentiment is cautious.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 5.93% | 20.71% | ★★★★★★ |

| Pro-Hawk | 17.03% | -6.66% | -2.75% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 15.01% | 0.09% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| HeXun Biosciences | NA | 74.95% | 119.41% | ★★★★★★ |

| S.A.S. Dragon Holdings | 77.35% | 3.64% | 7.13% | ★★★★★☆ |

| Tai Sin Electric | 28.69% | 9.56% | 4.66% | ★★★★★☆ |

| Pizu Group Holdings | 48.10% | -4.86% | -19.23% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Brilliance Technology (SZSE:300542)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Brilliance Technology Co., Ltd., along with its subsidiaries, offers information solutions and services in China, with a market cap of CN¥4.97 billion.

Operations: Brilliance Technology generates revenue primarily from its information solutions and services. The company's net profit margin is 15.32%, reflecting its ability to efficiently convert revenue into profit.

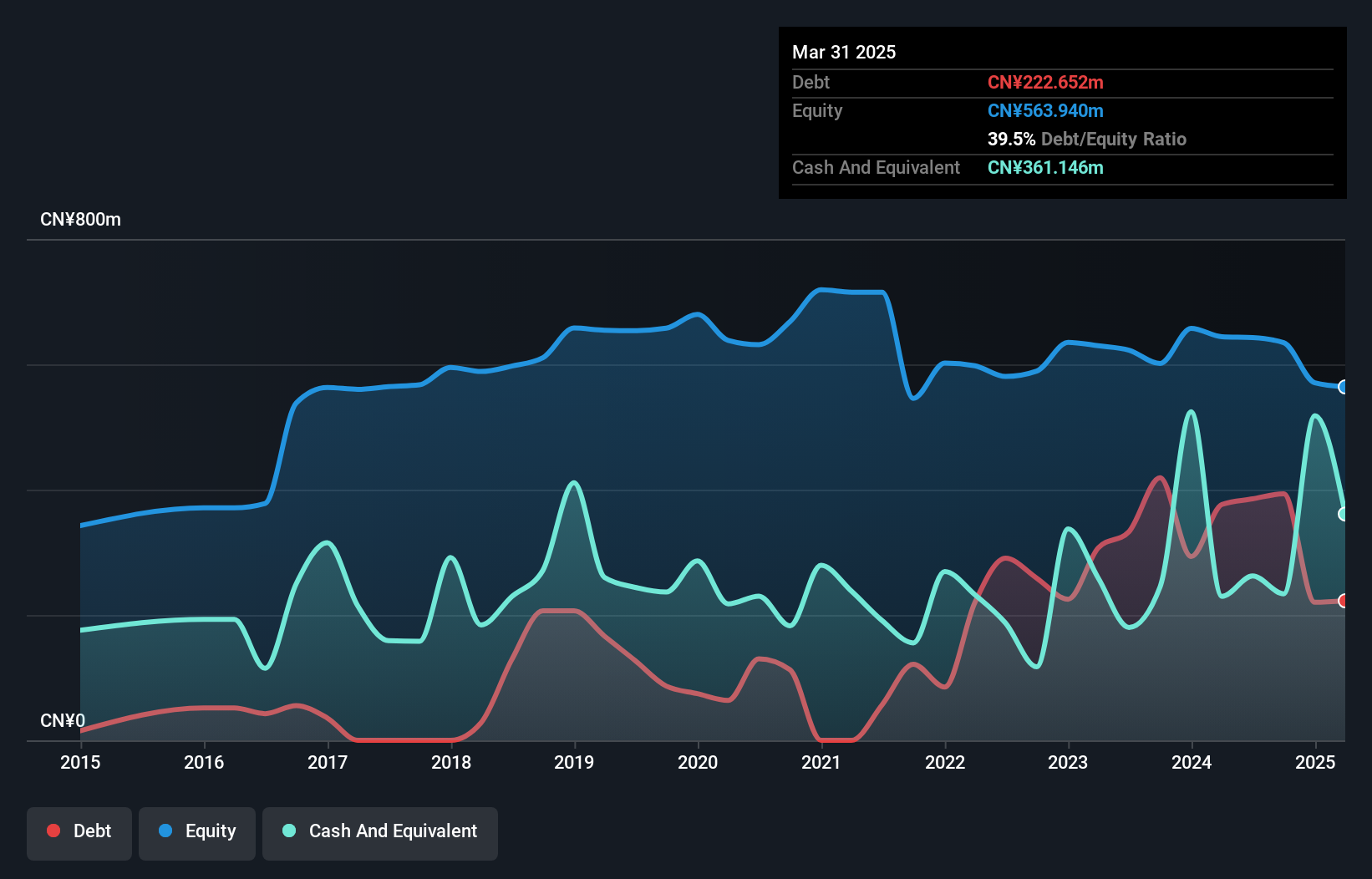

Brilliance Technology, a small cap player in the IT sector, has shown impressive earnings growth of 64.7% over the past year, outpacing the industry's -12.3%. Despite a debt to equity ratio increase from 13.1% to 62% over five years, its net debt to equity ratio remains satisfactory at 25.2%. The company is profitable with well-covered interest payments (3.5x EBIT coverage). A significant one-off gain of CN¥13.9M impacted recent results, highlighting potential volatility alongside its volatile share price history. Recently announced private placements could influence future capital structure and investor dynamics further.

Shanghai Hajime Advanced Material Technology (SZSE:301000)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Hajime Advanced Material Technology Co., Ltd. focuses on the development and production of advanced materials for industrial applications, with a market capitalization of CN¥9.67 billion.

Operations: Shanghai Hajime Advanced Material Technology generates revenue primarily from the Machinery & Industrial Equipment segment, amounting to CN¥755.94 million. The company's financial performance is highlighted by its net profit margin, which reflects the efficiency of converting revenue into actual profit after all expenses.

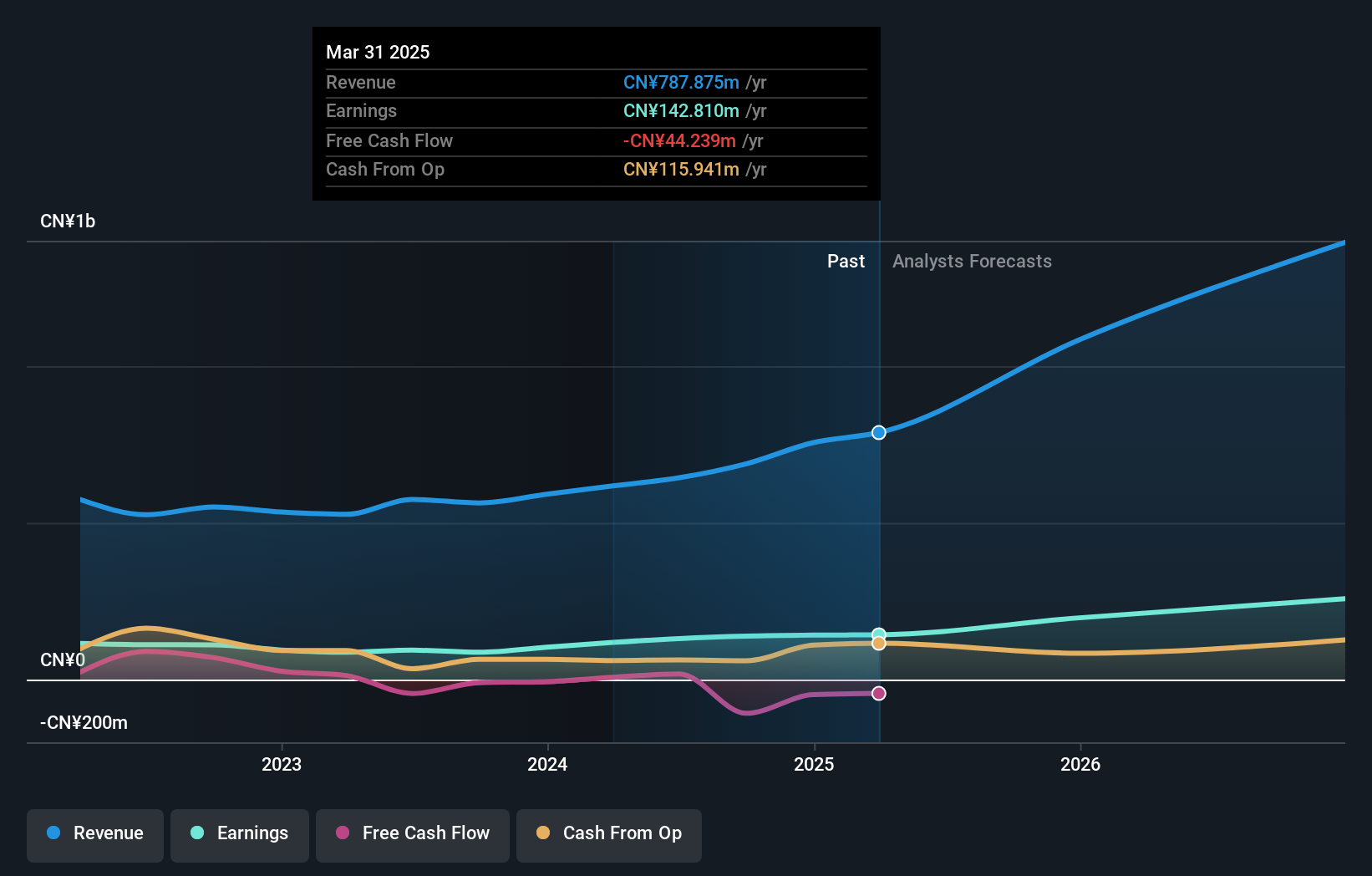

Shanghai Hajime Advanced Material Technology showcases a robust growth trajectory, with its earnings surging by 37% last year, outpacing the chemicals industry. Its sales reached CNY 733 million, up from CNY 559 million the previous year. Despite a volatile share price recently, this debt-free company has demonstrated high-quality earnings and solid profitability. The net income rose to CNY 141.8 million from CNY 103.31 million, reflecting strong operational performance. While free cash flow remains negative at times due to high capital expenditures like -CNY 158 million in recent quarters, future earnings are expected to grow annually by around 29%.

Xiamen Voke Mold & Plastic Engineering (SZSE:301196)

Simply Wall St Value Rating: ★★★★★☆

Overview: Xiamen Voke Mold & Plastic Engineering Co., Ltd. specializes in the design and manufacturing of precision molds and plastic components, with a market cap of CN¥6.26 billion.

Operations: Xiamen Voke Mold & Plastic Engineering generates revenue primarily through the design and manufacturing of precision molds and plastic components. The company has a market capitalization of CN¥6.26 billion.

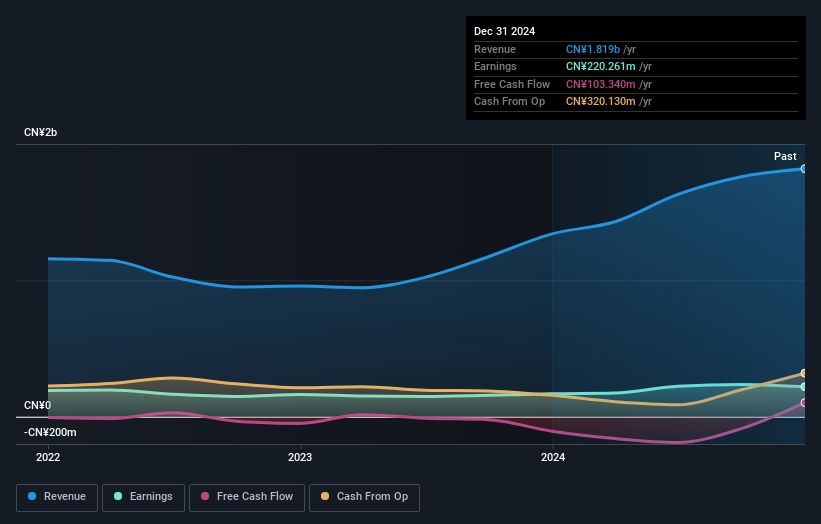

Voke Mold & Plastic Engineering, a nimble player in its industry, has seen impressive earnings growth of 31.1% over the past year, outpacing the broader machinery sector. With a price-to-earnings ratio of 33.1x, it offers better value compared to the CN market average of 36.3x. Its financial health appears robust as cash exceeds total debt and interest coverage is not an issue. Despite increased volatility in share price recently, net income rose from CNY 168 million to CNY 220 million over the last year with basic EPS climbing to CNY 1.77 from CNY 1.35 previously.

Seize The Opportunity

- Click through to start exploring the rest of the 3250 Global Undiscovered Gems With Strong Fundamentals now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301196

Xiamen Voke Mold & Plastic Engineering

Xiamen Voke Mold & Plastic Engineering Co., Ltd.

Excellent balance sheet with acceptable track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026